- The velocity and MVRV ratio spiked, hinting at a price decrease.

- Money flowing into Dogecoin stalled as indicators favored a fall to $0.16.

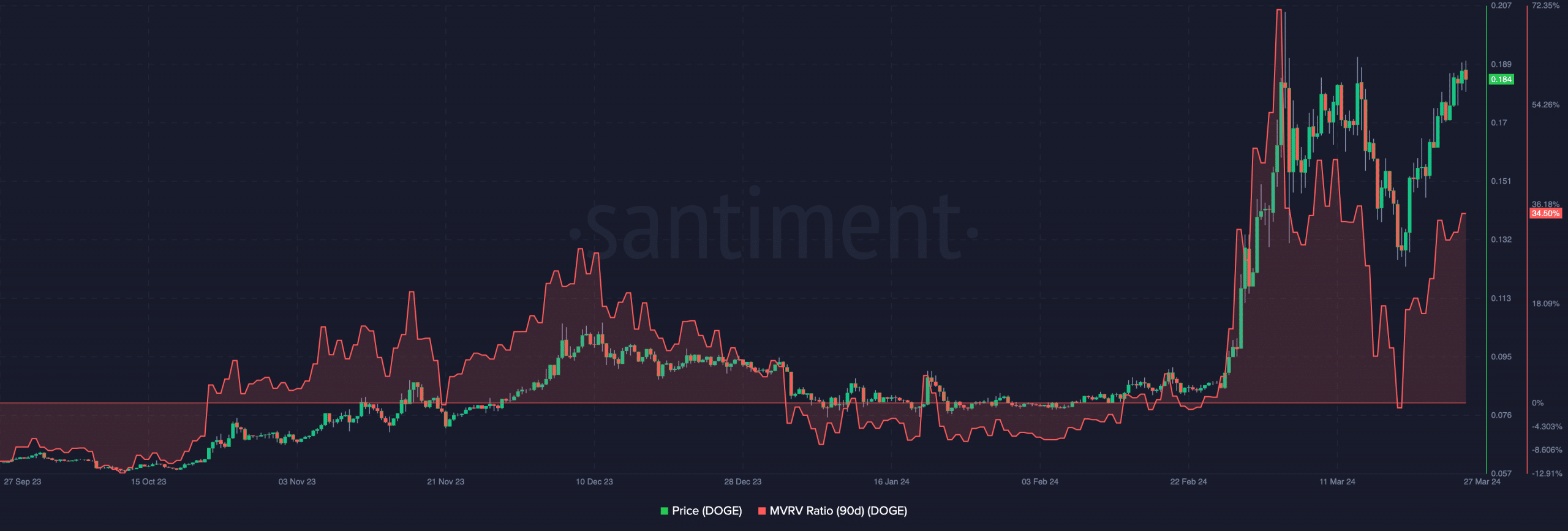

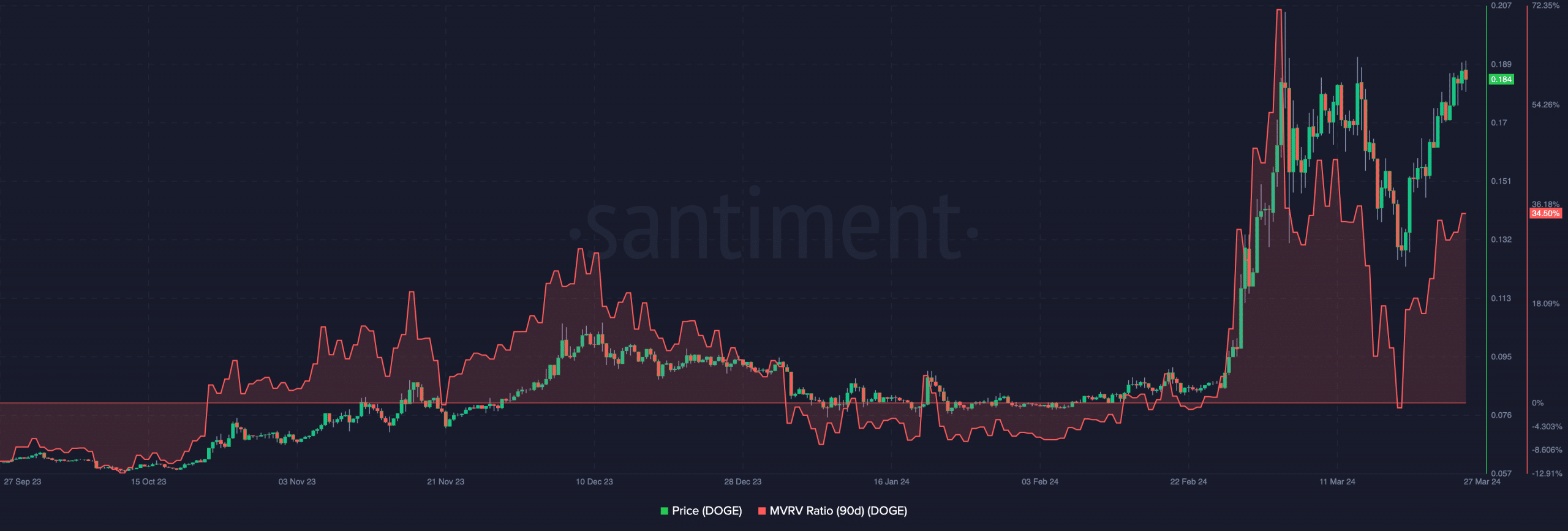

After a 34.76% seven-day increase, Dogecoin [DOGE] could pause the week-long surge. This prediction was because of the Market Value to Realized Value (MVRV) ratio.

According to AMBCrypto’s analysis, Dogecoin’s 90-day MVRV ratio was 34.50%. This indicates that unrealized profits within the last three months have been relatively impressive.

Historically, a negative MVRV ratio is a bullish sign, and market participants use that opportunity to stack more coins. However, a double-digit positive value is not typically great for the price action.

For Dogecoin, this might not be the time to accumulate as holders might begin booking profits. If profit-taking increases, a correction could be next.

Some weeks back, AMBCrypto reported how holders in profit might continue to grow. During that time, 85% of total DOGE holders had unrealized gains.

Source: Santiment

As it stands, that percentile might decrease as the coin might soon face selling pressure. DOGE’s price was $0.18. But in the first week of March, the value was higher.

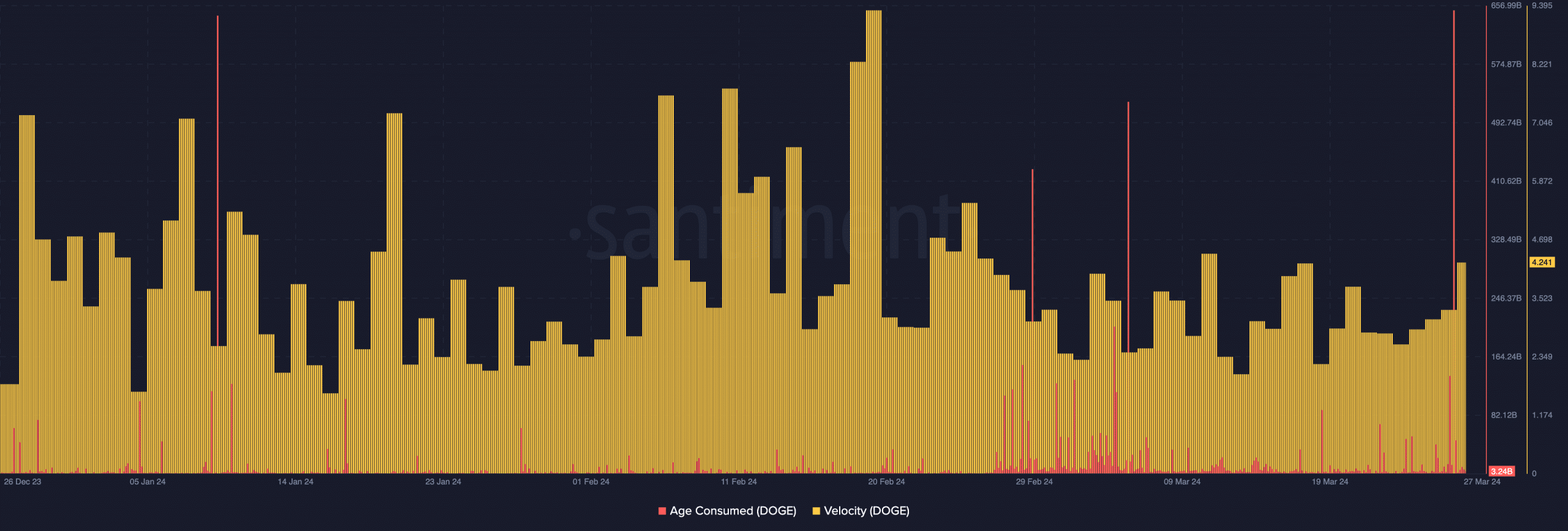

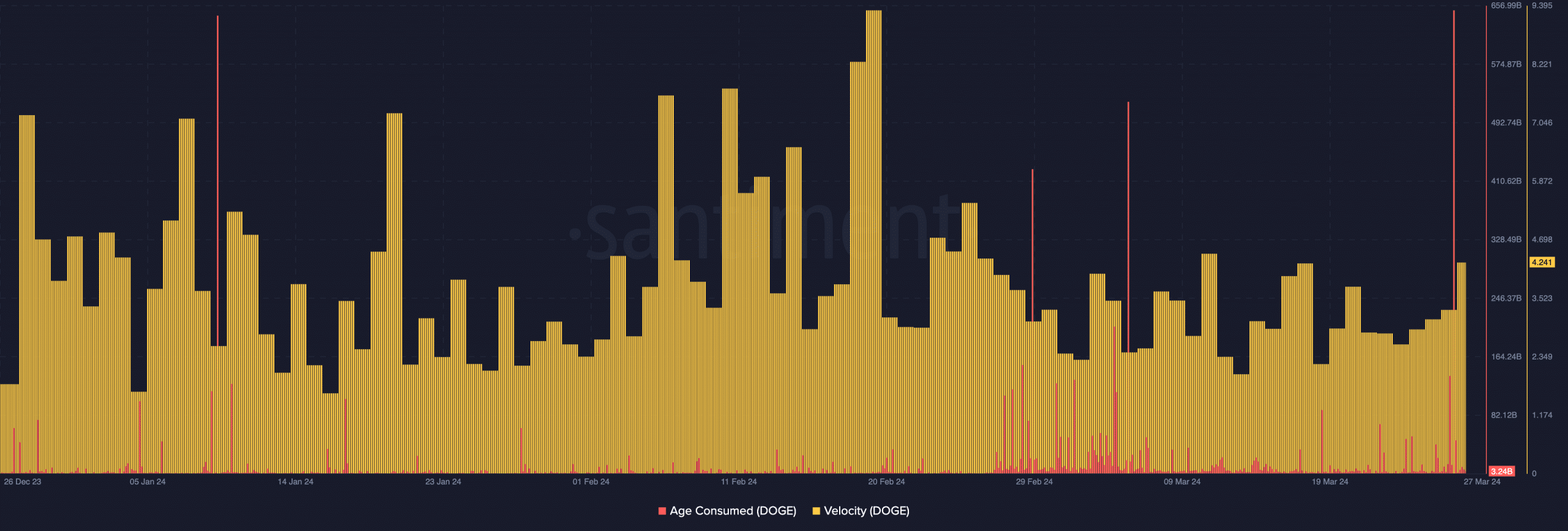

While there was a decline afterward, we found another metric indicating that a move toward $0.20 might be postponed. Based on our assessment using Santiment, the Age Consumed metric agreed with the MVRV ratio indications.

On the 27th of March, Dogecoin’s Age Consumed spiked. A hoisted reading of the coin’s age means that dormant addresses were transferring the coins somewhere else.

In most cases, some of these transfers go into exchanges. If the exchange inflow climbs, the price of the cryptocurrency risks a decline, and that was the case with DOGE.

Likewise, the velocity painted a bearish picture. At press time, the velocity increased, suggesting that a lot of Dogecoin was circulating.

In recent times, whenever the velocity decreases, the price of DOGE falls days after. Therefore, there is a high chance that history might repeat itself.

Source: Sentiment

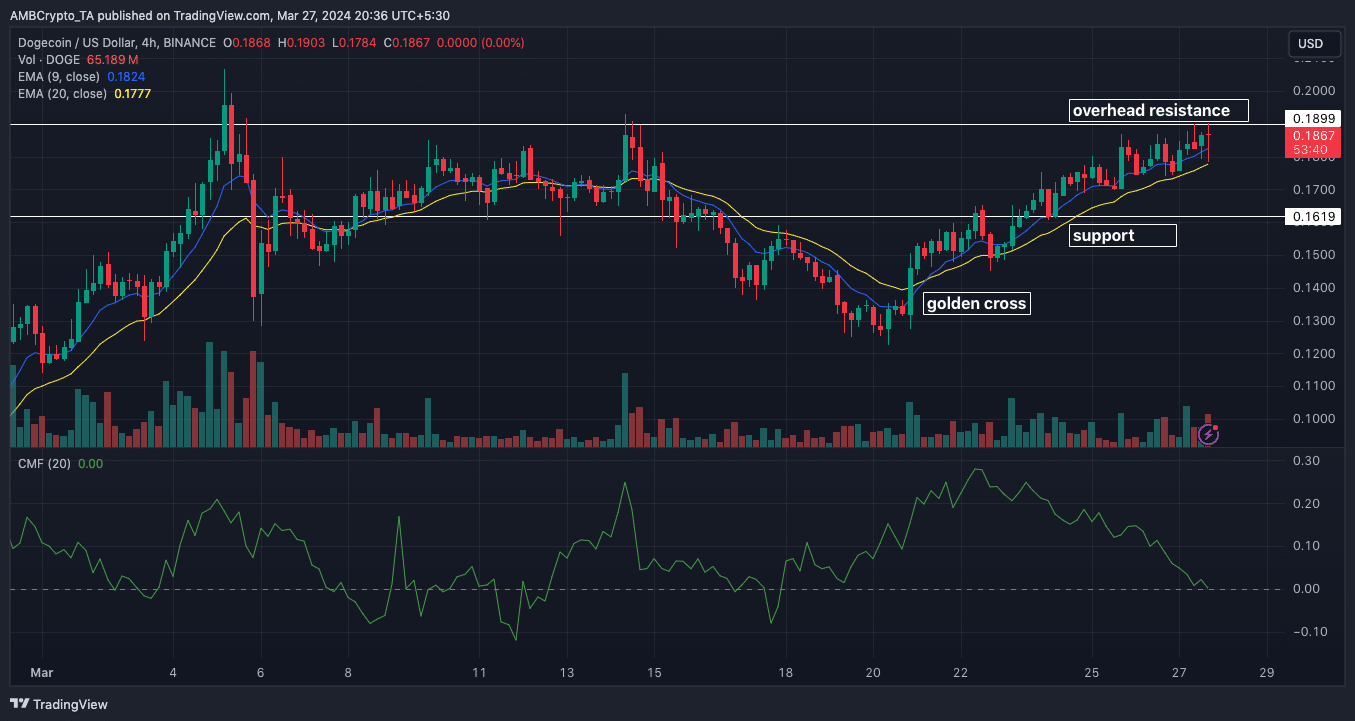

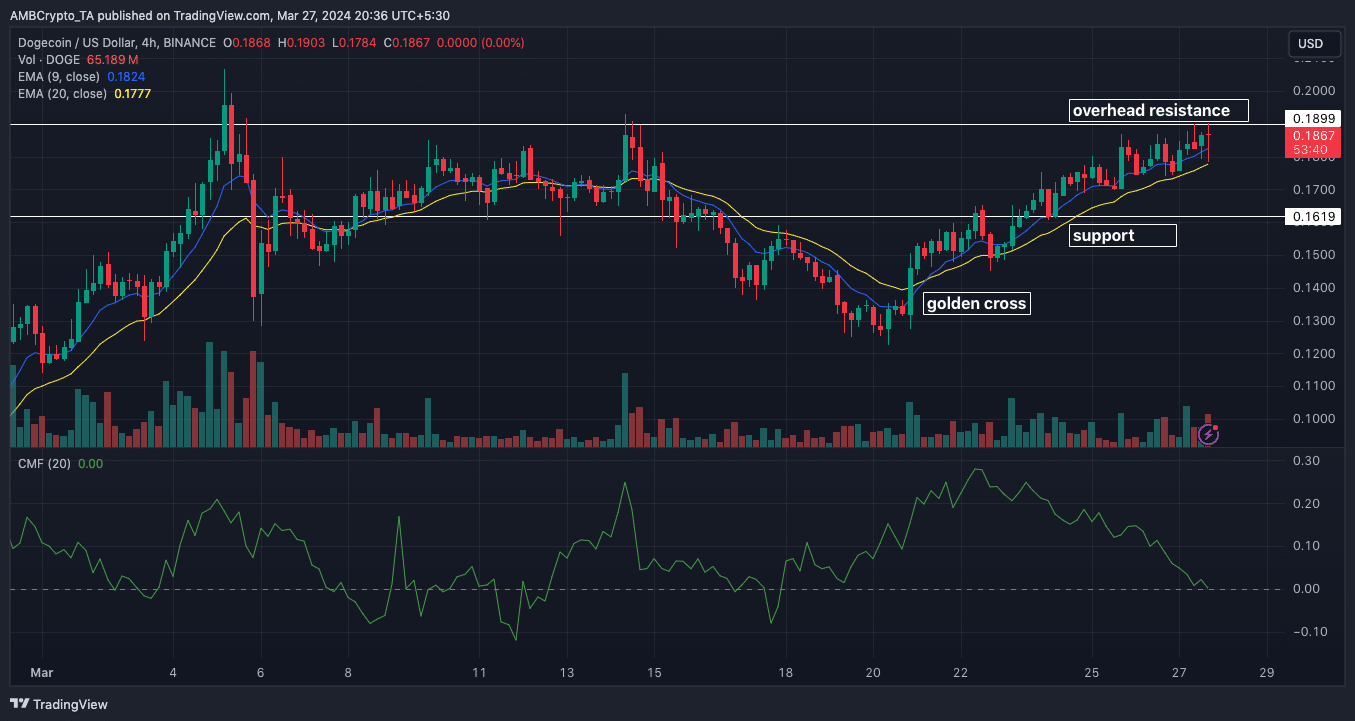

Beyond the on-chain signals, AMBCrypto also looked at DOGE’s technical outlook. At press time, the Exponential Moving Average (EMA) formed a golden cross on the 21st of March as the 9 EMA (blue) crossed over the 20 EMA (yellow).

This crossover was one of the reasons the price rallied. However, the DOGE was on the brink of falling below the EMAs. If this happens, the price of the coin might retrace to the $0.16 underlying support.

However, bulls might attempt to key into the overhead resistance at $0.18. But in the meantime, a rejection might follow.

Source: TradingView

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

Additionally, the 4-hour chart revealed that the Chaikin Money Flow (CMF) had fallen to the neutral region.

If the CMF continues to oscillate around the same region, previously sustained buying pressure might fizzle out. Hence, Dogecoin’s price might not hit $0.20 before this week ends.

Leave a Reply