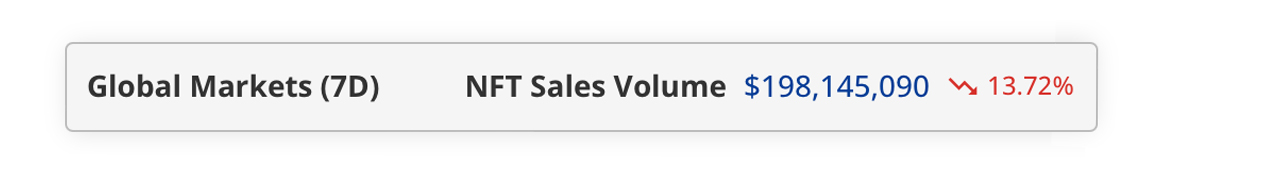

Over the past week, sales volume for non-fungible tokens (NFTs) experienced another week-on-week decrease, marking a 13.72% reduction. This downturn marks the fourth consecutive week of declining NFT sales, a stark contrast to the record-breaking achievements witnessed throughout other sectors in March. During this period, the splendor of trading volumes did not extend to digital collectibles.

NFT Sales Slide 13.72% Lower Than Last Week

Both centralized and decentralized cryptocurrency exchanges hit peak trading volumes in March, yet marketplaces procuring non-fungible tokens (NFTs) consistently recorded declines week after week. The trend continued through the seven days between March 29 to April 5, 2024, with a 13.72% dip in sales, as six leading blockchains in NFT sales posted weekly downturns. Leading the pack, Bitcoin-centric NFT sales amassed $66.67 million, despite witnessing a 17.99% drop from the previous week’s figures.

Ethereum secured the runner-up spot with $63.98 million in sales, experiencing an 8.89% decrease. Following Ethereum, Solana with a 12.70% reduction, Mythos dropping by 4.36%, and Polygon with a 19.7% fall, completed the top five blockchain platforms by NFT sales volume. Leading the pack in NFT collections, Uncategorized Ordinals amassed $21.11 million, while the Bored Ape Yacht Club (BAYC) collection claimed the second-highest volume for the week at $6.68 million, according to cryptoslam.io stats.

This week, the Dmarket collection from Mythos notched $6.63 million in sales, with Bitcoin’s Nodemonkes trailing slightly at $6.3 million. Mad Lads fetched $5.52 million, despite a 27% decrease from the previous week. The highest-priced NFT sold last week was a BNB Lockdeal digital collectible, fetching $651,963. Following closely, BAYC #591 was acquired for $301,563. Approximately five days ago, Bitcoin Shroom #173 was purchased for $216,657.

What do you think about this week’s NFT sales data? Let us know what you think about this subject in the comments section below.

Leave a Reply