- Binance founder faces a 36-month prison term, spotlighting illicit activities in the crypto space.

- Legal actions against Binance and earlier FTX raise questions about crypto adoption.

Amidst ongoing legal battles, Changpeng Zhao, the founder of Binance [BNB], finds himself at a critical juncture.

Scheduled for sentencing on the 30th of April in a Seattle courtroom, Zhao faces a pivotal moment as U.S. prosecutors pursue a 36-month prison term.

What’s the issue?

The allegations revolve around his alleged failure to prevent extensive money laundering on the Binance platform, marking a significant development in the discussion surrounding him.

According to the Justice Department in a sentencing memorandum filed last week, the prosecutors said,

“Zhao’s willful violation of U.S. law was no accident or oversight.”

They added,

“He made a business decision that violating U.S. law was the best way to attract users, build his company, and line his pockets.”

This highlighted Zhao’s wilful neglect to establish an effective anti-money laundering program mandated by the Bank Secrecy Act.

In fact, the decision for a three-year prison term, exceeding the recommended 18 months, underscores the gravity of Zhao’s purported offenses and the imperative for strict adherence to the law.

Grounds of allegations

Zhao allegedly facilitated Binance in processing transactions tied to illicit activities, including those involving Americans and sanctioned individuals.

Prosecutors attribute unreported suspicious transactions and deficient controls to Zhao’s leadership. They have also underlined the involvement of some designated terrorist groups like Hamas and al-Qaida.

In response to the allegations, last year in November, Zhao stepped down as CEO of Binance, and just recently, he admitted his breach of the Bank Secrecy Act.

In a letter to the overseeing judge, he expressed remorse for failing to implement adequate compliance controls at Binance, acknowledging that there was “no excuse” for his actions.

“I apologise for my poor decisions and accept full responsibility for my actions. In hindsight, I should have focused on implementing compliance changes at Binance from the get-go, and I did not. There is no excuse for my failure to establish the necessary compliance controls at Binance.”

Interestingly, Binance’s founder had once told his team, that it’s “better to ask for forgiveness than permission” in matters of legal compliance.

This statement adds intrigue as observers await Zhao’s response, while prosecutors remain firm in their stance.

Other instances of money-laundering

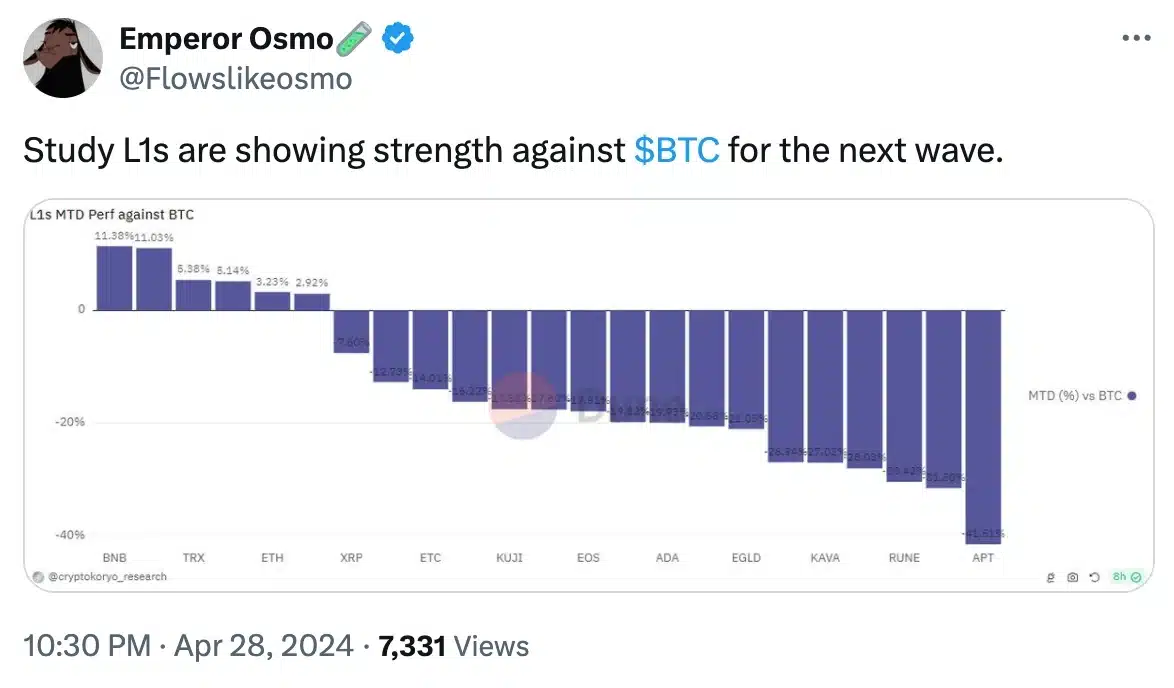

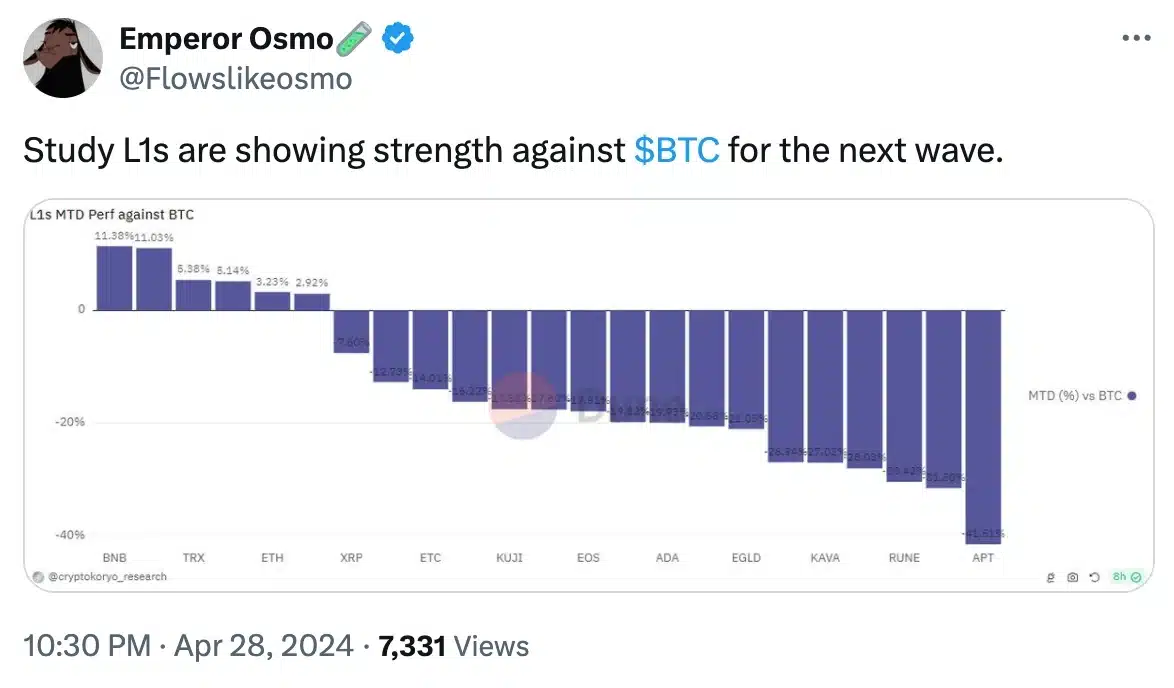

Despite Binance’s recent challenges, the performance of its BNB token and other L1s against BTC remained strong, as noted by a crypto researcher, Emperor Osmo,

Source: Emperor Osmo/Twitter

Well, Binance is not the first one to undergo such allegations. Recently, Nigeria has made headlines by seeking to prosecute Binance and two of its executives on charges of money laundering and tax evasion.

Additionally, FTX too faced a downfall in 2022, leading to Bankman-Fried’s conviction for fraud and a 25-year prison sentence.

This underscores the regulatory hurdles confronting major players in crypto.

Leave a Reply