- XRP’s market cap now over $33 billion

- Since it did so, the crypto has continued to hold its price in the $0.6 zone

XRP recently recorded a shift in its market cap position, ascending further within the top ten rankings. In doing so, it overtook popular market stablecoin – USDC. However, despite its latest price performance, nearly 20% of the altcoin’s supply remains unprofitable.

XRP displaces USDC

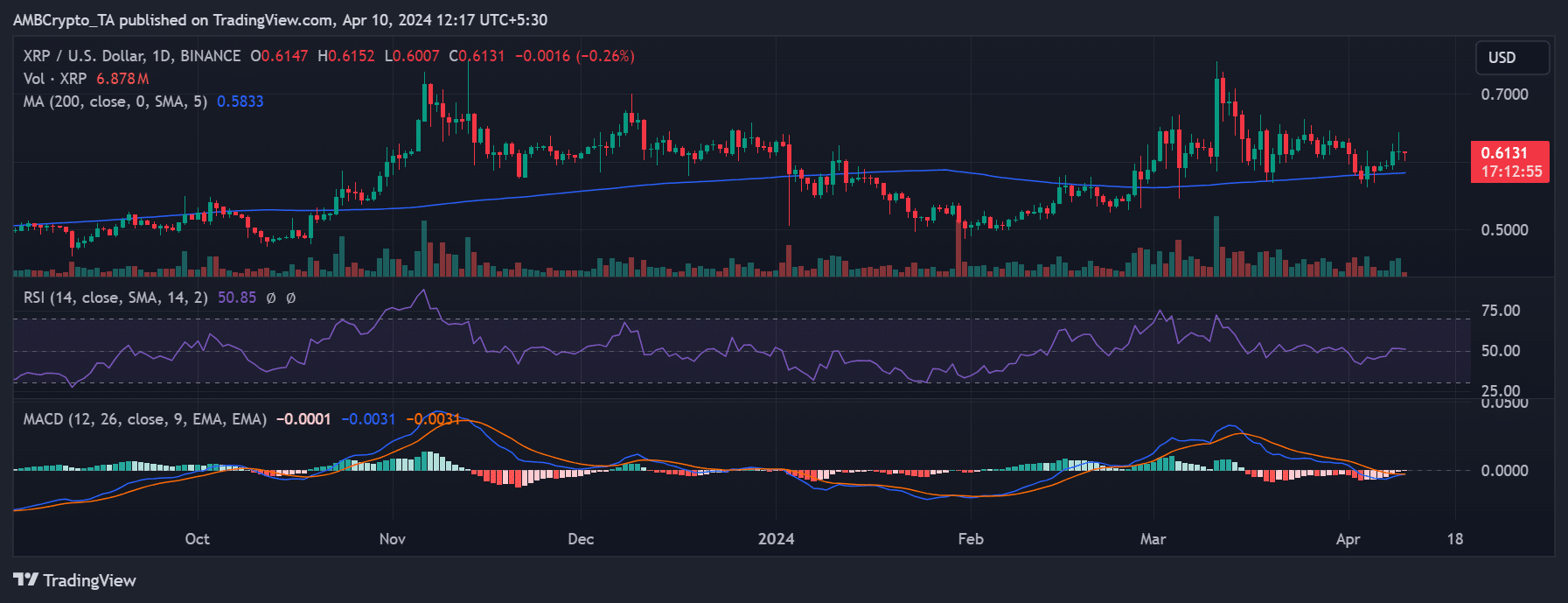

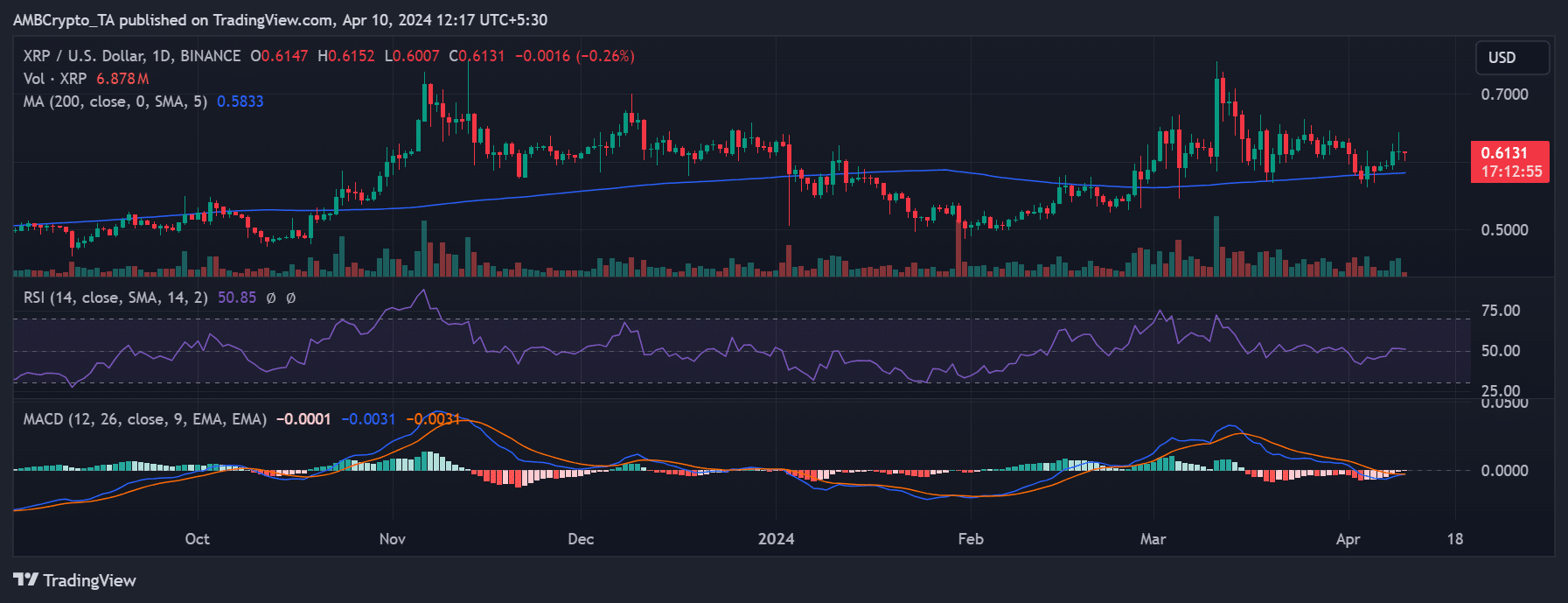

XRP concluded its trading session on 9 April with more northbound price movement. Examination of its daily timeframe chart revealed a modest hike of less than 1%, bringing its trading price to approximately $0.61. Additionally, the previous trading session saw a more significant uptick of over 3%, firmly situating it within the $0.6 price range.

This was the case at press time too, despite the altcoin depreciating by 1%.

Source: TradingView

On the charts, its Relative Strength Index (RSI) maintained its position above the neutral line, signaling a weak bull trend. This was corroborated by its Moving Average Convergence Divergence (MACD), slightly above zero.

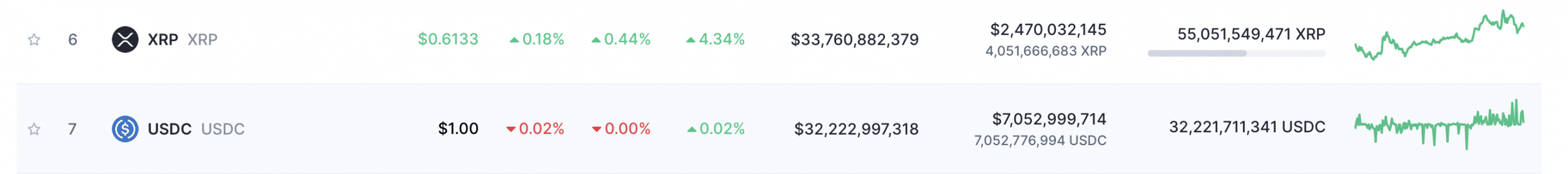

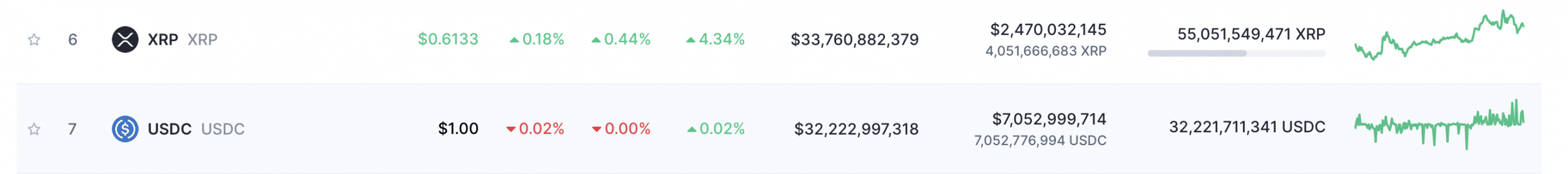

Owing to how well XRP did on the price front, there was a change in its market capitalization rankings too. XRP has now overtaken USDC as the sixth-largest cryptocurrency in the market.

Source: CoinMarketCap

A few negatives in sight

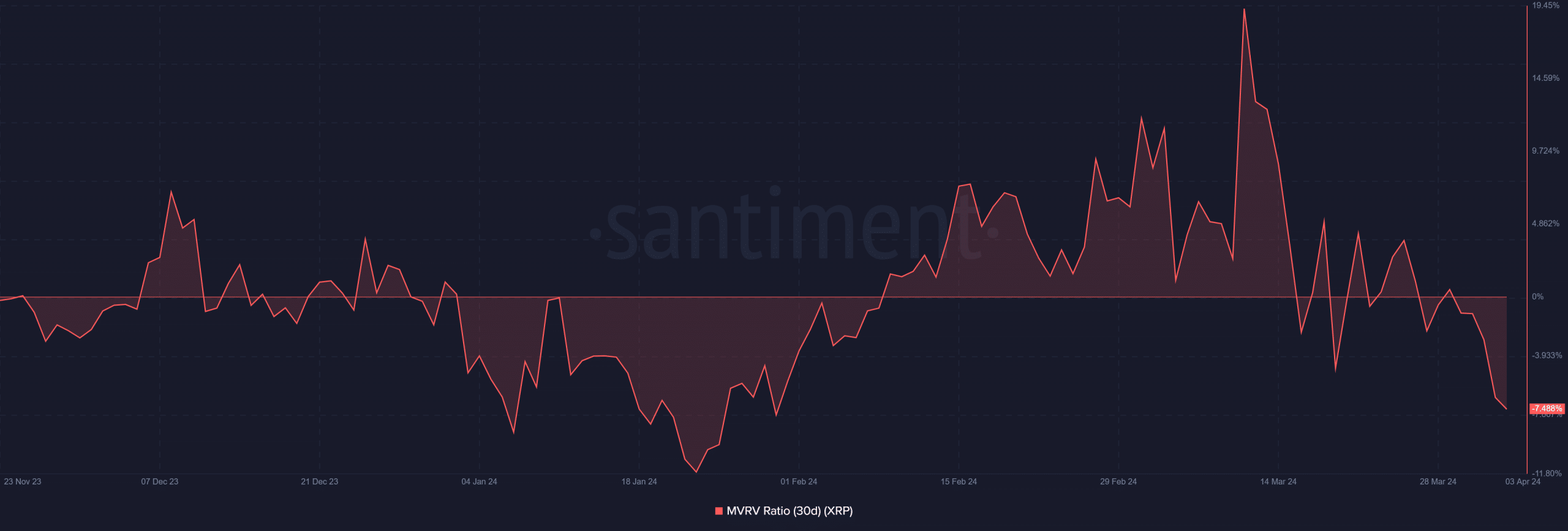

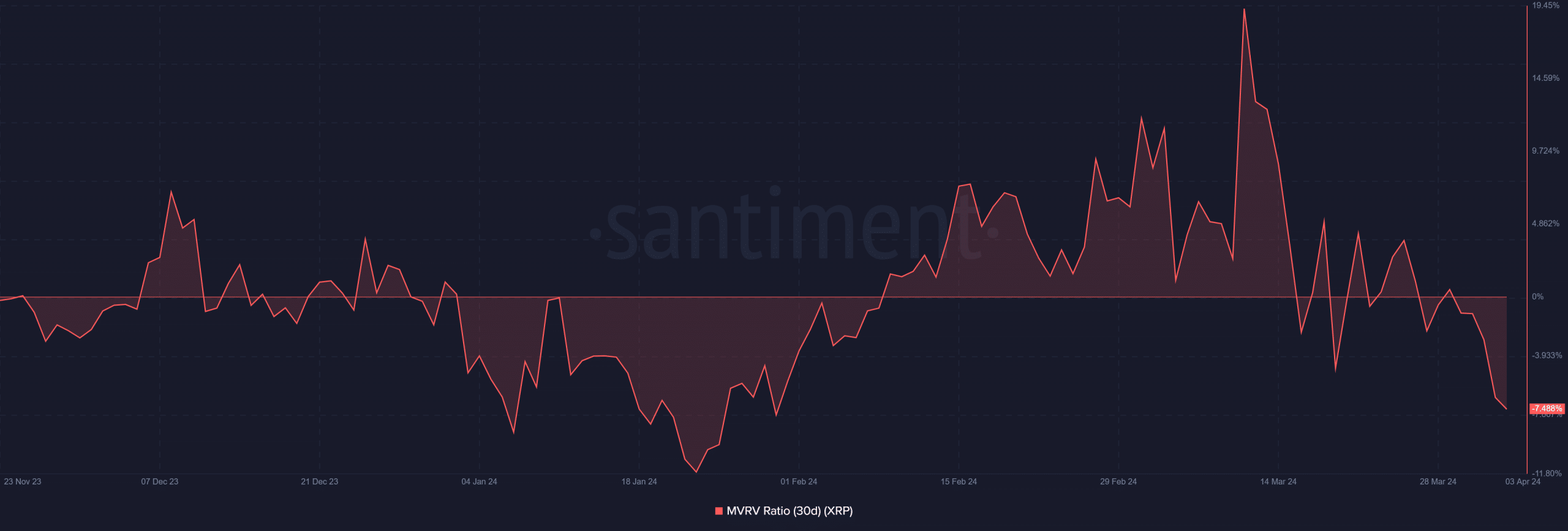

An analysis of XRP’s 30-day Market Value to Realized Value ratio (MVRV) revealed that despite the recent price increase, holders are still experiencing losses. In fact, the MVRV chart depicts a decline starting from the end of March, with the value standing at around -7.4% at the time of this writing.

This negative percentage suggests that holders who acquired XRP during this period are currently holding at a loss. Additionally, the recent market capitalization shift has not translated into favorable outcomes for traders falling within this wallet category.

Source: Santiment

Supply in profit continues its fall

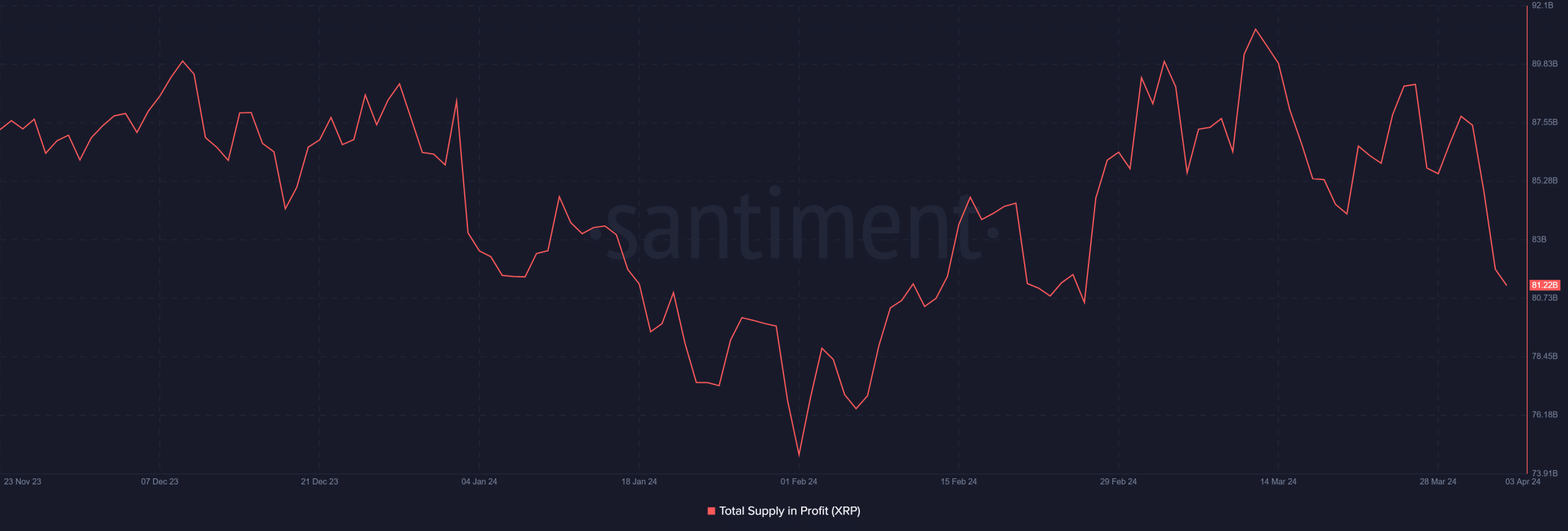

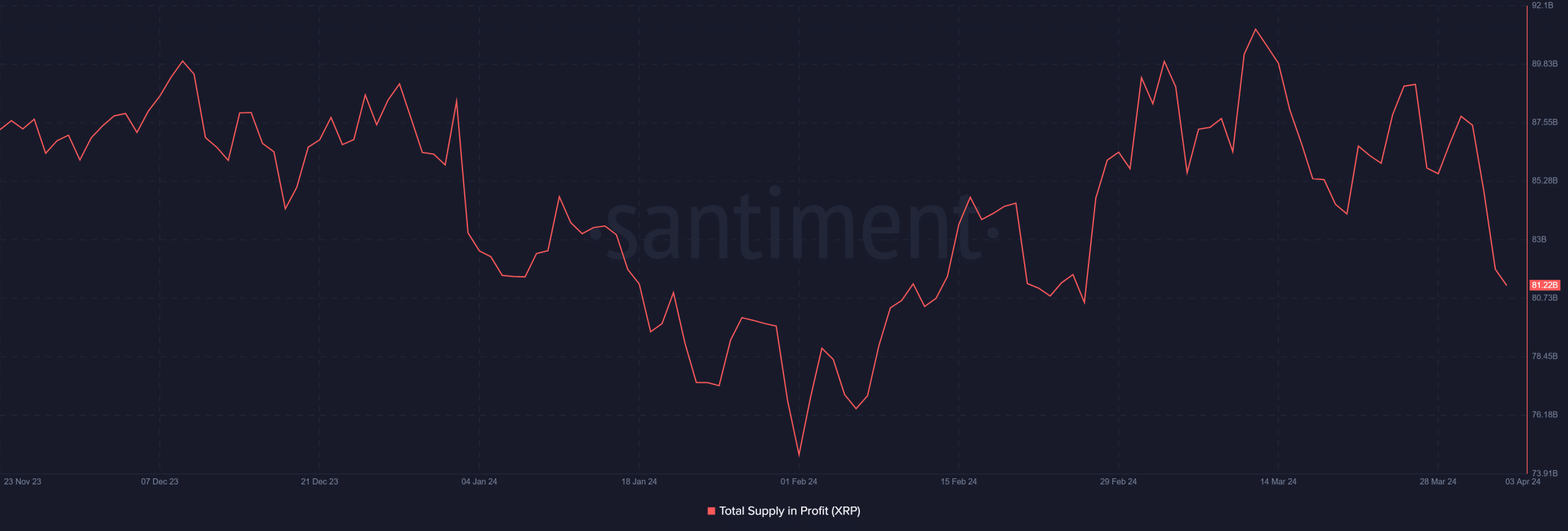

Another significant metric that has not positively reflected the recent price hike is the supply of XRP in profit. According to AMBCrypto’s assessment, there has been a sustained decline in the XRP supply in profit. In fact, as per Santiment, at the time of this writing, around 81.2% of the XRP supply was in profit, equivalent to around 81.2 billion XRP.

This represents a notable decrease from the figure of >87 billion XRP seen towards the end of March.

Source: Santiment

Can XRP maintain this new market cap?

The gap between XRP and USDC, which now holds the seventh position, is approximately over $1 billion. What this means is that a price decline could swiftly erode the recent gains in market cap.

However, a closer analysis of its 30-day Market Value to Realized Value (MVRV) ratio also revealed a potential for a future price hike. Trending below zero at press time, a slight upward trend in the MVRV would likely positively impact market capitalization.

Read Ripple (XRP) Price Prediction 2024-25

The implication is that in the long term, XRP stands a better chance of surpassing USDC and sustaining that trend.

Leave a Reply