- Historical trends suggest that Bitcoin’s price might rise in the coming months

- Metrics and technical indicators turned red after major price correction

The last 12 hours saw Bitcoin [BTC] record major price corrections on the price charts. Even so, it’s not too far off its recent all-time high. However, BTC’s price wasn’t the only metric to hit an ATH recently. In fact, its demand also increased sharply.

The newfound interest in Bitcoin among investors could play a pivotal role in propelling further growth. Let’s have a closer look at what’s going on.

New investors are demanding Bitcoin

Bitcoin is expecting its next halving in just a week. In the meantime, however, its demand has skyrocketed. Elja, a popular crypto-investor and influencer, recently shared a tweet highlighting the fact that demand for BTC from accumulation addresses has been exceeding supply from miners. This is the first time this has happened in BTC’s history.

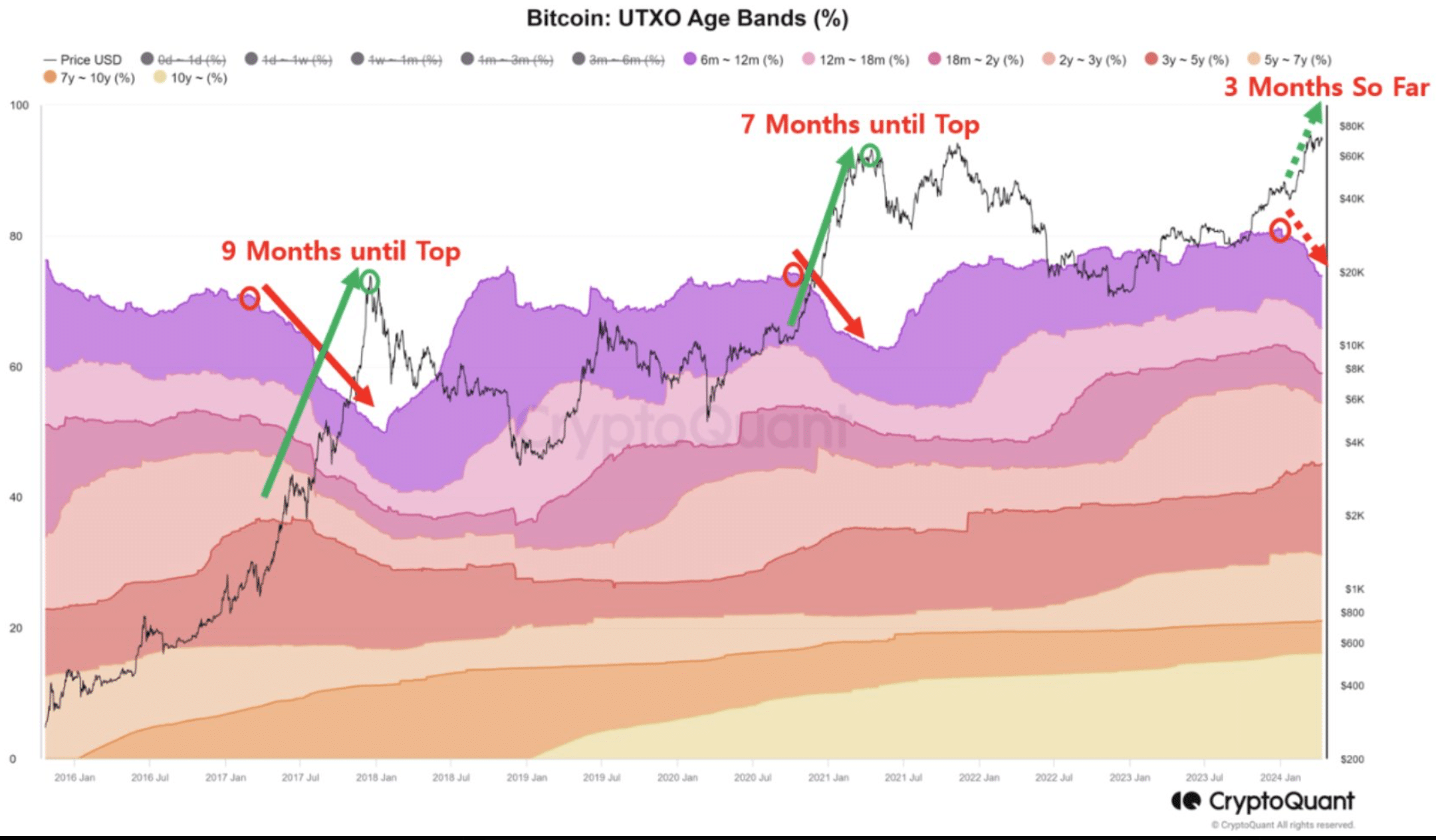

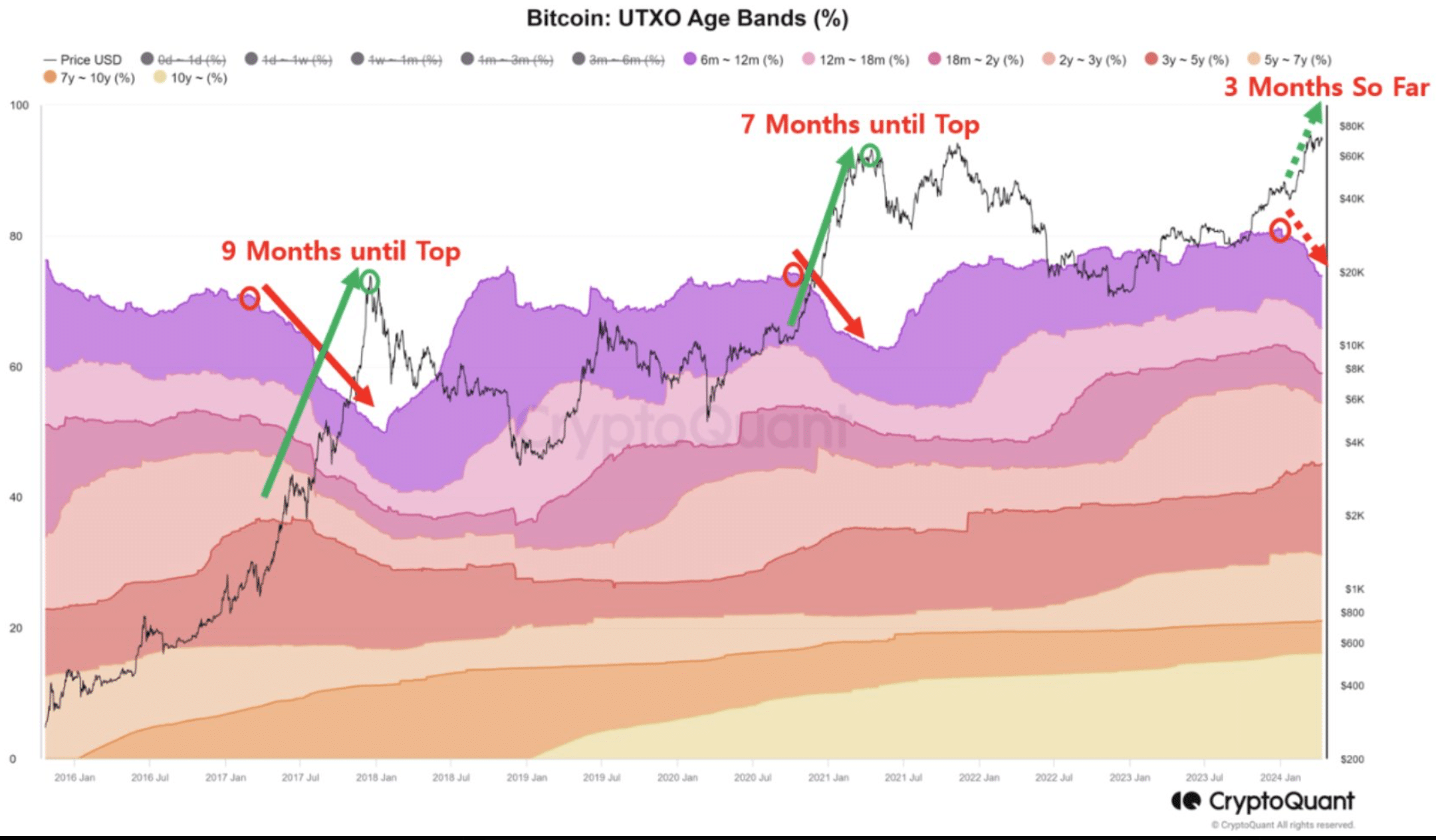

In fact, CryptoQuant recently posted an analysis pointing out how new investors are entering the market. CryptoDan, an analyst and author at CryptoQuant, mentioned in an analysis that Bitcoins held for more than 6 months mean that the number of Bitcoins traded for less than 6 months has increased, indicating an influx of new investors. Similar incidents have happened before, each of which was followed by bull rallies.

“In 2017, after a large influx of new investors began, Bitcoin reached its peak 9 months later, and in 2021, Bitcoin reached its peak 7 months later.”

Source: CryptoQuant

On this occasion, about 3 months have passed since new investors began to flow in. This is a sign that there are still a few more months left before BTC hits a new peak. Ergo, people who have been making $100k and $150k price predictions may not be wrong really.

This peak, however, may be a little late, especially in light of the cryptocurrency’s most recent price correction. According to CoinMarketCap, BTC was down by over 5% in 24 hours, at press time. Owing to Bitcoin’s fall, other cryptos had followed suit too.

Is Bitcoin getting ready for a new rally?

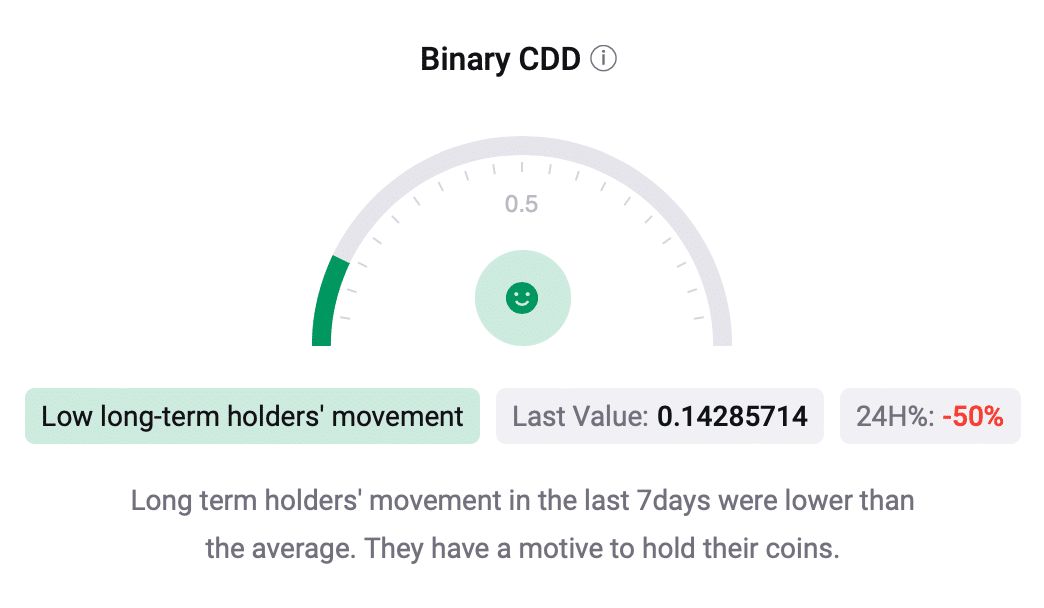

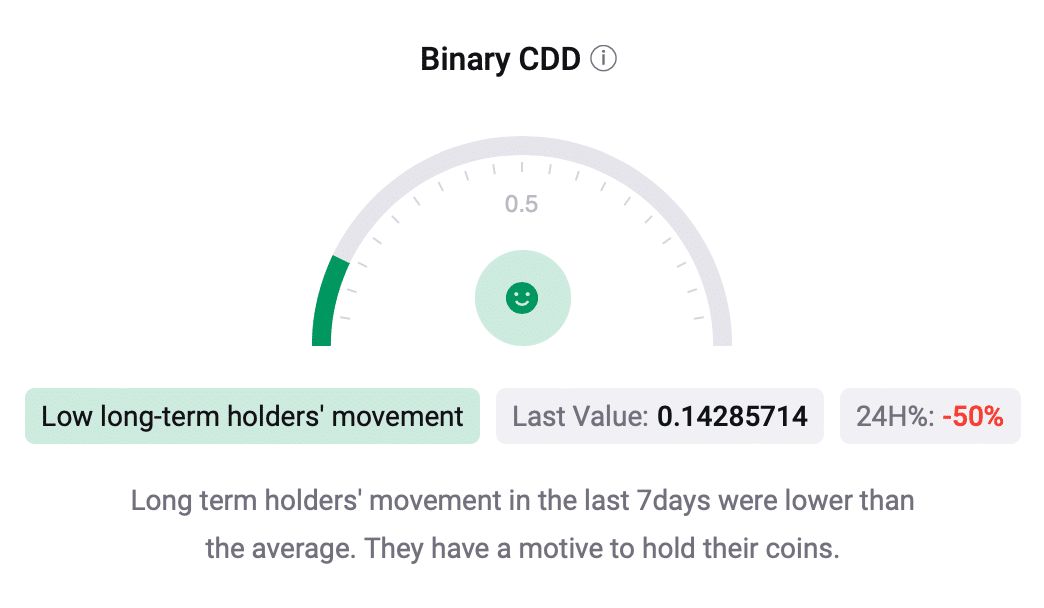

Since the chances of new investors fueling a bull rally seemed high, AMBCrypto then checked BTC’s metrics to find whether they supported this possibility. We found that not only new investors, but also long-term holders are now in a mood to hold their assets. The same was evidenced by the green binary CDD.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

On the price charts, however, BTC’s indicators were seeing red, at the time of writing. For instance, both the CMF and MFI dipped dramatically, with the former close to 0 on the charts now.

Leave a Reply