In this article we explore new earning opportunities in the Ethereum restaking sector, increasingly targeted by crypto airdrop hunters due to its reward potential.

In particular, we see how to become eligible for the airdrops of Renzo and Etherfi (2nd round), both besieged by ether stakers in the last month with a significant influx of capital coming in.

Participating is very simple: all the details below.

Renzo Protocol: how to participate in the crypto airdrop

Renzo is one of the various restaking protocols built on Ethereum that have yet to launch a governance token, on which the chances of an airdrop to the community stakers are very high.

The platform allows you to take advantage of the security stakes of ETH staking on various AVS at the consensus level, simplifying the interface Eigenlayer and improving collaboration between decentralized services and node operators.

In recent months Renzo has become so popular in the world DeFi, to the point of being nicknamed as “the Restaking Hub of Eigenlayer“, as well as attracting a mass of new capital from crypto airdrop farmers.

We note in particular how in the last month the platform has stood out as the second source of inflow for Ethereum staking by channeling the entry of over 278,000 ETH into the Beacon chain.

Only the competitor platform Ether.fi has managed to do better with 437,000 ETH.

Source: https://dune.com/hildobby/eth2-staking

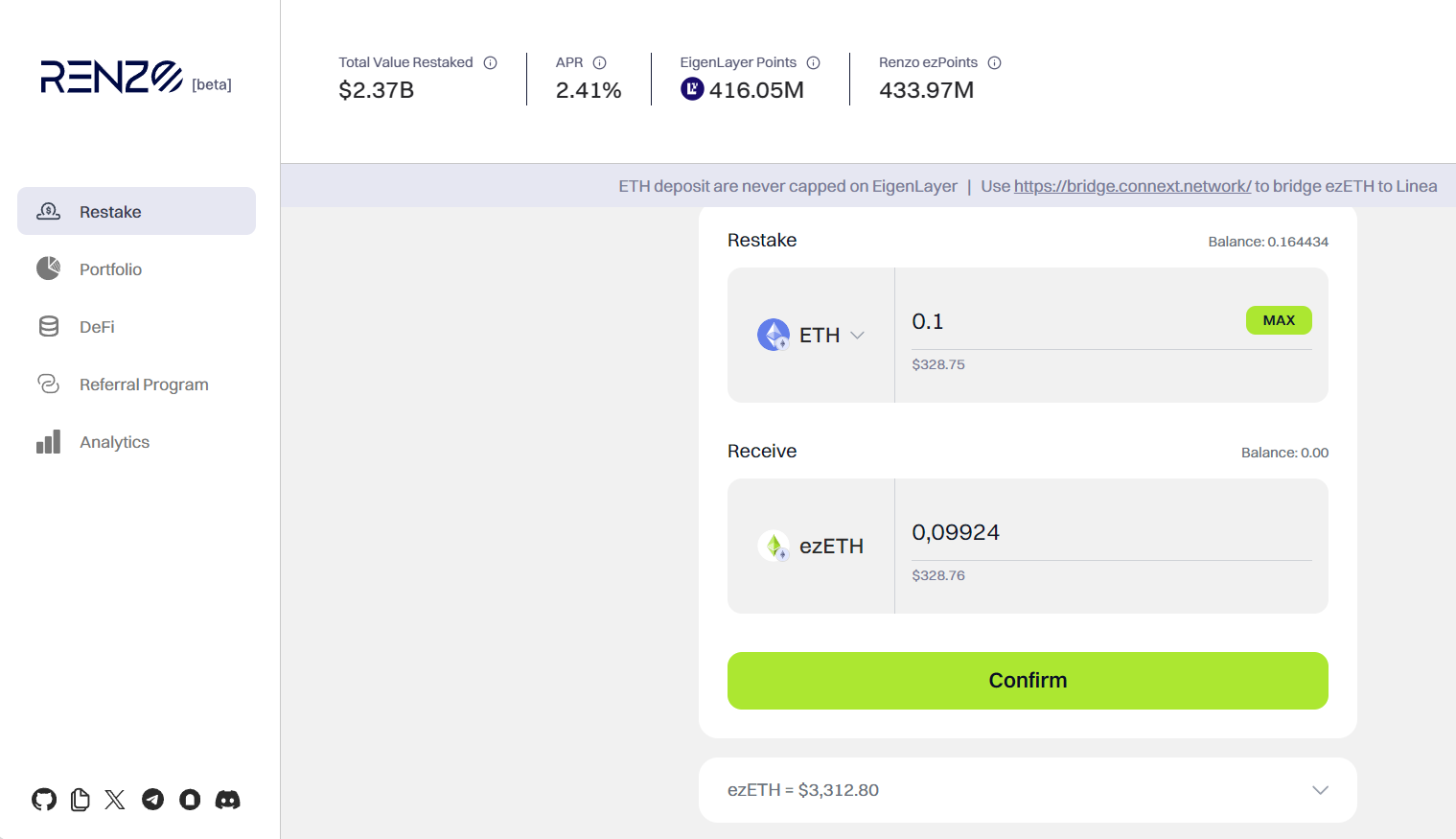

To participate in Renzo’s airdrop, all you have to do is deposit ETH (or the wrapped version WETH) or alternatively a derivative LST (stETH, wBETH etc) by minting the liquid restaking coin ezETH.

We underline how on Renzo, unlike other restaking protocols, we can operate with different available blockchains in addition to the Ethereum Mainnet, such as Linea, Base, Arbitrum, Mode and Bsc, taking advantage of the possibility to interact with the dapp by paying low transaction fees.

By staking ezETH, in addition to earning an additional 2.41% APR on top of the Ethereum staking yield, we also receive points that will be converted into Renzo’s governance token once the airdrop is officially launched.

In addition, we are also earning points for the Eigenlayer airdrop, which will likely take place within the next two months.

Regarding the calculation of the score, both on Renzo and on EigenLayer, every ETH staked corresponds to a reward of 1 point per hour. These are currently traded at a price of 0.37 dollars on secondary markets like Whales.market.

To increase your bets and maximize the return of Renzo’s airdrop, with the new governance token of the protocol that will be launched shortly in proportion to the score obtained on the platform, it could be appropriate to use your ezETH in DeFi applications.

The same liquid restaking token that guarantees us the airdrop points credit, can be used on different cryptographic protocols, obtaining an additional boost.

Dapps like Pendle, Zircuit, ZeroLend, Balancer, Blackwing, Thruster, Particle and many others offer a 2x boost on Renzo points and increased yield.

It should be noted that by blocking one’s ezETH on Zerolend, we can simultaneously farm 3 different airdrops, adding the ZERO token airdrop to the first two already presented.

ZeroLend works as a fork of Aave operating on Ethereum’s layer-2, therefore it acts as a market maker allowing users to deposit assets and borrow others.

ZeroLend x Renzo

ZeroLend has integrated @RenzoProtocol’s $ezETH on its Ethereum markets.

Supply $ezETH on ZeroLend to get @eigenlayer, @RenzoProtocol (2x), and $ZERO (2x) points.https://t.co/wqlJxGgnkY pic.twitter.com/nba4OLz62z

— ZeroLend (@zerolendxyz) March 28, 2024

Other airdrops in the world of restaking: second round of rewards announced for Etherfi

In addition to Renzo, within the restaking sector we find other tempting opportunities to participate in crypto airdrops and obtain excellent rewards.

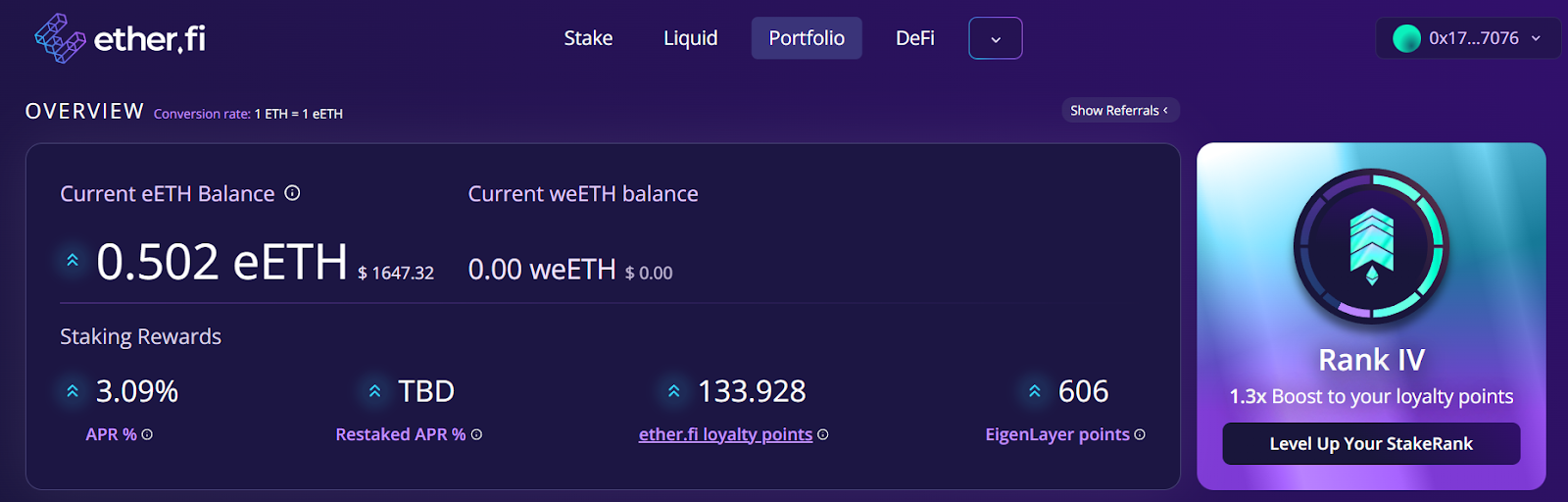

The “Season 2” of the Etherfi airdrop immediately catches the eye, whose token ETHFI was recently launched successfully in Season 1.

Now this protocol has allocated a sum of 50 million ETHFI, equal to 5% of the total coin supply, to be allocated to all platform stakers who lock their capital until June 30th.

Also in this case the campaign is managed with a program in points, where the more capital is deposited on the protocol, the more ” Etherfi Loyalty Points ” are accrued.

Points Season 2: StakeRank is LIVE! 🎉

TLDR:

– Users who stake longer get 💪 rewards

– Loyalty points accumulation rate increases by 10x for season 2

– Season 2 is on from Mar 15 – Jun 30

– Season 2 allocation is 5% of total ETHFI supply, over 50M tokens

– Liquid points are… pic.twitter.com/RMzwUAMM3f— ether.fi (@ether_fi) April 4, 2024

To participate, the mechanism is identical to that observed on Renzo, with the only necessary condition being the staking of ETH or an LST token like stETH (APR 3.09%) and the corresponding minting of eETH.

However, on Etherfi it is not possible to operate on layer-2 but only and exclusively on the Ethereum mainnet, paying the necessary fees for each interaction with the blockchain.

In the second season of this airdrop we find the novelty of the presence of a “StakeRank” which offers a multiplier of etherfi points based on the user’s cryptographic activity.

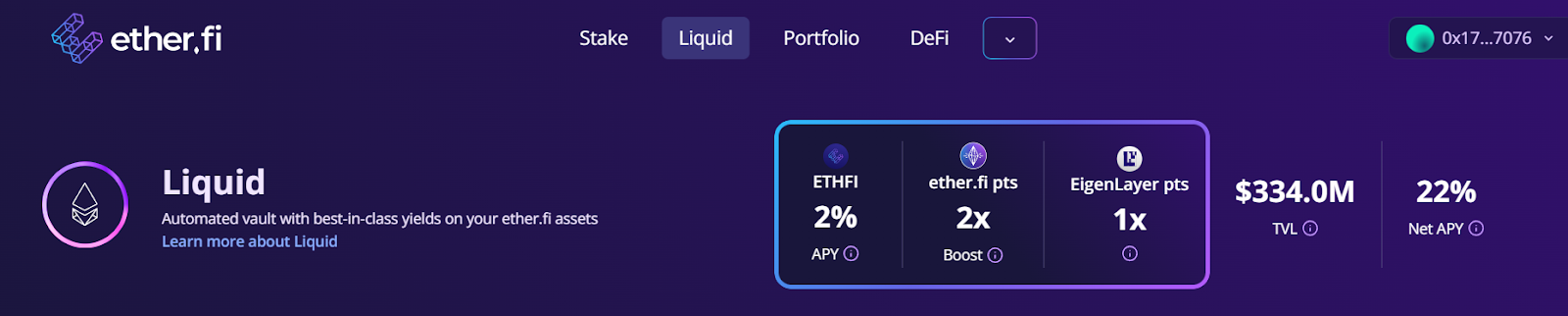

Loyalty Points can be further increased by using eETH in DeFi applications such as Pendle, Balance, Gearbox, Curve, Term, and Gravita with a boost of up to 2x.

Another method to achieve a higher score is to take advantage of the automated vault “liquid” within the restaking platform, committing WETH, eETH or weETH, also enjoying an APY of 22% paid in ETHFI.

Other restaking protocols likely to release a crypto airdrop to Ethereum stakers are Swell, KelpDAO, and Mantle.

Leave a Reply