- On-chain data showed AVAX was at a point that sent its value on a 4x run.

- AVAX’s price might jump to $51.45 in the short term, and could leave SOL behind.

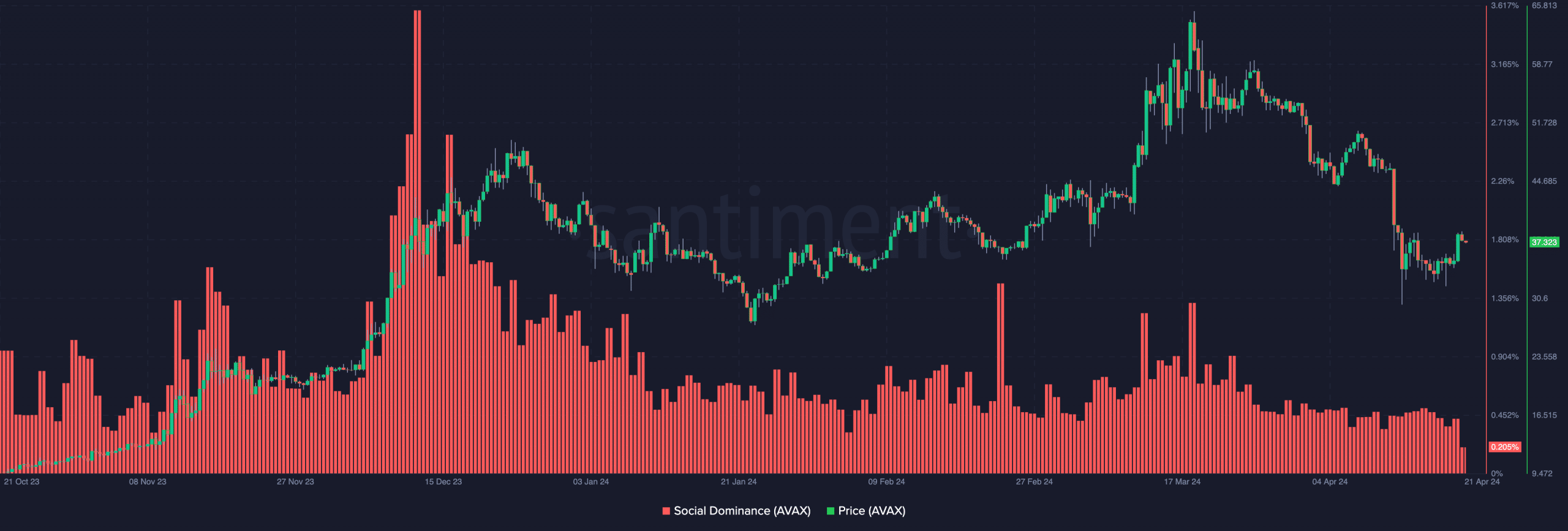

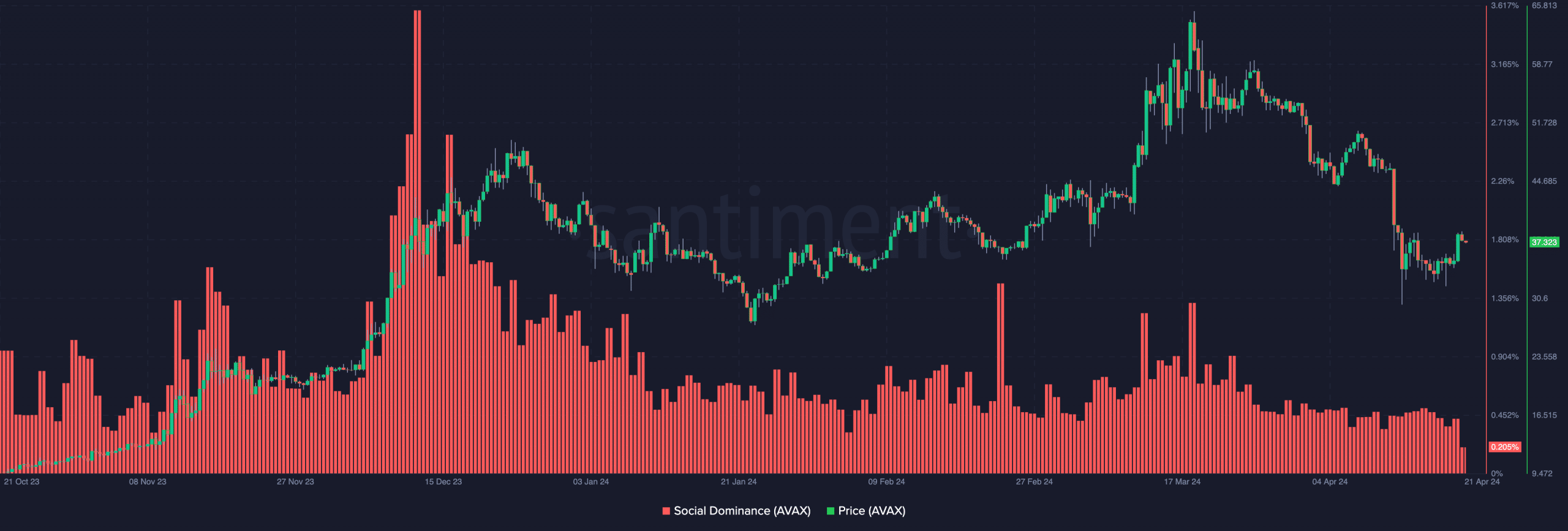

For the first time since November 2023, Avalanche’s [AVAX] social dominance has reached its lowest. According to Santiment data analysed by AMBCrypto, the social dominance was 0.205%.

The decrease in the metric meant that discussions about the token when compared to the top 100 were low. But the last time the dominance hit this low, the price of the token went from $11.62 to $48.93 in less than two months.

Source: Santiment

AVAX in a perfect place to outrun SOL?

Around that period, AVAX and Solana [SOL] were almost on the same pedestal in terms of price growth. Though both prices had tumbled compared to their performances in Q4 2023, SOL still had a better performance in Q1 2024.

Within the last 90 days, SOL’s price has increased by 64.43%. AVAX, on the other hand, recorded an 18.93% increase. However, the low social dominance seems to be the catalyst to get its Midas touch back.

If this happens, the price of the token might rally to $50.60 within a few weeks. At press time, AVAX changed hands at $37.31. But there were other places where the Solana ecosystem outpaced Avalanche apart from the value of their native tokens.

For instance, dogwifhat [WIF] is the top memecoin on Solana. Coq Inu [COQ], on the other hand, is the leading one on Avalanche. But the prices in the last 30 days were on opposite sides.

While COQ fell by 34%, WIF jumped by 37%, indicating that interest in SOL was much more than that in AVAX. Despite the disparity, AVAX seems to offer a better buying opportunity than SOL as traders might find the low values worthy of increased liquidity.

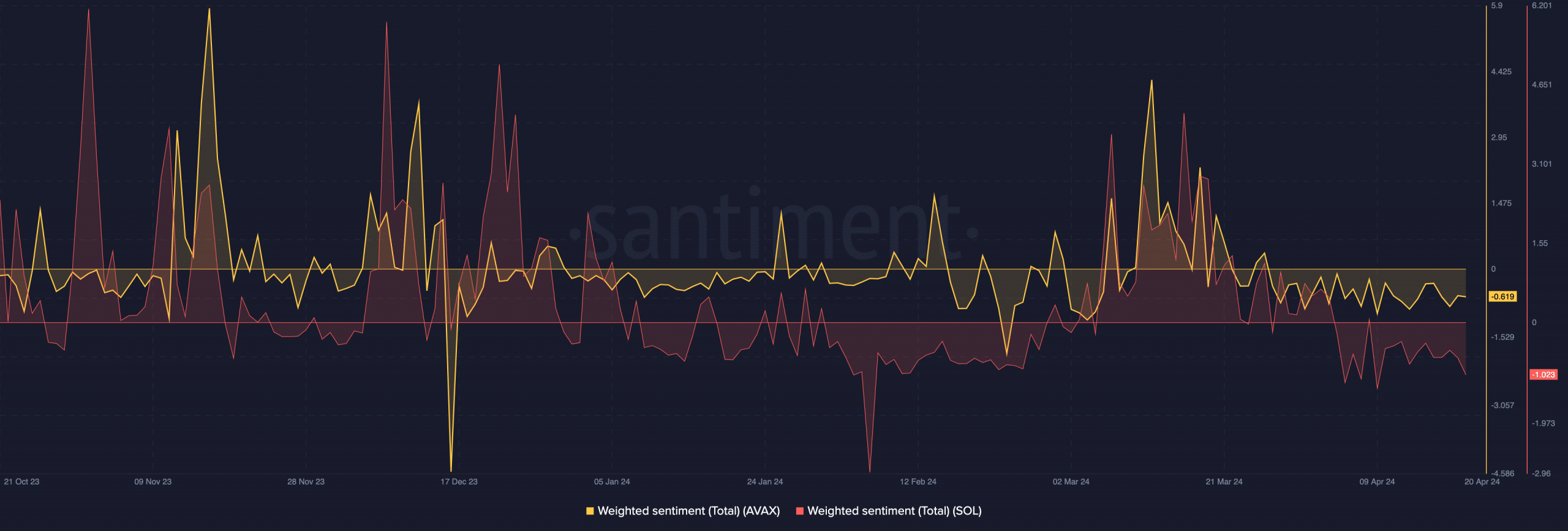

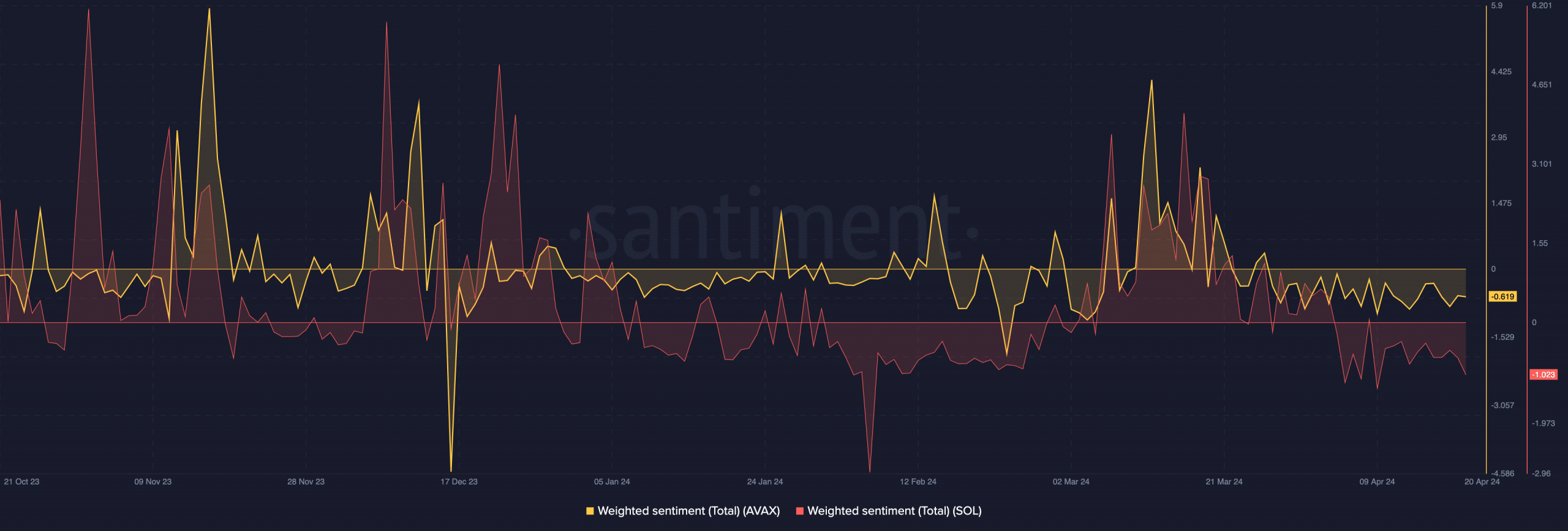

In the meantime, the sentiment around SOL and AVAX was negative. While AVAX had a reading of -0.619, SOL’s Weighted Sentiment was -1.023, suggesting that traders believed more in AVAX’s bullish projection in the short term than the latter.

Source: Santiment

No energy on ground

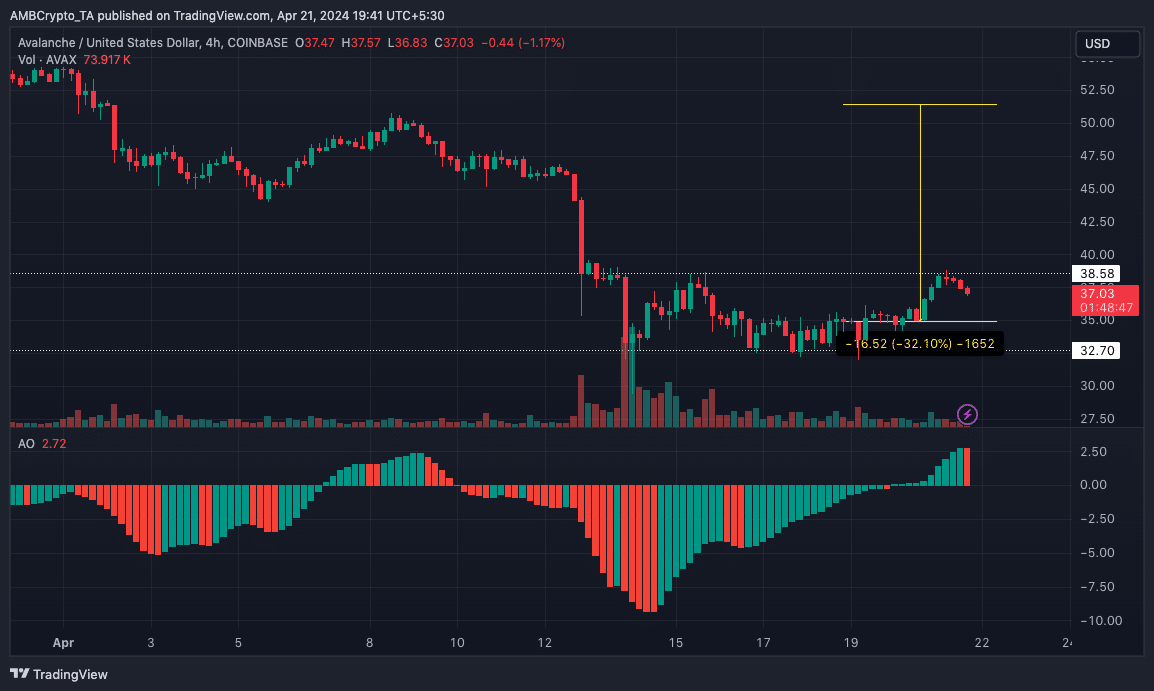

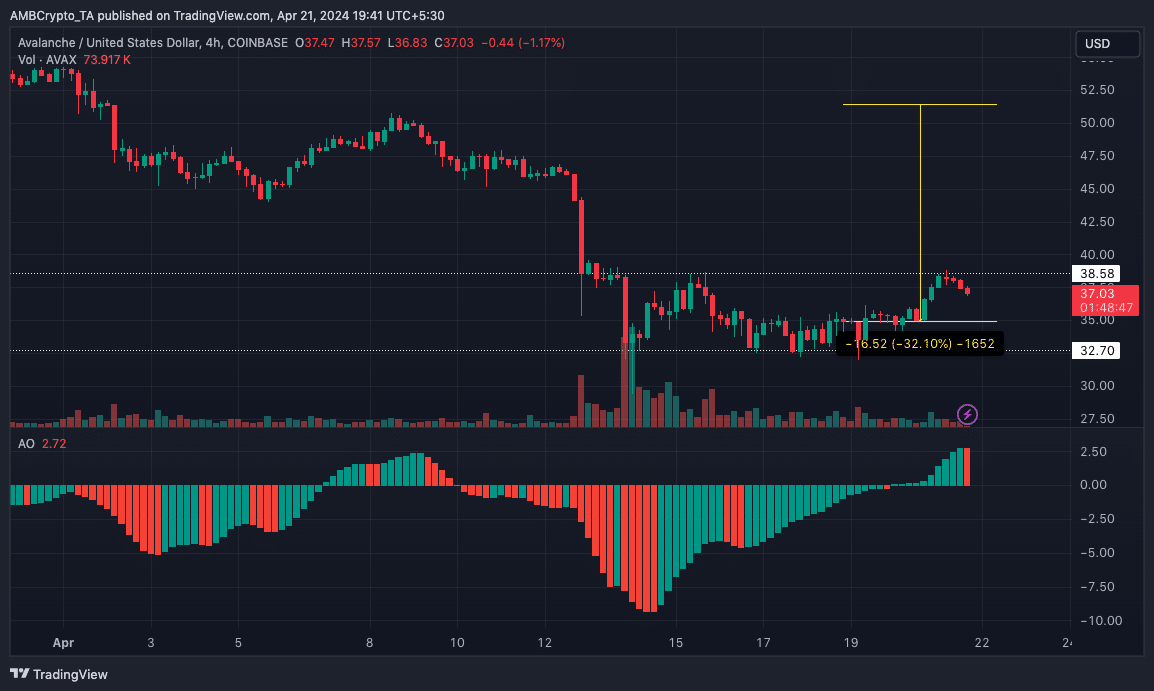

On the 4-hour timeframe, bulls had built support at $32.70, ensuring that the price did not slip below the level. However, the overhead resistance at $38.58 had halted the upward trajectory.

Despite the decline, the Awesome Oscillator (AO) was positive, indicating increasing upward momentum. But a red histogram bar appeared on the AO, suggesting that bulls might not have the firepower to ensure AVAX keeps accelerating.

Should this continue, AVAX might draw back to $35.01. However, a rebound at this point could set the stage for a 68.62% increase that could lead the price to $51.45.

Source: TradingView

Realistic or not, here’s AVAX’s market cap in SOL terms

From this analysis, we can conclude that the 12th ranked cryptocurrency still has good upside targets. At some point, it might outperform SOL.

However, in the long run, the tokens might move at a similar pace but that does not mean that AVAX would hit SOL’s market cap.

Leave a Reply