- Bitcoin’s recent recovery hits $64,000, raising market optimism.

- Technical indicators like the Ichimoku Cloud suggest bearish market

Despite a recent uptick in Bitcoin’s [BTC[ market value, the king coin’s journey back to the $64,000 mark is shadowed by enduring concerns that could potentially dampen the optimism surrounding its recovery.

Though this recent reclaim of the $64,000 mark indicates further upward movement for its price, However, an analyst has given reasons why traders should remain cautious despite the apparent bullish signs.

A fragile recovery amidst optimism

Bitcoin’s resilience is often a barometer of market health. Recently, Bitcoin demonstrated a semblance of recovery, gaining 2.4% over the past week, and marking a modest increase of 0.6% in just the past 24 hours.

These gains have propelled Bitcoin to once again touch the $64,000 threshold—a level viewed as a critical indicator of potential upward trajectories.

However, the celebration of this milestone may be premature as underlying issues loom.

The recovery comes as BTC records a 13% drop from its peak in March, suggesting that the path to recovery could be fraught with volatility.

The recent gains, although encouraging, represent a delicate balance in a market still recovering from previous setbacks.

Josh Olszewicz, a seasoned trader, pointed out that despite Bitcoin’s ascent above $64,000, the cryptocurrency is not quite out of danger.

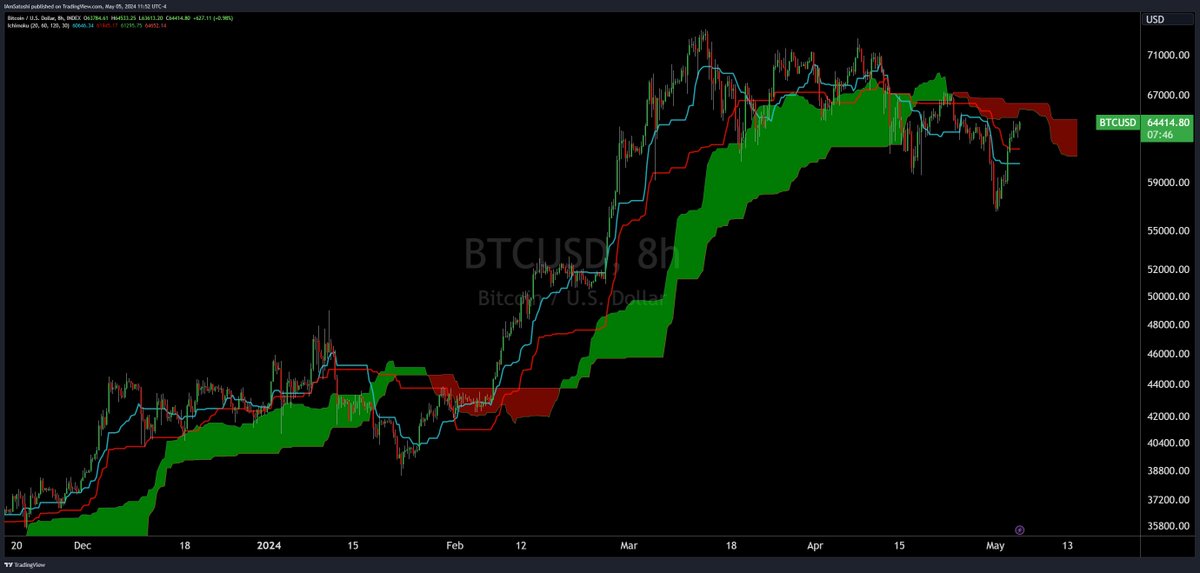

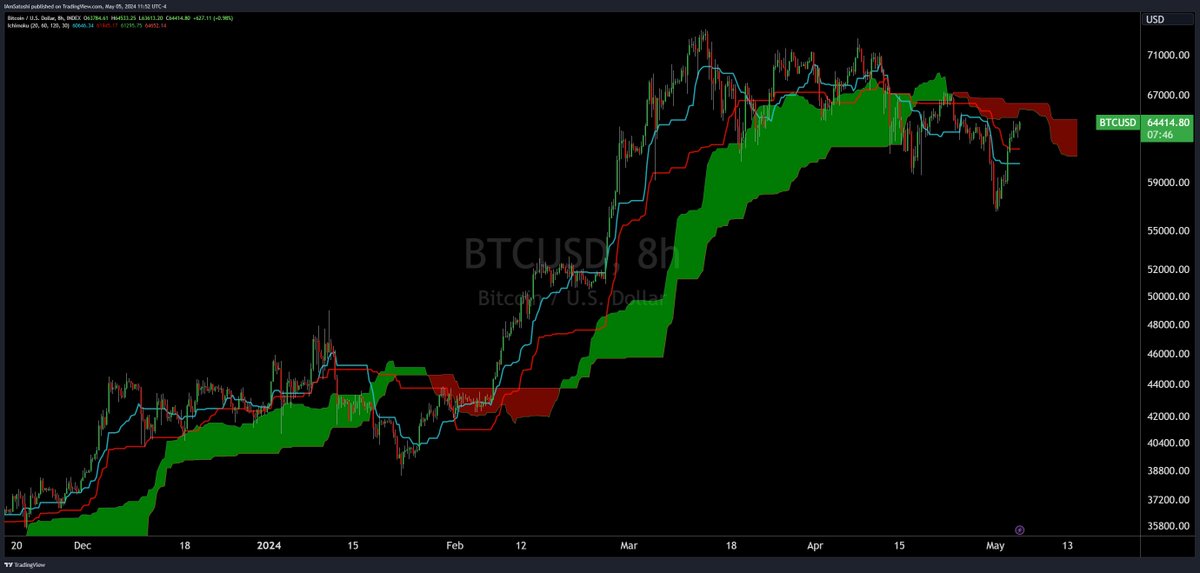

Source: TradingView

His analysis employs the Ichimoku Cloud, a complex indicator that provides a multifaceted view of market momentum and potential resistance and support levels.

Currently, the cloud remains red as shown above, signaling that the bearish trend is still dominant, with Bitcoin trading below this crucial indicator, which now acts as a significant barrier.

The Ichimoku Cloud suggests a continuation of bearish momentum unless Bitcoin can sustainably break above this cloud, transforming it from a resistance to a support zone.

Olszewicz recommends watching for a potential bullish confirmation through the inverse head and shoulders pattern alongside the cloud dynamics, which could indicate a stronger reversal from the bearish trend.

Where will Bitcoin head next?

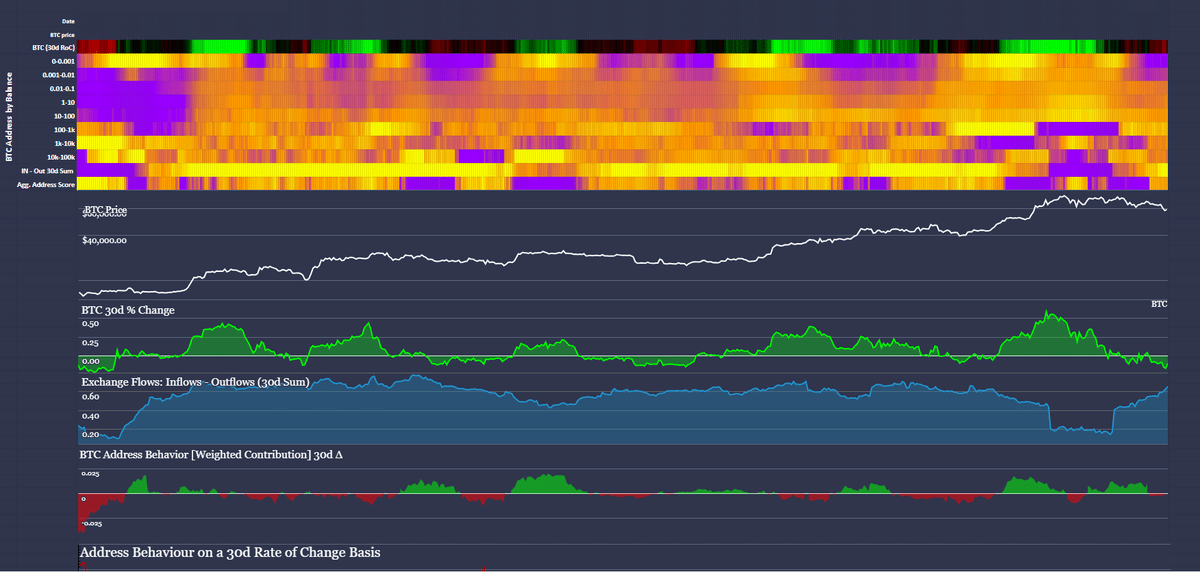

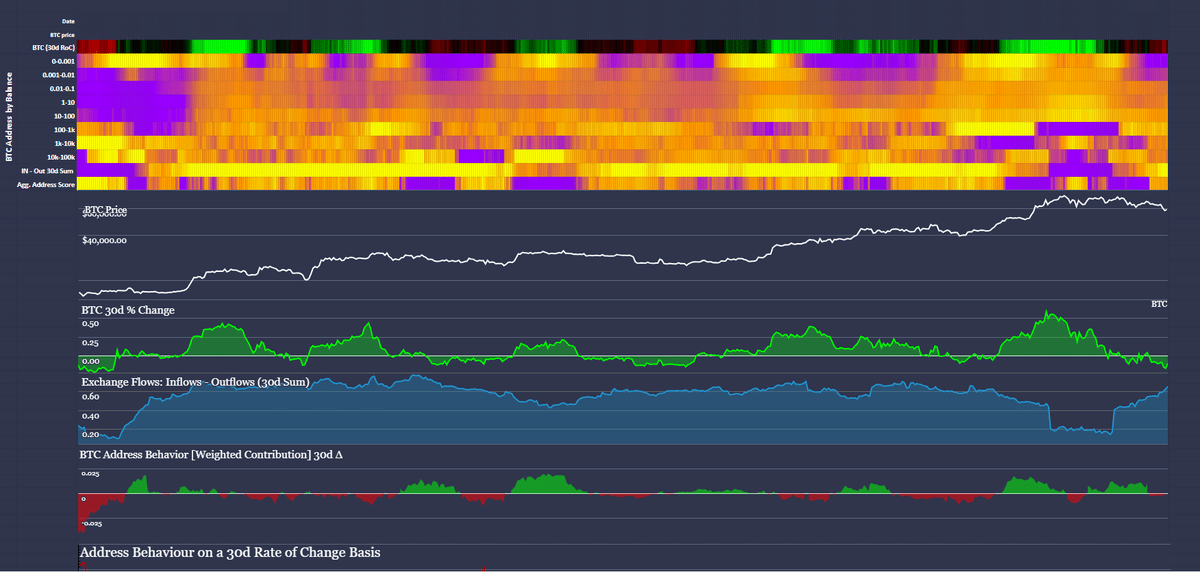

Further complicating the narrative, data from the analytics firm Santiment underscored a more nuanced perspective.

It suggested that while there are signs of distribution, the overall wallet activity indicates robustness without significant structural weaknesses.

This could mean that while immediate gains are visible, the broader market sentiment remains cautiously optimistic.

Source: Santiment

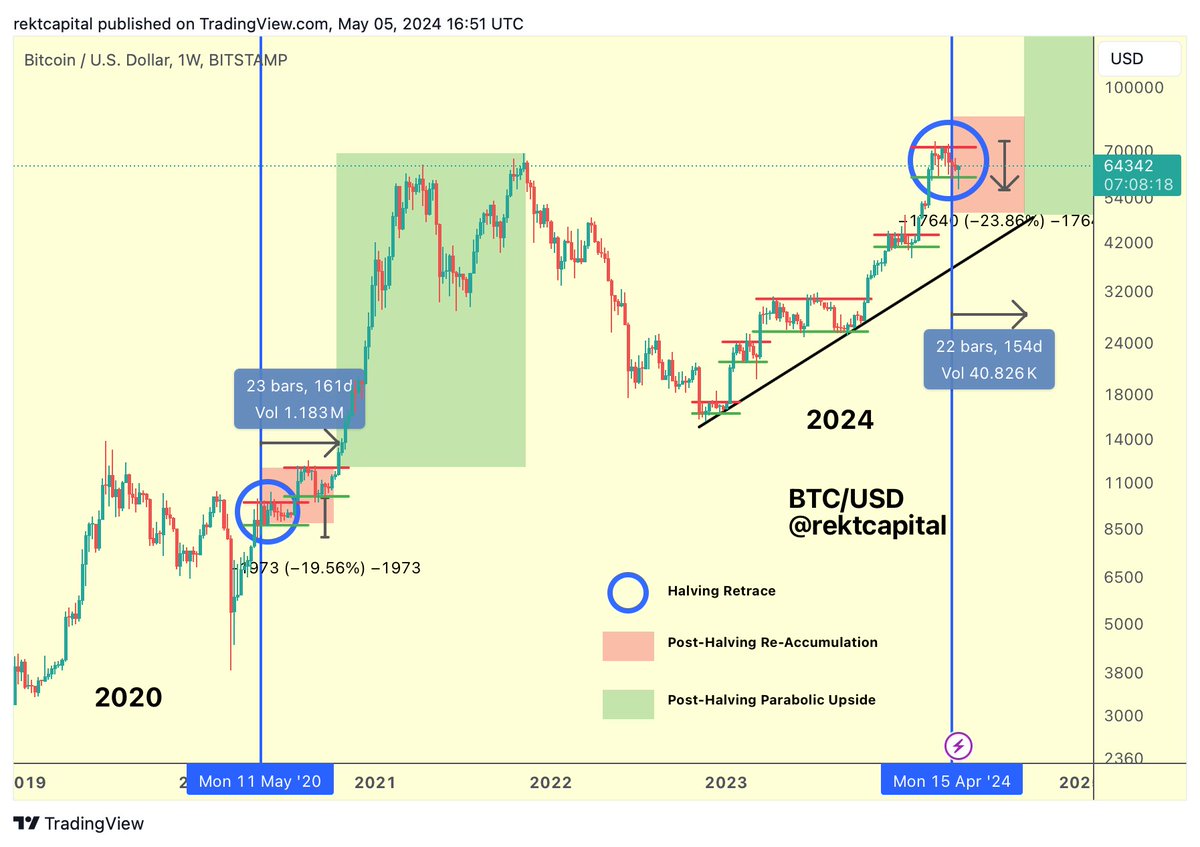

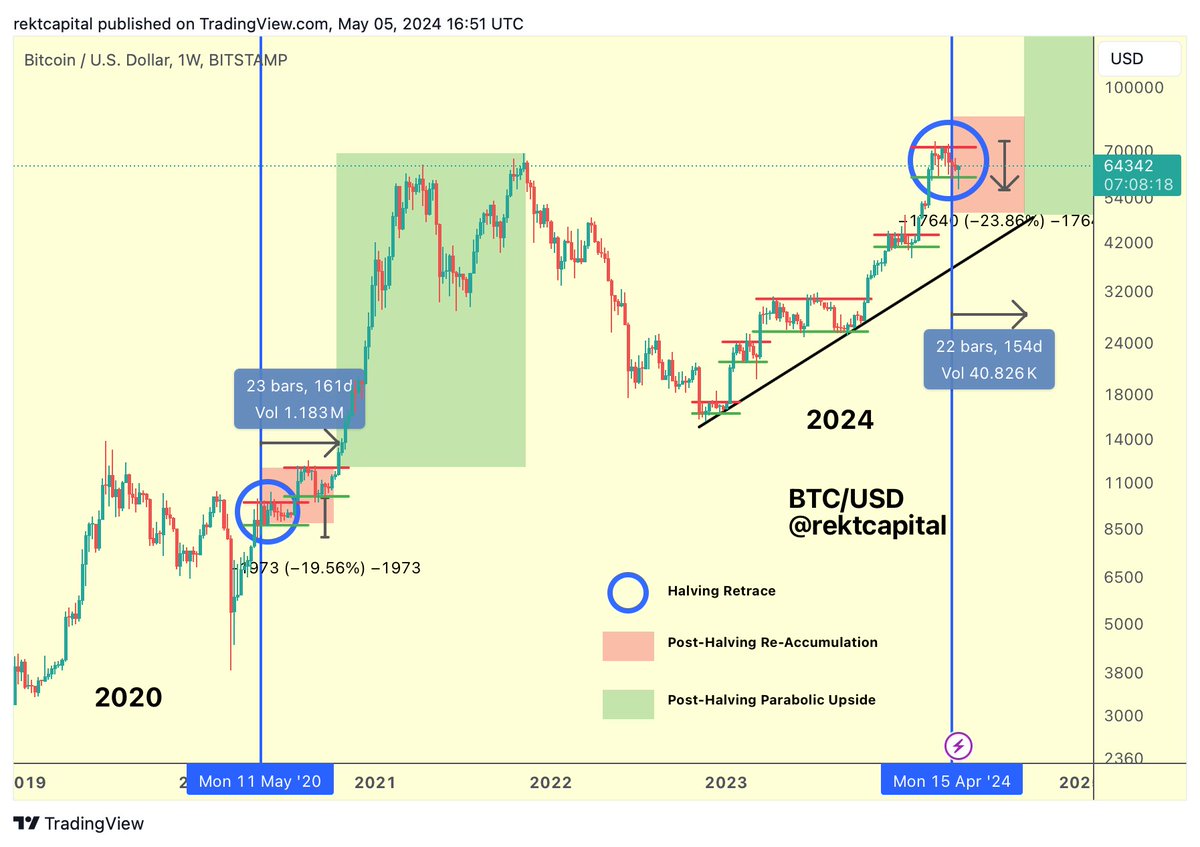

Moreover, according to crypto analyst Rekt Capital, Bitcoin is transitioning from a price-based capitulation to a time-based consolidation phase post-Halving.

This aligns with historical patterns that typically precede substantial bullish runs.

This phase, expected to last over 150 days, might be setting the stage for a more sustained growth period, echoing past cycles where prolonged consolidation led to robust upward movements.

Source: X

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Adding to the complexity, AMBCypto’s recent reports have shown positive signs, breaking out of a falling wedge pattern, suggesting an increase in buying momentum.

This is further supported by Glassnode’s data, indicating a bullish signal as Bitcoin’s reserve risk escalates within favorable zones historically associated with price increases.

Leave a Reply