The Solana blockchain is home to hundreds of decentralized applications (dApp) that leverage the blockchain’s high throughput, scalability, and composability.

There’s a reason it’s one of the largest DeFi ecosystems, with billions in total value locked.

Decentralized exchanges (DEXs) underpin this bustling community and account for the lion’s share of the TVL on Solana. They provide users with the necessary tools to trade on-chain, swap between different tokens, offer liquidity, and much more.

In the following, we attempt to provide comprehensive information on the best Solana DEXs, including important information about their protocols, but also:

- Key features

- Trading fees: critical detail when trading on-chain

- Supported self-custody wallets and more

Solana has several aspects that make it an ideal chain for DEXs. It has given birth to some of the best-known decentralized trading platforms, not just within its own ecosystem but within the entire industry.

Quick Navigation

- Should You Trade on a DEX?

- Advantages of Decentralized Exchanges

- Disadvantages of Decentralized Exchanges

- Comparison of the Top Solana DEXs

- Top 5 Best Solana DEXs

- Jupiter: Most Popular Solana DEX

- Raydium: Veteran Solana DEX

- Drift Protocol

- Orca

- Zeta Markets

- Future Outlook for Solana DEXs

- Is Trading on DEXs Safe?

- Frequently Asked Questions

- Best Solana DEXs – Final Thoughts

Should You Trade on a DEX?

Decentralized exchanges (DEXs) offer several advantages over traditional exchanges, like enhanced privacy and autonomy, as well as access to a broader range of tokens.

Unlike centralized exchanges (CEXs), DEXs are non-custodial and don’t need to individually verify tokens for compliance with regulations before listing them. This means you could find new projects on DEXs far before they are listed on a centralized exchange, offering traders opportunities for early access.

Decentralized exchanges can offer innovative trading features and incentive mechanisms not found in their centralized counterparts, such as yield farming, automated trading pools, and much more.

If you prioritize security, privacy, and control over your crypto, DEXs might be a good fit. They’re also useful for trading niche tokens unavailable on CEXs. There is, however, a learning curve to DEX trading, so make sure you’re well aware of the intricacies.

Note: One thing to consider, though, is that you will need a self-custody wallet if you want to use a DEX. We have a comprehensive guide on the top Solana wallets that you can read and choose the one that best serves your needs.

Let’s have a condensed look at their advantages and disadvantages because there are some.

Advantages of Decentralized Exchanges (DEXs)

DEXs have several pros and cons to them, and it’s important for users to look at both sides of the picture to make an informed decision.

Ownership & Enhanced Security

DEXs mitigate security risks associated with centralized exchanges by not having centralized systems privy to internal issues or external exploits. A centralized exchange holds users’ funds, making them vulnerable to certain risks, including:

- Cybersecurity attacks

- Custodial risks, censorship, and account banning

- Your funds could be exposed or trapped in the platform.

- Privacy is severely compromised since exchanges store and manage your personal information.

Instead, DEXs leverage smart contracts for trade execution and recording on the blockchain, ensuring trustless transactions. Moreover, you’re solely responsible for your coins since you manage your wallet.

Privacy

DEXs offer increased privacy since users maintain control of their crypto wallets externally. This eliminates the need for traders to disclose private keys and relieves DEXs of liability for funds.

Furthermore, DEX users are not typically required to undergo Know Your Customer (KYC) or Anti-Money Laundering (AML) procedures, which can be convenient but may pose legal challenges in certain contexts.

In essence, DEXs provide the potential for heightened security through decentralization and offer greater privacy by not mandating users to disclose sensitive information such as emails, addresses, phone numbers, etc. However, this may raise regulatory concerns in certain countries with unclear crypto regulations.

Accessibility

DEXs offer global accessibility, allowing users worldwide to access them as long as they have an internet connection and a compatible wallet. There are usually no jurisdiction-based restrictions.

Asset Diversity

Likewise, DEXs boast a larger table of cryptocurrencies than their centralized counterparts. They are more open to smaller or lesser-known projects, enabling users to explore a broader range of assets.

Disadvantages of decentralized exchanges (DEX).

Let’s explore the cons of DEXs below, starting with smart contract security.

Smart Contract Vulnerabilities

While smart contracts create a trustless environment and eliminate third parties, they can be subject to code bugs or vulnerabilities that hackers can exploit.

Complexity

DEXs can be challenging for beginners to navigate, with less intuitive user interfaces and a requirement for greater technical knowledge to execute trades.

Fewer users also means there’s a smaller pool of buyers and sellers for any given token, making it harder to find a good match for your trade. While DEXs use AMMs, these ultimately can’t replicate the efficiency of matching specific buy and sell orders directly.

Liquidity Issues

DEXs may suffer from lower liquidity, particularly for less popular tokens, potentially hindering trade execution at desired prices. Lower liquidity on DEXs can lead to higher slippage, meaning you might end up paying more (or receiving less) than you anticipated.

Comparison of the Top Solana DEXs

The following is a summarized and comprehensive visual representation of their features and other characteristics.

The 5 Best Solana DEXs

With all of the above out of the way, let’s explore the best Solana DEXs.

The protocols were chosen based on trading volume, foundations, competitive features and fees, TVL, market capitalization, and other important components.

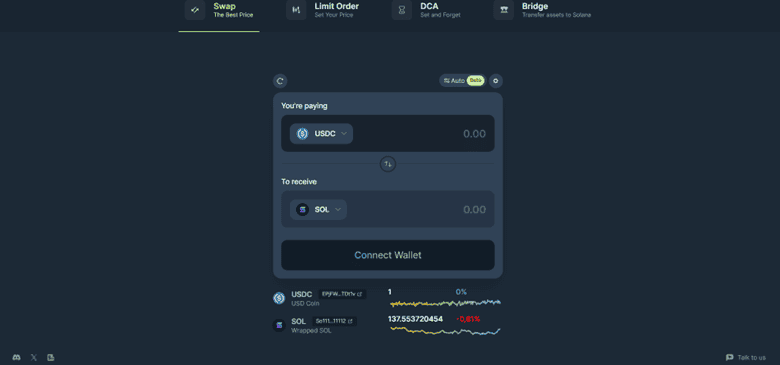

Jupiter: Most Popular Solana DEX

Quick summary:

- The most popular DEX on Solana. It’s behind one of the largest airdrops in crypto history: the JUP token.

- Leading DEX by total value locked (TVL).

- Leading DEX by derivatives volume.

Jupiter is a decentralized exchange aggregator. That means it cross-checks and gathers prices across different DEXs to provide users with the best prices in the market. Its popularity is such that a lot of Solana DEX trades go through Jupiter, highlighting the protocol’s efficiency, low swap fees, and liquidity.

Jupiter started as a liquidity provider, similar to 1inch on Ethereum. However, the business model changed last year as the protocol decided to provide derivatives trading similar to GMX and dYdX.

JUP is the governance token that allows users to vote in favor or against all aspects and changes taking place on Jupiter. It’s also used as a discount fee for traders. The JUP token might be remembered for its massive airdrop, in which over 40% of the 10 billion minted tokens were allocated to the community and distributed periodically.

Key Features of Jupiter

Jupiter is considered one of the best Solana DEXs, designed to facilitate token swaps with minimal slippage and affordable fees. Its user-friendly interface caters to both beginners and experienced traders, supporting over hundreds of tokens and thousands of trading pairs.

Here’s a quick rundown of Jupiter’s key features:

- Limit Order: This feature enables users to place buy or sell orders at specific levels, aiding traders in avoiding slippage and securing optimal prices.

- DCA (Dollar-Cost Averaging): Permits users to purchase a fixed amount of tokens within a specified price range over a set period, offering flexibility in time intervals (minutes, hours, days, weeks, or months).

- Bridge: Facilitates bridging tokens from EVM blockchains like Ethereum, BNB Chain, Arbitrum, or non-EVM blockchains like Tron to Solana, ensuring optimal routes for low slippage and transaction fees.

- Perpetual: This feature allows users to trade futures contracts for supported tokens with a maximum leverage of up to x100. It is powered by Pyth Network, Solana’s biggest oracle network.

Moreover, the exchange also focuses on developer tools, making it easier to integrate DApps and interfaces. There are dozens of tools, documentation resources, and programs designed for developers, including:

- Jupiter Terminal, which allows DEXs to integrate the Jupiter UI

- A payments API, which allows users to pay for anything with any SPL token by using Jupiter and SolanaPay

- An open-source referral program to provide referral fees for projects integrating Jupiter Swap and Jupiter Limit Order

What are the Jupiter Fees?

Jupiter does not charge transaction fees, but certain fees apply to other important features within the protocol. Here’s the breakdown:

- Limit order fees: 0.2% on taker (partners integrating Jupiter Limit Order are entitled to a share of 0.1% referral fees. Jupiter collects the other 0.1% as platform fees, according to Jupiter’s documentation page).

- Jupiter DCA fee: 0.1% on order completion.

Which Wallets Does Jupiter Support?

Jupiter is compatible with most reputable wallets, including those from Solana and Ethereum. Some examples are:

- OKX Wallet

- Phantom

- Ethereum Wallet

- Solflare

- Coinbase Wallet

- Trust

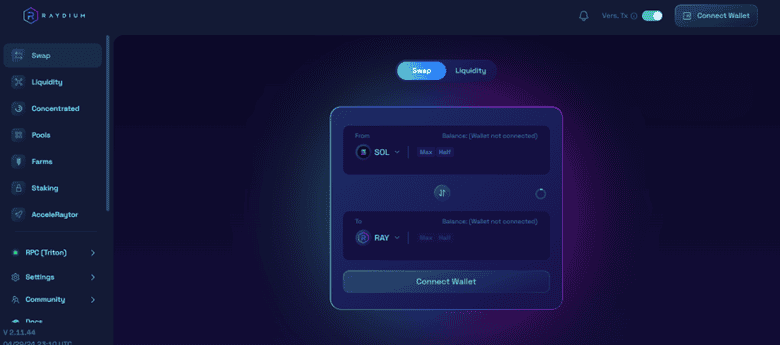

Raydium: Veteran Solana DEX

Quick summary:

- Top Solana DEX by trading volume — $109B.

- Largest DEX on Solana by TVL —$850M

- RAY market capitalization: $410M

Raydium (RAY) is a close contender to Jupiter in terms of trading volume. Both often surpass each other in terms of daily trading volume. It’s known for its slick, user-friendly design, low fees, and support for hundreds, if not thousands, of cryptocurrencies.

Main Features

Raydium facilitates token swaps, liquidity provision, and yield farming for users. The protocol facilitates asset trading using an automated market maker (AMM) algorithm. It also features Acceleraytor, a launchpad that hosts initial DEX offerings (IDOs) for new Solana projects.

What sets Raydium apart is its integration with OpenBook’s central limit order book. This allows users and liquidity pools on Raydium to tap into the broader liquidity and order flow of the entire OpenBook ecosystem and vice versa.

Raydium also allows anyone to create a liquidity pool for a token pair, allowing for permissionless participation and enhancing liquidity within the ecosystem.

What are Raydium Fees?

Raydium has a complex fee structure. It charges a small trading fee for each swap in a pool, which is typically 0.25% taken on the trade. The fee is then divided to reward liquidity providers, conduct RAY buybacks, and contribute to the Raydium treasury.

Treasury fees from CLMM pool trades are automatically converted to USDC and transferred to another designated address controlled by the Squads Multi-sig, which is used to cover RPC expenses.

For Concentrated Liquidity (CLMM) pools, the trading fee varies across four tiers: 100 bps, 25 bps, 5 bps, or 1 bp. Liquidity providers receive 84% of the fee, while 12% is allocated to RAY buybacks and the remaining 4% to the treasury.

Users who want to create a standard AMM pool must pay a fee of 0.4 SOL. This is done to discourage pool spamming and support the protocol’s sustainability.

What Wallets Does Raydium Support?

Raydium supports several wallets, including hardware wallets such as Ledger. Here’s a quick breakdown:

- Solflare

- Phantom

- OKX Wallet

- Trust Wallet

- Sollet

- Exodus

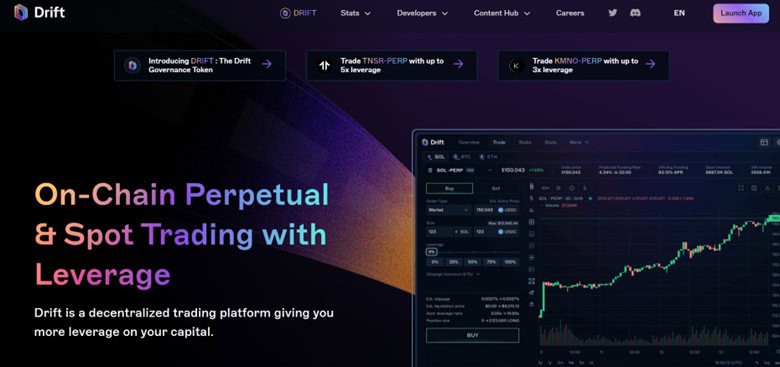

Drift Protocol

Quick summary:

- It has raised over $23 million, with lead investors including Multicoin Capital and Jump Capital.

- Focus on both spot and derivatives DEX Trading

- Cumulative volume of over $22B as of April 2024.

Drift Protocol is one of the largest Solana DEXs. It is designed as an open-source, non-custodial, and capital-efficient platform for those seeking spot and perpetuals trading.

It offers many features: spot and perpetuals trading, lending and borrowing, and passive liquidity provision. Naturally, most of the attention gravitates towards perpetuals. Users can long or short supported assets with up to 10x leverage.

Key Features of Drift Protocol

Drift Protocol uses a cross-margined risk engine, a keeper network, and multiple liquidity mechanisms, enabling the platform to provide users with low fees, minimal slippage, and high performance.

Moreover, it provides features such as automatic deposit yield and leveraged staking with annual yields of up to 10% (subject to fluctuations).

Drift v2 employs a series of complex trading and liquidity mechanisms to deliver a seamless experience for users. Some of its key components are:

- Drift v2 AMM uses an external Backstop AMM Liquidity (BAL), which, in simple terms, allows users to provide backstop liquidity to specific markets, increasing the depth and collateralization within the market and earning them a rebate from taker fees.

- Drift’s decentralized orderbook (DLOB): Limit orders are executed in two ways: they either match opposing orders at the same price or trigger against the Automated Market Maker (AMM) under specific conditions.

- Keepers: They listen for, store, organize, and execute valid limit orders, compiling them into off-chain order books. Each Keeper maintains its own decentralized order book. They execute trades by matching crossing and limit orders against the AMM when certain conditions are met. They earn fees for executing trades.

What are Drift Protocol Fees?

Drift has a complex structure that uses the maker-taker fee model. Fees are calculated on a per-trade basis and the user’s position size. Review the documentation page for more information.

What Wallet Does Drift Protocol Support?

Drift Protocol supports multiple crypto wallets, including:

- Phantom

- Solflare

- Trust Wallet

- WalletConnect

- Coin98.

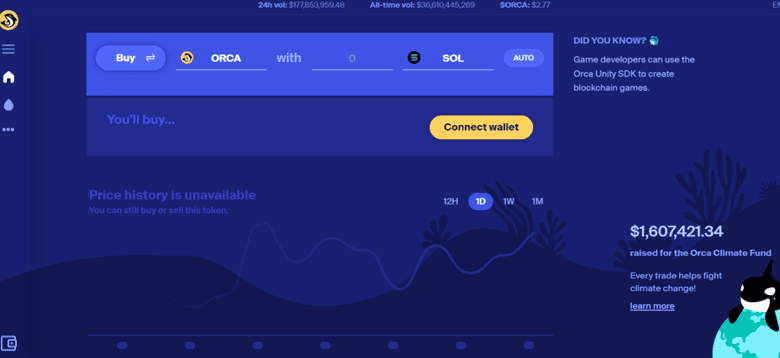

Orca

Quick summary:

- One of Solana’s biggest DEX by TVL

- ORCA’s market capitalization surpassed $133M

- Only DEX on Solana to use a CLAMM (concentrated liquidity AMM)

Orca is a decentralized exchange praised for its simplicity and user-friendly interface launched in February 2021.

The DEX stands out for its deep liquidity across multiple pools. This has been known to attract a lot of traders who are looking to optimize their overall DEX trading performance.

Key Features of Orca

Orca enables token swapping and provides a share of trading fees through its aquafarms. This concept of liquidity pooling for trading originated from Ethereum’s decentralized exchanges like Uniswap.

Despite similarities with other Solana exchanges, Orca stands out due to several distinctive features.

- Orca’s interface includes a Fair Price Indicator, aligning with its trader-centric design philosophy. This tool helps traders ensure that a cryptocurrency’s price remains within 1% of CoinGecko’s aggregated exchange prices, offering a comprehensive market overview within a single interface.

- The protocol provides a convenient panel displaying user balances without requiring separate browser extensions.

- Another key feature is the Magic Bar, a user-friendly search feature enabling quick access to desired token pairs by typing their tickers.

It should be evident by now that Orca’s approach is to simplify things for traders and liquidity providers, highlighting its user-centered approach.

An interesting feature of Orca is that every trade made on the network contributes to the Orca Climate Fund, an autonomous enterprise that invests in climate-friendly technologies and innovations.

What are Orca Fees?

Fees on the Orca DEX vary, depending on the percentage each pool charges independently.

Pools with a fee tier of ≥0.3%:

- 87% of the trading fee goes to the maker (Liquidity Provider)

- 12% is allocated to the DAO treasury.

- 1% is contributed to the Climate Fund.

Pools with a fee tier of <0.3%:

- All fees are paid to the maker (aka the liquidity provider).

Overall, this fee distribution model aims to incentivize liquidity provision while supporting the platform’s governance and contributing to environmental initiatives through the Climate Fund.

What Wallet Does Orca Support?

Orca supports multiple wallets, including hardware wallets like Ledger. Here’s a quick rundown:

- Trust Wallet

- OKX Wallet

- Phantom

- Solflare

- SafePal

- BitGet

Zeta Markets

Quick summary:

- Backed by prominent VCs, including Solana Ventures

- Has raised over $23M in funding

- Near-zero gas fees and up to 20x leverage

Zeta Markets is a perpetuals exchange powered by the Solana blockchain. It was launched in 2021 and is backed by prominent venture capital (VC) investors, including Jump Capital, Wintermute, and Solana Ventures.

Key Features of Zeta Markets

Zeta Markets leverages the Solana blockchain to allow fast transactions and trade orders without compromising security. Here’s a rundown of the protocol’s main features:

- Security: Users have full control over their assets with self-custody, and trading is margined in USDC, enhancing safety.

- Capital Efficiency: Traders can access up to 10x leverage through cross-margining, optimizing capital utilization.

- Decentralized Price Discovery: The exchange employs a fully on-chain limit order book (CLOB), ensuring price discovery without centralization.

- Institutional Liquidity: Zeta Markets facilitates programmatic connectivity through its SDK/CPI programs, enabling smart contract integration for Market Makers and other institutional players.

- Gamification: The platform introduces gamified elements such as leaderboards, referral programs, and trading rewards, enhancing user engagement and interaction

What are Zeta Market Fees?

Zeta Markets uses fee tiers. You can view them on the Fee Tiers documentation page. Note that fees are notably lower compared to other derivatives exchanges on Solana.

What Wallet Does Zeta Markets Support?

Compared to other DEXs, the wallet options are somewhat limited, as the protocol only supports Solflare, WalletConnect, Backpack, OKX Wallet, and Phantom.

Future Outlook for Solana DEXs

With the exception of Solana’s downturn in 2021 and 2022, largely induced by FTX’s downfall, the network and its token have performed very well, more or less, since their inception.

Recall that FTX was a strong backer of Solana, holding many SOL tokens. Once the exchange defaulted following SBF’s fiasco, many SOL investors reduced or eliminated their exposure out of fear for the entire network because of FTX’s influence.

However, the protocol itself has since proven resilient. Solana has successfully decoupled from the impact of FTX and proved that this wouldn’t have a long-term impact on it.

As a result, the network has been thriving, as it can be seen in multiple components, including but not limited to:

- SOL’s price

- Transaction count on Solana

- New addresses on Solana

- Development activity and more

A lot of it is owed to the success of the teams behind the best Solana decentralized exchanges because they underpin the entire local DeFi ecosystem.

If protocol developers continue to deliver and improve the capabilities of Solana, it’s perhaps justified to assume that the future for Solana DEXs is looking bright.

Is Trading on DEXs Safe?

To answer this question, we must first make a few important clarifications.

First, trading on a DEX requires more technical knowledge and preparation, compared to trading on a centralized exchange. You have to have your own self-custody wallet, which can present certain challenges on its own.

However, if you are confident in your ability to maneuver in an on-chain environment, trading on a DEX can be safer. This is because you, as a trader, are in complete control over your funds—there is no central party that can censor your transactions, block your deposits or withdrawals, or impact your trading activities in any way.

All things considered, though, the majority of users are not as technical and might encounter challenges when trading on a DEX. That’s why it’s highly recommended to make sure that you are entirely aware of their intricacies so you don’t end up paying for high slippage or worse – put your coins in jeopardy.

Frequently Asked Questions

Which Solana DEX has the most volume?

Jupiter is ranked as the Solana DEX with the most daily trading volume, but the spot is highly contested by Raydium, which is typically regarded as the second-largest DEX on Solana.

What is the first DEX on Solana?

Solar Dex is the first DEX on Solana. This has become somewhat of a crypto memorabilia because Solar Dex is not amongst the top decentralized exchanges any more.

What is the best Solana DEX?

The best Solana DEX is the one that serves your particular needs. If you are looking for spot trades, perhaps Raydium is your choice. If you want more capabilities such as limit orders and DCA – maybe you should turn to Jupiter.

What is the best DEX crypto?

DEX cryptocurrencies usually refer to the native coins underpinning the decentralized exchange’s ecosystem and governance

Best Solana DEXs – Final Thoughts

In conclusion, the Solana ecosystem boasts several prominent DEXs, each offering unique features and advantages.

The network continues to thrive in most measurable metrics, and DEX development has undoubtedly been a major part of it.

The teams compete to bring new and exciting features for traders, such as limit orders, on-chain derivatives trading, dynamic pools, and more—all of which are bound to attract traders as the ecosystem grows in the future.

Leave a Reply