- ADA continued the stop-and-start price trend.

- Active addresses increased slightly.

After experiencing a two-day downtrend, the recent uptrend in Cardano [ADA] would certainly be welcomed by holders. However, are there any metrics indicating a sustained run for ADA?

ADA sees a slight positive trend

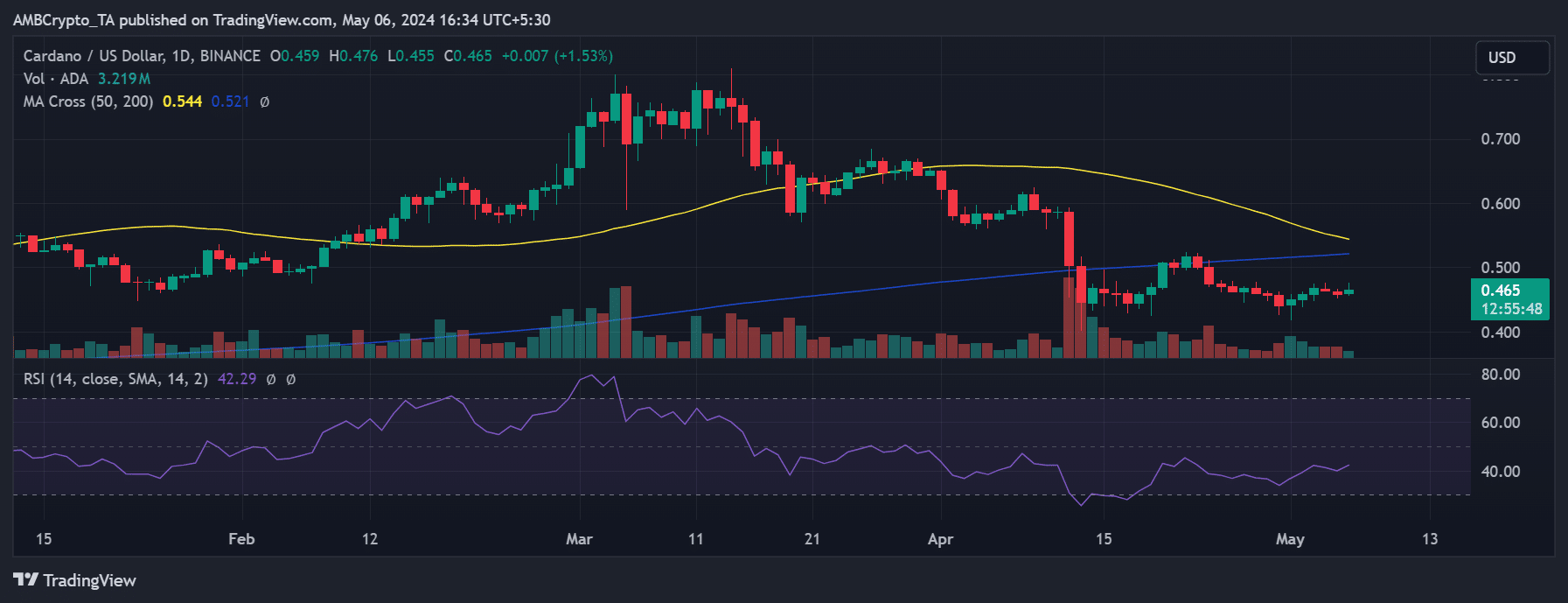

AMBCrypto’s analysis Cardano’s price trend indicated a fluctuating pattern in recent days.

The month began on a positive note with a three-day consecutive uptrend observed from the 1st to the 3rd of May, during which the price rose from around $0.45 to $0.46.

However, these gains were followed by consecutive declines, bringing the price back to around $0.45. This trend of downtrends following uptrends has persisted, signaling a lack of sustained momentum.

Source: TradingView

As of this writing, ADA was trading with a nearly 1% increase, returning to the $0.46 price zone.

Despite this, it remained entrenched in a bear trend, as indicated by its Relative Strength Index (RSI) hovering just above 40.

But the price chart suggests a potential death cross if ADA fails to sustain its uptrend.

A death cross occurs when the long moving average (blue line) crosses above the short moving average (yellow line), typically signaling a negative price trend.

As of this writing, the price was trending below the blue and yellow lines, underscoring the uncertainty in ADA’s price trajectory.

Cardano volume shows declining trading activity

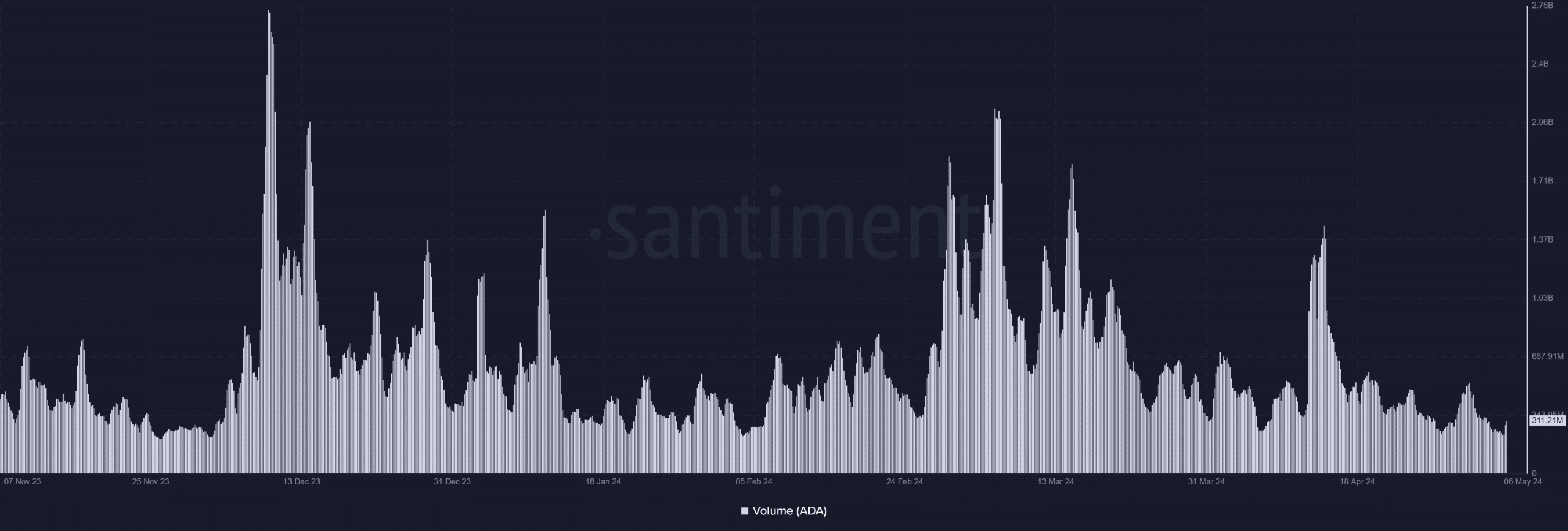

Cardano’s volume does not provide encouraging signs. Analysis of the volume indicates a decline over the past few days.

At the beginning of the month, the volume surged to over $400 million, briefly surpassing the $500 million mark.

Source: Santiment

However, it has since declined. At press time, the volume stood at around $279 million. Typically, an increase in volume can drive price movements, reflecting heightened trading activity.

Conversely, the current downward trend suggests a decrease in trading activity, which may hinder the potential for sustained positive momentum in ADA’s price.

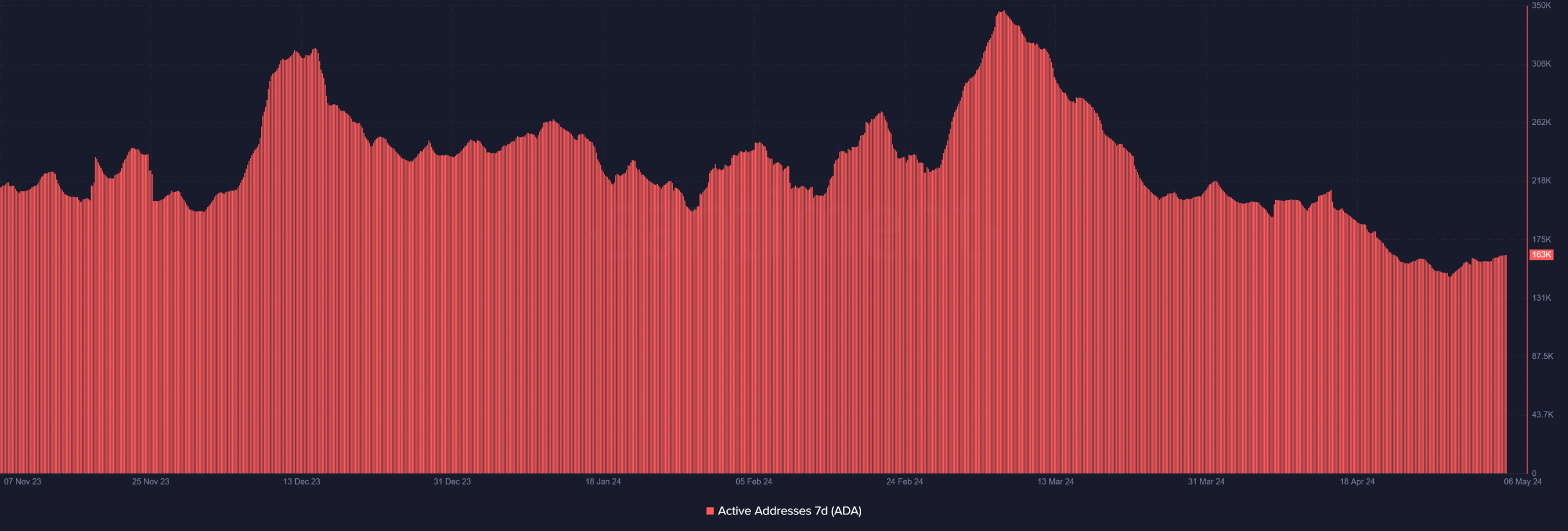

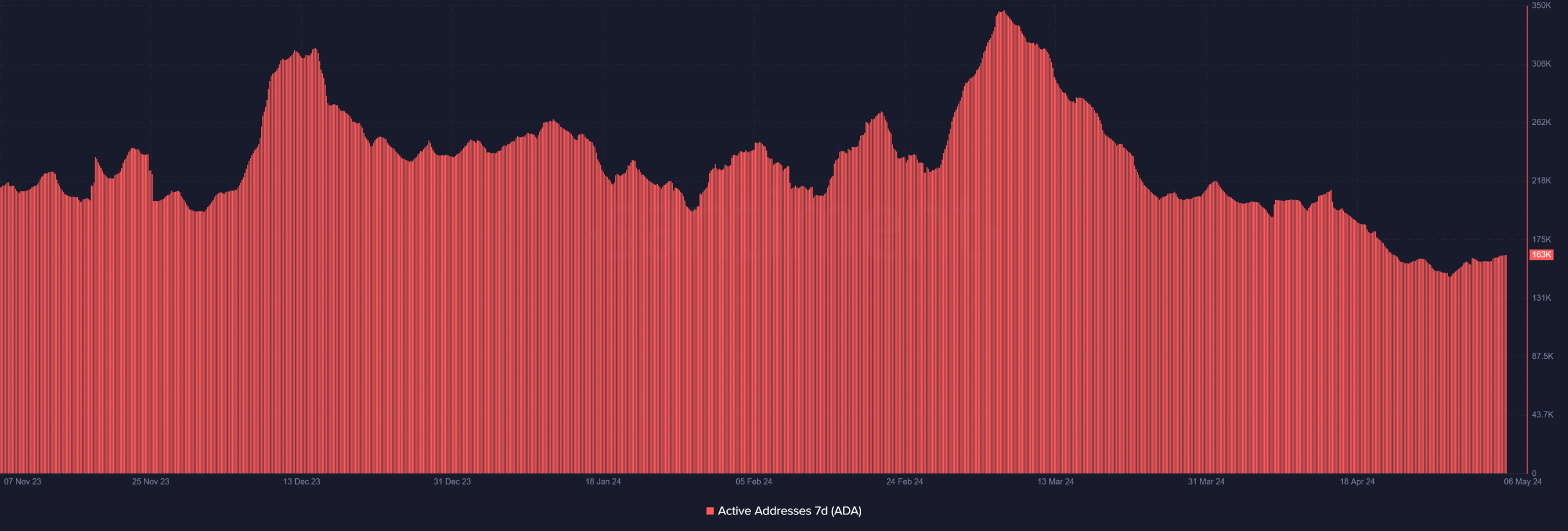

Slight tick in Cardano active addresses

AMBCrypto’s analysis further indicated a recent uptick in the seven-day Cardano active addresses metric.

Is your portfolio green? Check out the ADA Profit Calculator

Also, Santiment revealed that between 4th May and press time, the number of active addresses rose from around 159,000 to over 163,000.

While this increase is notable, it appears insufficient to impact trading activity on the network significantly.

Source: Santiment

Leave a Reply