- Ethereum saw two sizeable waves of profit-taking in the past month that projected doubts about an upcoming rally.

- The ETH whales have added to their stash, with retail being keen to sell.

Ethereum [ETH] saw a rejection from the $3360 resistance level over the weekend. This outlined short-term bearish sentiment.

In other news, the latest Dencun upgrade was a success, helping L2 solutions reach low gas fees.

The next target for the developers is called Prague. Even though hopeful news was breaking, on-chain metrics showed a lack of faith from market participants.

The clues from the Ethereum supply distribution

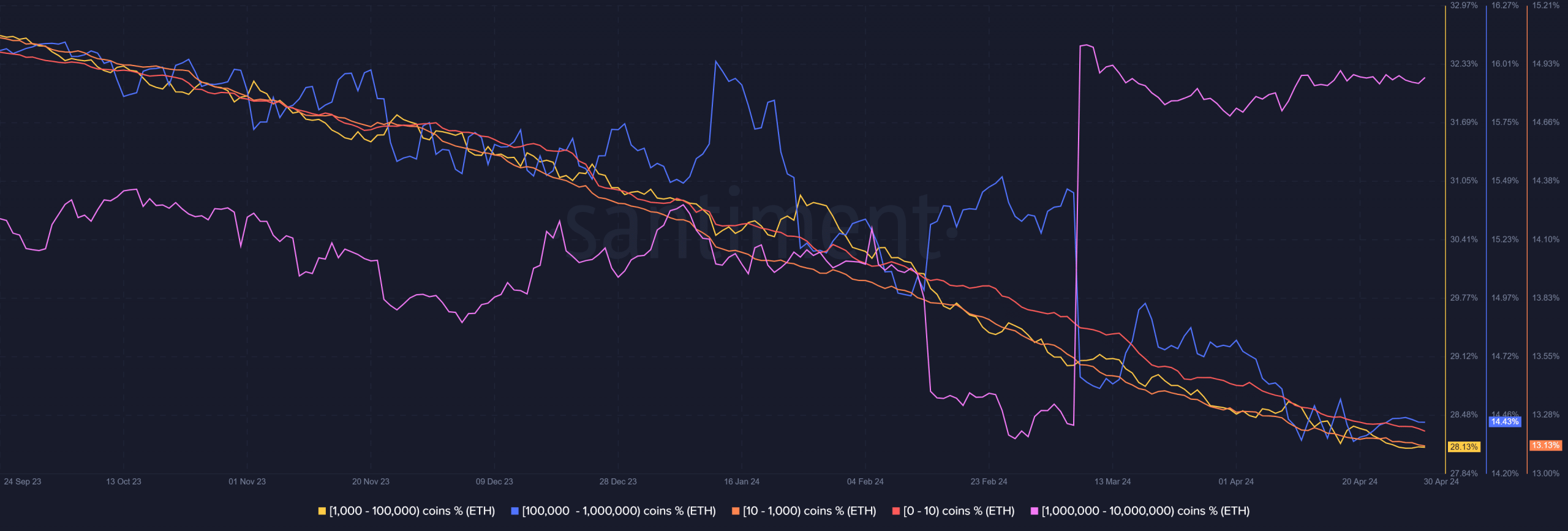

AMBCrypto’s analysis of the supply distribution showed that almost every wallet holding anywhere from 1 to 100k ETH has been selling in recent months.

The micro wallets with under 0.1 Ethereum were the ones buying, hopeful of a rally after Bitcoin’s [BTC] halving.

In the past, when the 100k-1 million token holder cohort was added to their stash, it came during a market rally. Sometimes it preceded a major retracement, like it did in mid-January.

The second half of April saw this cohort quiet down, neither adding to nor selling their supply.

The 1 million- 10 million cohort saw a sharp uptick in early March. Since then, they too have been quiet. Together, it showed that the large participants expected bullish sentiment in the coming months.

A sharp spike in the 100k- 1 million holders’ supply could be useful for traders to mark local tops and imminent retracements.

Does fear still rule the market?

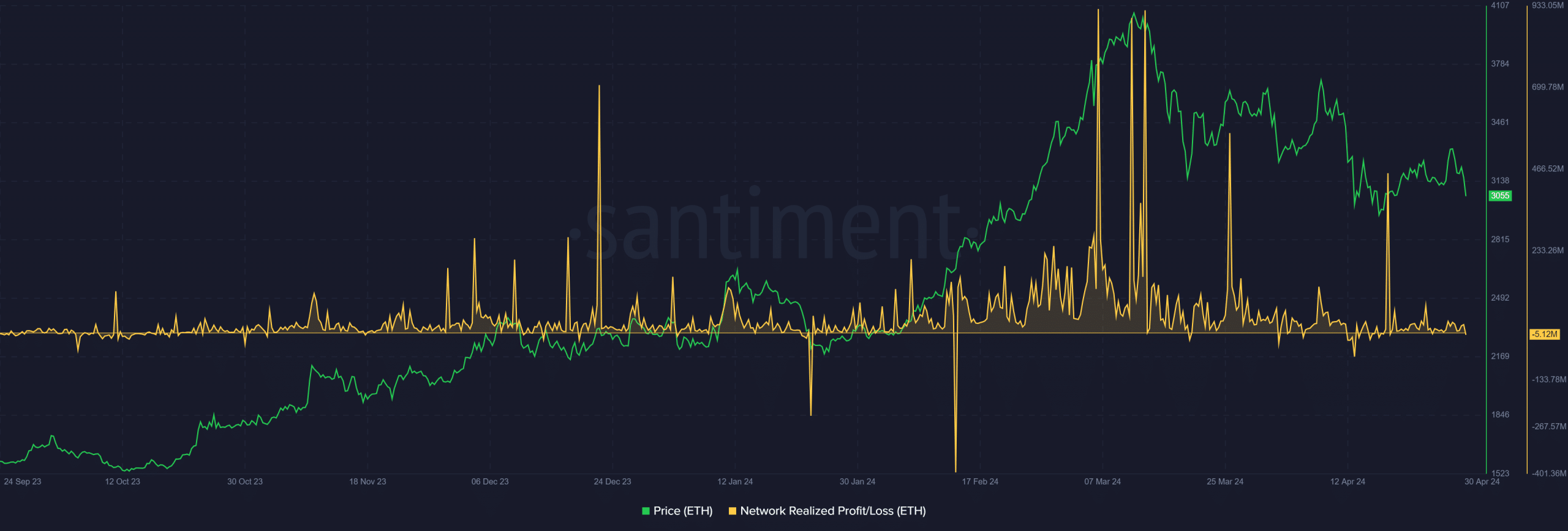

The network realized profit/loss (NRPL) grows during periods of swift price appreciation as profits pile up. The first two weeks of March saw strong price rallies alongside NRPL spikes.

This indicated profit-taking activity.

However, the NRPL has trended downward since then. It saw occasional spikes, such as in late March and mid-April, each smaller than the last.

This showed participants were keen on booking profits even though the price was just above the $3k support zone.

It indicated a lack of faith, which is part of the extended retracement Ethereum has witnessed in the past two months.

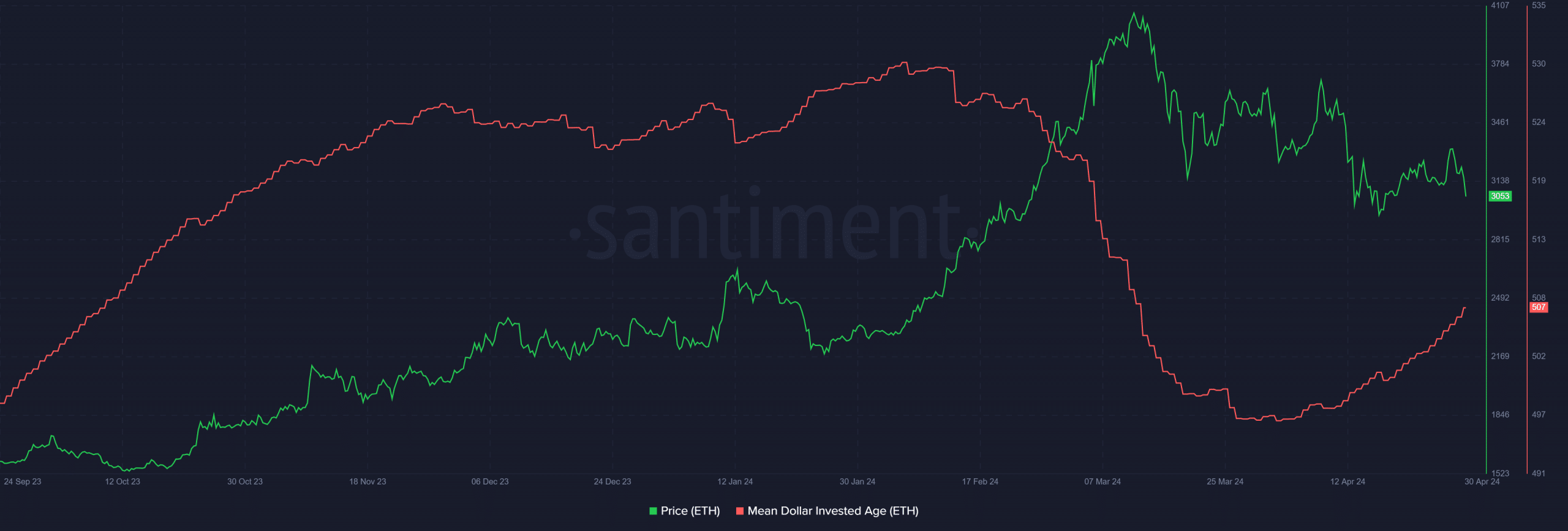

On the other hand, the mean dollar invested age (MDIA) has trended strongly higher in the past month. This metric shows that the asset is in an accumulation phase once again.

It fell sharply during the rally to indicate holders were realizing profits en masse.

Read Ethereum’s [ETH] Price Prediction 2024-25

In the past month, the HOLDer sentiment has been stronger than the collective urge to book profits.

In conclusion, the metrics showed both fear and hope were present in the market, but long-term investors have more reason to hold on than to sell.

Leave a Reply