- XRP’s MVRV and MDIA were similar to August and September 2023.

- The social metrics were not wholly positive.

Ripple [XRP] failed to hold on to the short-term support zone at $0.5 over the past two days. The frenzied selling activity behind Bitcoin [BTC] saw many altcoins falter at key support levels, and XRP was no different.

Criticism that the Ripple network has little utility and merited classification as a “zombie token” was a hard pill to swallow for long-term investors. On the other hand, swing traders could profit from the recent turn of events.

What do the on-chain metrics show for XRP prices?

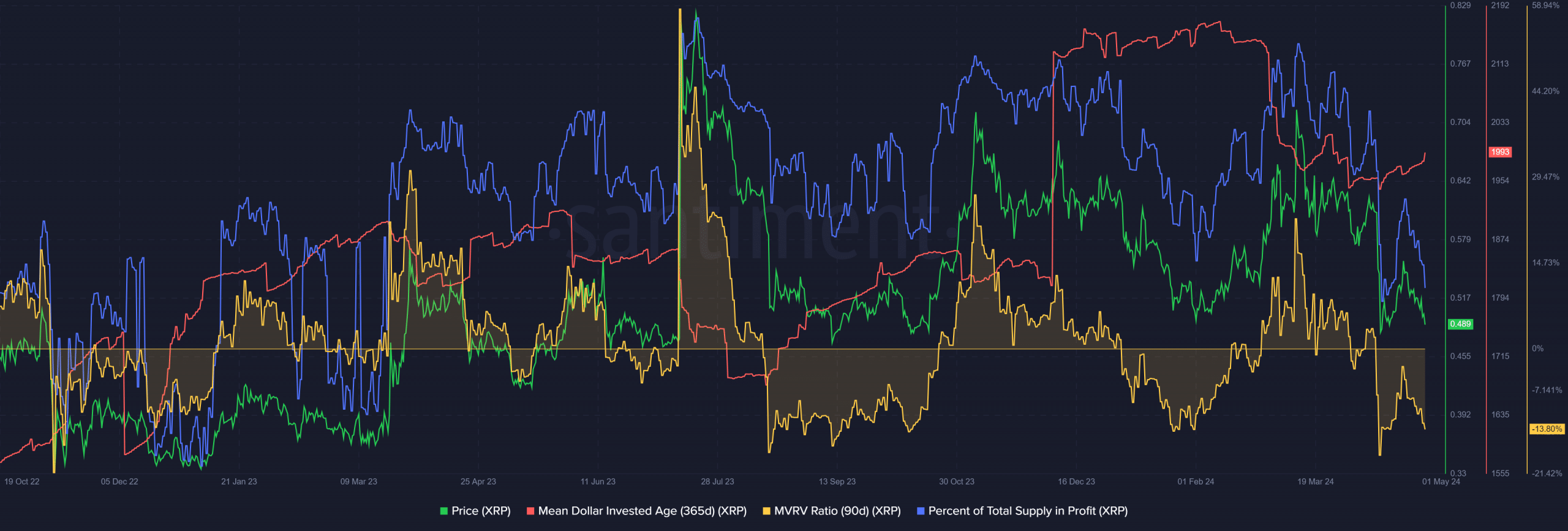

The percent of total supply in profit fell from 92% on 12th of March to 72.6% at press time. This was understandable given the 32.6% losses XRP has endured in the past six weeks. Yet, the Mean Dollar Invested Age (MDIA) appeared to be turning a corner.

This was a welcome sight. It indicated accumulation was underway once more. Additionally, the MVRV ratio showed that XRP was deeply undervalued. Holders did so through a sizeable loss.

In August and September 2023, the MVRV ratio was below -10% but the MDIA was slowly trending higher. During this period, XRP prices consolidated at the $0.48 support zone before rallying.

The price, MDIA and MVRV ratio were repeating what they did in September 2023. If the MDIA can continue to move higher, it could give bulls a good reason to bid for the token.

The social metrics were uninspiring

The social volume saw a slight drop in April compared to the levels it sustained in March. The social dominance was also lower, and only saw a brief spike early in April. Together they showed that social media engagement behind XRP has weakened.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Conversely, the 3-day weighted sentiment was positive. However, the sentiment was positive in early April too, when prices bounced from $0.56 to $0.63.

It highlighted that market sentiment, while powerful, could shift in an instant.

Leave a Reply