- DOGE’s Funding Rate went lower, suggesting a drop in traders’ optimism.

- The price might trade between $0.15 and $0.18 in the short term.

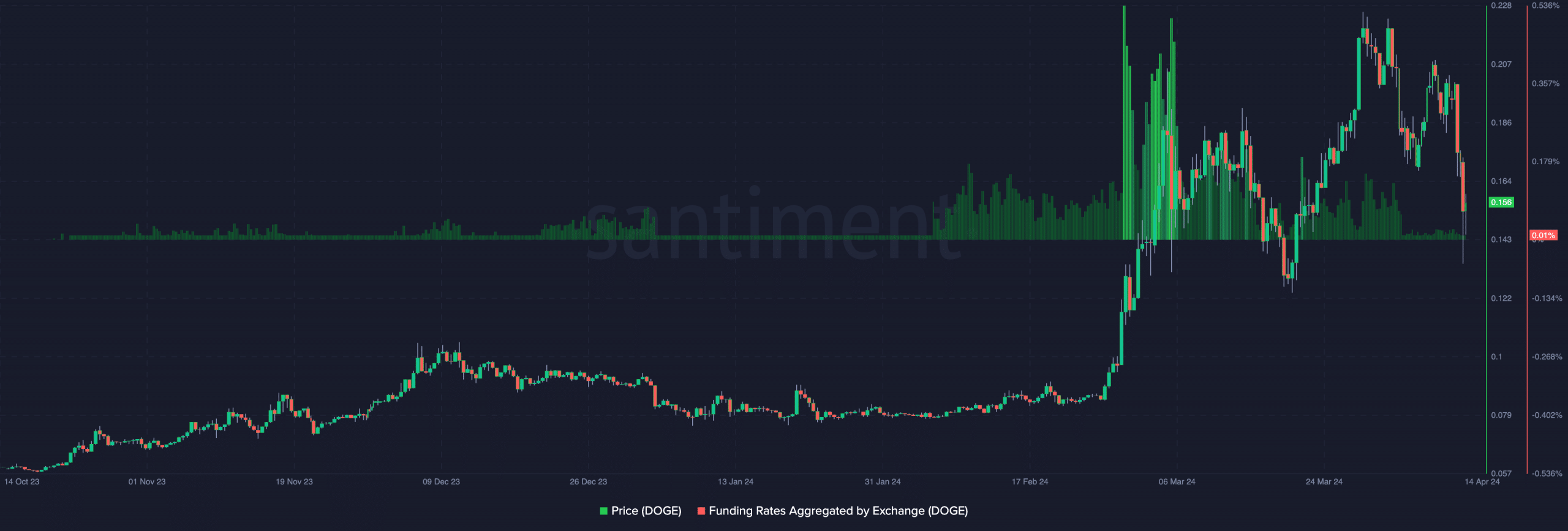

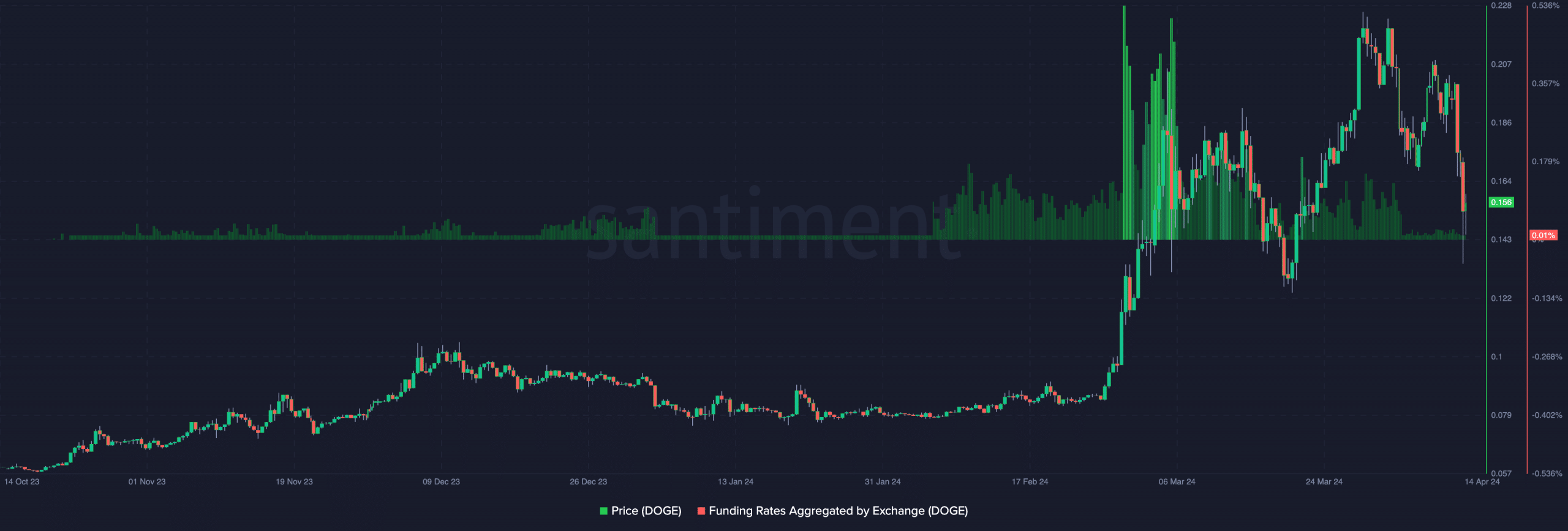

Since the 2nd of April, Dogecoin’s [DOGE] Funding Rate has remained at an extremely low spot. The last time, the metric was at the said level was around the first of February.

For those unfamiliar, Funding Rate is the cost of keeping a perp position open. If funding is positive, then it indicates a strong interest in long-leverage trades.

But if the reading is negative, it means that traders’ sentiment is bearish and short positions are dominant.

Confidence drops as DOGE falls

In Dogecoin’s case, funding was not negative.

However, having a very low positive reading suggested that the bullish bets were mild, and traders did not expect the coin’s value to hit astronomical points in the short term.

At press time, DOGE changed hands at $0.15, thanks to the price crash that happened over the last two days. If funding continues to drop, while DOGE’s price also follows, longs might fail to get rewards.

Source: Santiment

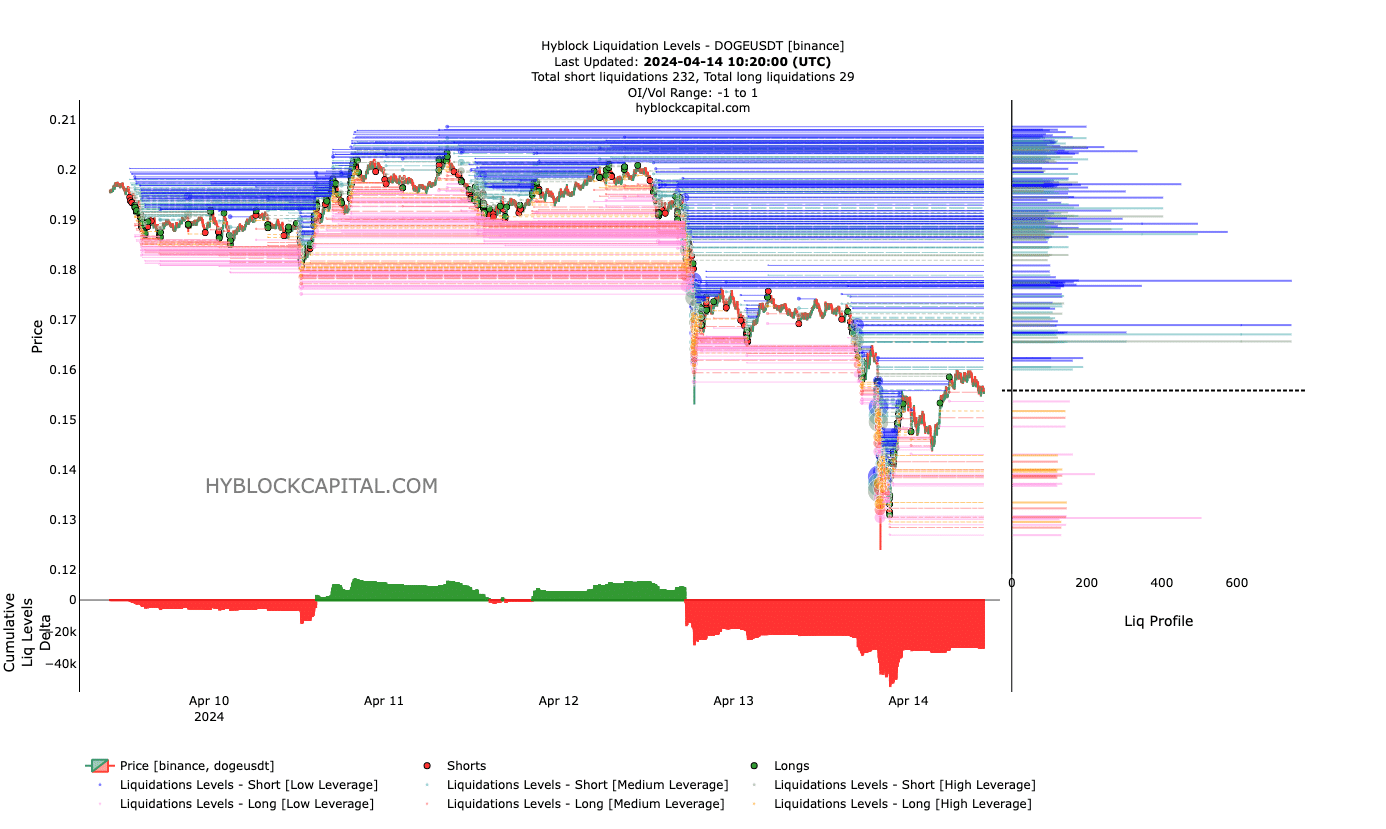

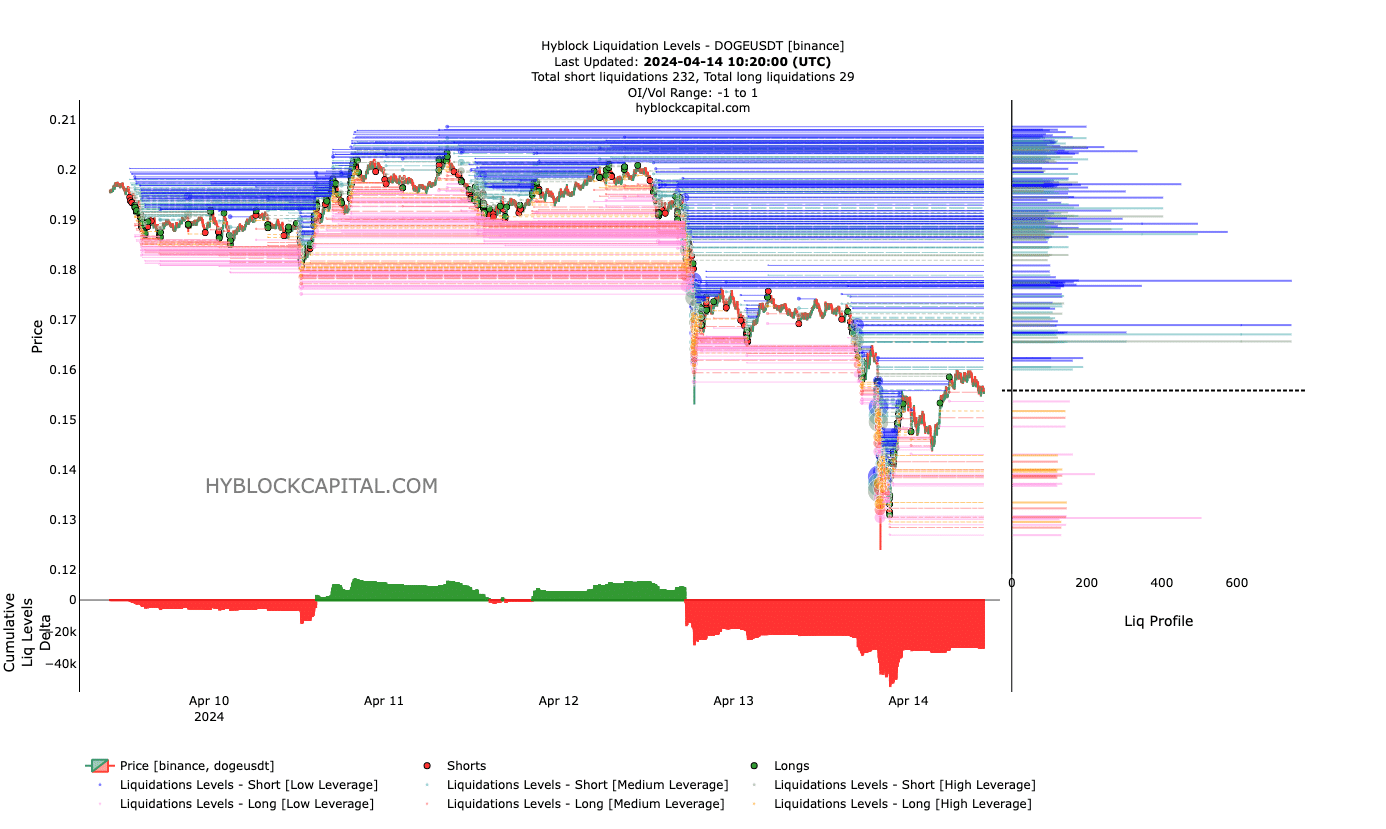

Concerning the price, this trend could be bearish, and the coin might see more downside. Apart from this metric, AMBCrypto analyzed the liquidation levels.

Liquidation levels give estimated price points where large liquidation events might occur.

Liquidation occurs when a trader’s position is forcefully closed because he can no longer meet the requirements to keep a position open.

This could be due to an insufficient margin balance. In other cases, the wipeout could be due to high leverage use amid high volatility in the market.

DOGE to wait for Bitcoin

At press time, Dogecoin lacked high liquidity between $0.15 and $0.18. This indicated that the price of the coin might not move in that direction yet.

Therefore, traders who decide to open long positions at this point could be at risk of liquidation. However, the Cumulative Liquidation Levels Delta (CLLD) displayed a different signal.

For context, a positive CCLD indicates that there are more long liquidation levels. On the other hand, a negative one suggests an increase in short liquidation levels.

Source: Hyblock

As of this writing, DOGE’s CLLD was negative. But for the price, this reading offers a bullish bias. The trend shown by the indicator revealed that late shorts are getting punished while trying to catch the dip again.

Hence, the price might dip slightly. But a bounce might not be far off in favor of longs. Despite the thesis, traders might need to apply caution.

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

For instance, the fourth Bitcoin [BTC] halving would happen within six to seven days. History shows that prices fluctuate a lot in the lead-up to the event.

As such, Bitcoin might not be the only cryptocurrency that could be affected. DOGE, and others, could also face severe swings.

Leave a Reply