- History called attention to a related decline as volatility increased

- A higher number of BTC is being spent, indicating a potential slip below $60,000

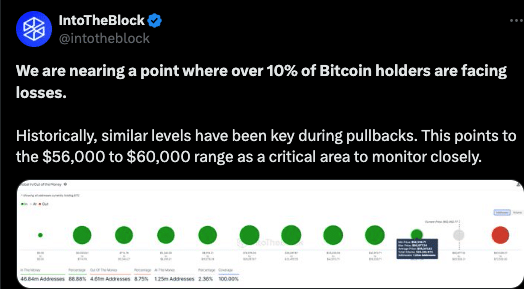

Bitcoin [BTC] finds itself at a crucial juncture now with only a few hours left for the much-anticipated 4th halving. However, according to data from IntoTheBlock, almost 10% of BTC holders are at a loss right now.

This increase in number could be linked to Bitcoin’s recent decline which was the price drop from over $70,000 to $62,324, at press time. That being said, this did not seem to be the only threat to BTC.

Can bulls defend BTC?

As per the said data, Bitcoin’s price could be set to plunge further and could settle between $56,000 and $60,000. This could happen if profitability declines, and the number of holders at a loss exceeds 10%.

Source: X

Here, it’s worth noting that AMBCrypto is not presenting this prediction without concrete reference to history. For instance, in January 2021, Bitcoin’s price fell from $40,000 to $31,000 after holders not in the money went higher than the aforementioned ratio.

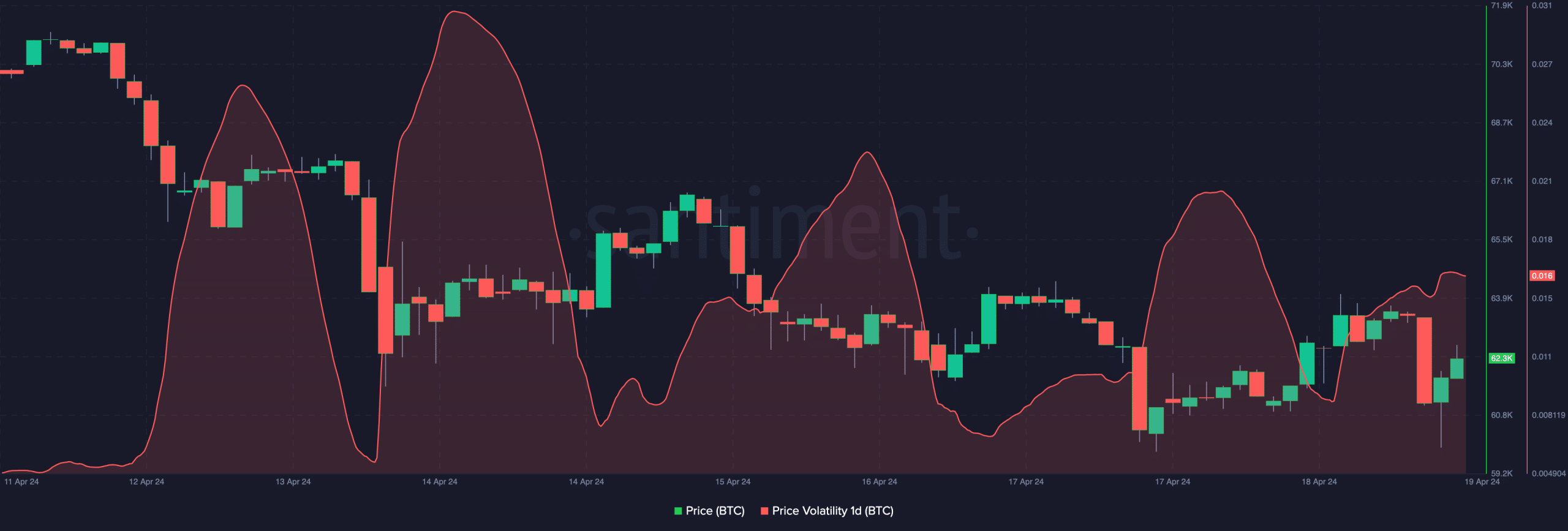

To ascertain this possibility, we checked the coin’s volatility using the on-chain analytics platform Santiment. At press time, the one-day volatility had risen to 0.016.

The higher the volatility, the higher the possible returns. Also, the hike in the metric has the potential to trigger a significant downward move on the charts.

At press time, Bitcoin’s volatility was not as high as it was on 14 and 16 April though. Ergo, if the metric hits any of those points, then the coin might record massive price swings on the charts.

Source: Santiment

If selling pressure increases, then a decline to $56,000 will be possible. However, a surge in buying pressure could change the forecast, and place BTC on a trajectory north.

Trouble ahead? Traders take cover

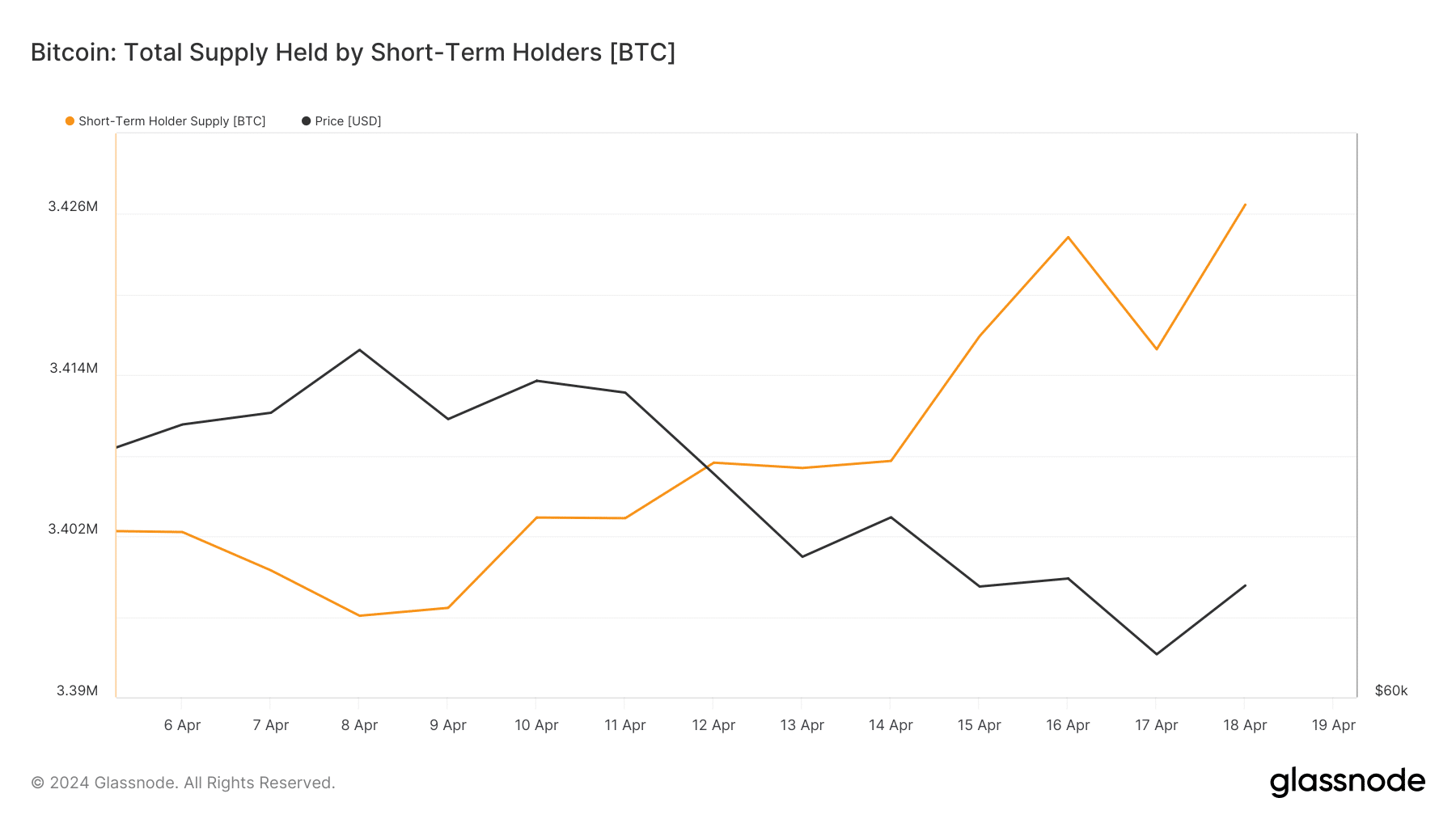

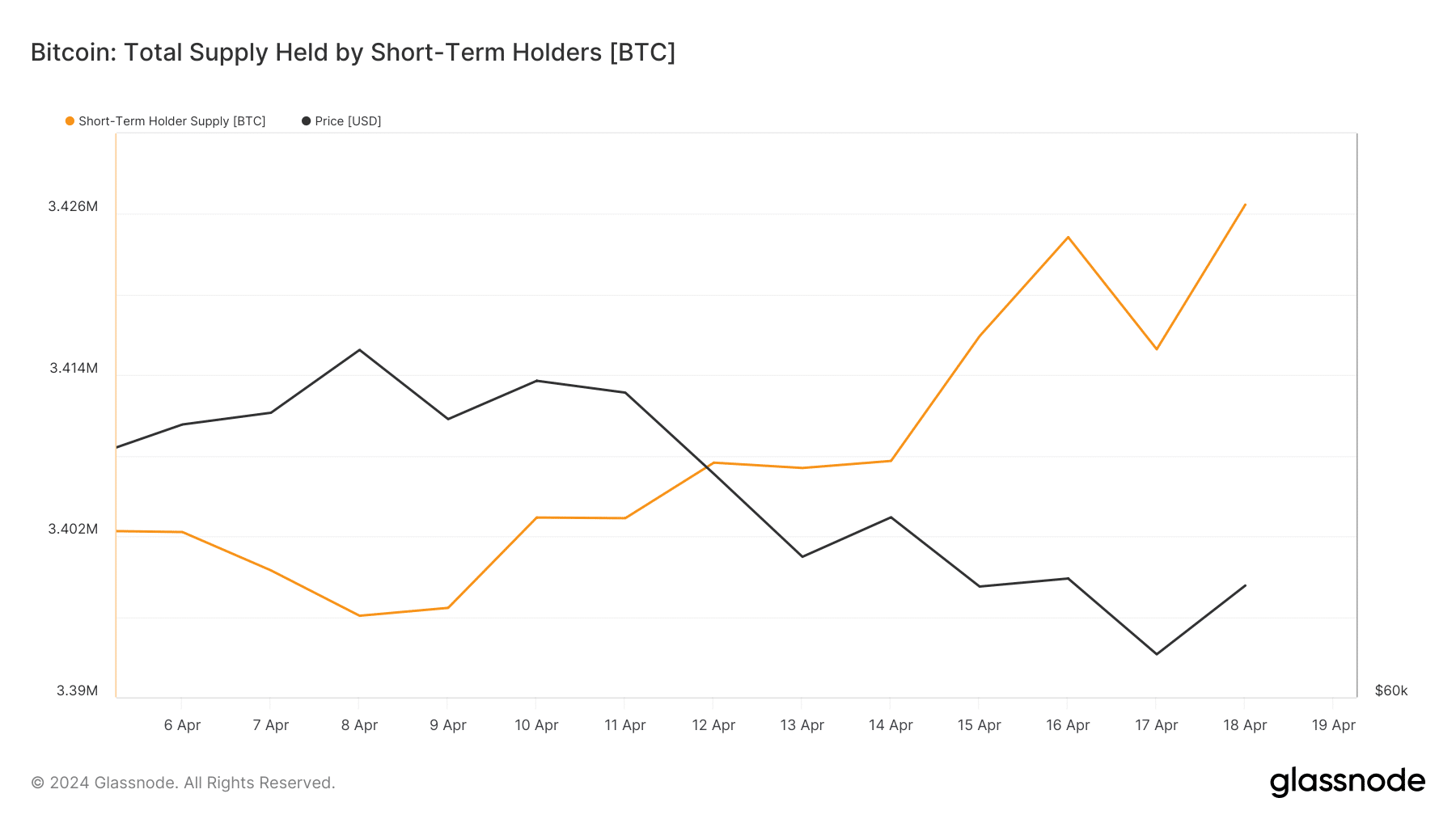

In the meantime, we found that Short Term Holder (STH) supply has been increasing. According to Glassnode, Bitcoin’s STH supply has jumped from 3.40 million to 3.42 million since 14 April.

The metric is the total amount of circulation supply held by short-term investors. If the metric tightens, it implies a decrease in the supply available to be spent or actively traded. Typically, this indicates a bullish scenario.

However, this was not the case with BTC as the potential implication could spell danger for the crypto’s price. Should the STH supply stall, the price of the coin might hold above $62,000.

Source: Glassnode

On the flip side, an increase in the supply could trigger a downturn, which could drive the value to as low as $56,000.

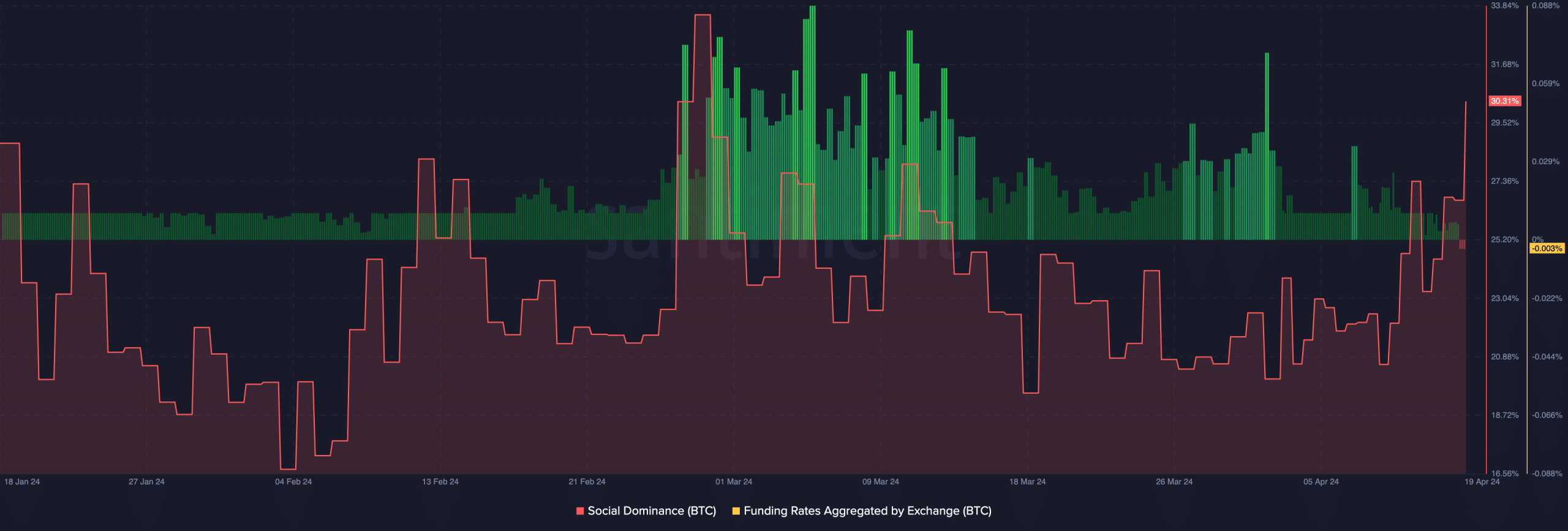

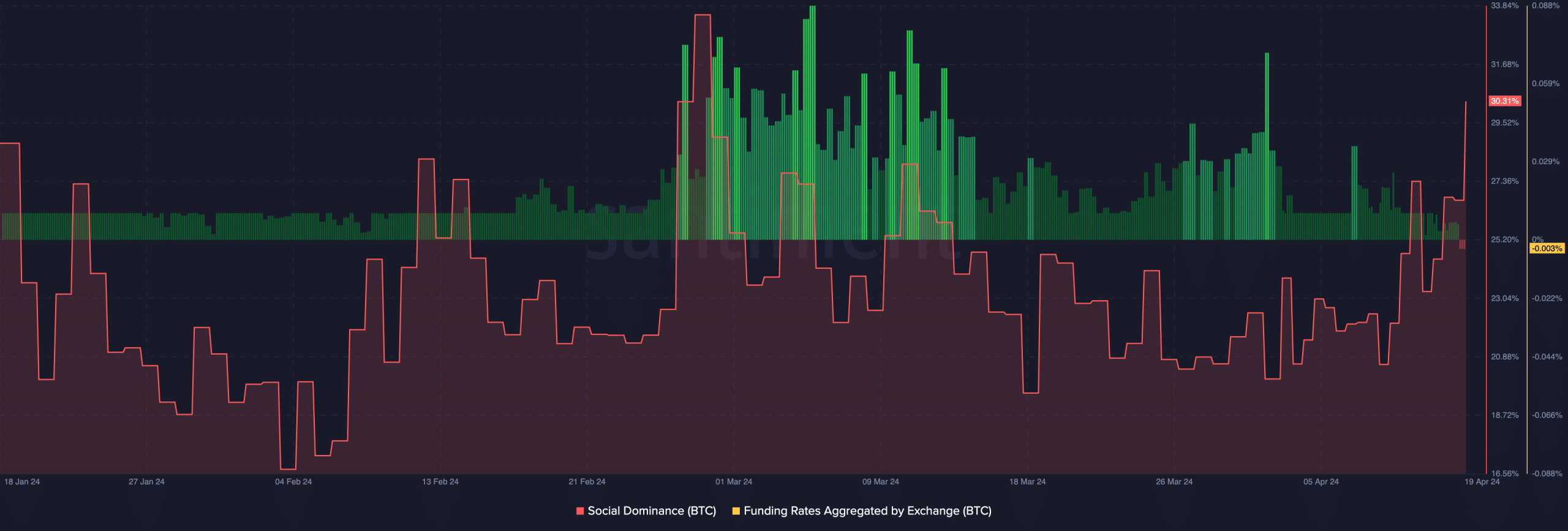

Despite the bearish bias, however, social dominance had increased to 30.31%. The surge could be linked to the nearing halving event which many believe will change the game for BTC this cycle. On the contrary, the aggregated Funding Rate went lower, indicating that traders are slowing down their bullish bets.

Source: Santiment

Is your portfolio green? Check the Bitcoin Profit Calculator

With the price moving lower and perp buyers reducing aggression, Bitcoin might not have the strength it needs to invalidate the possible decline. If this remains the case when the halving takes place, then a fall on the charts can be expected.

Leave a Reply