- Fierce long positions and a large OI suggest that shorts are at risk.

- Indicators presented a bullish bias that could drive Bitcoin toward $77,000.

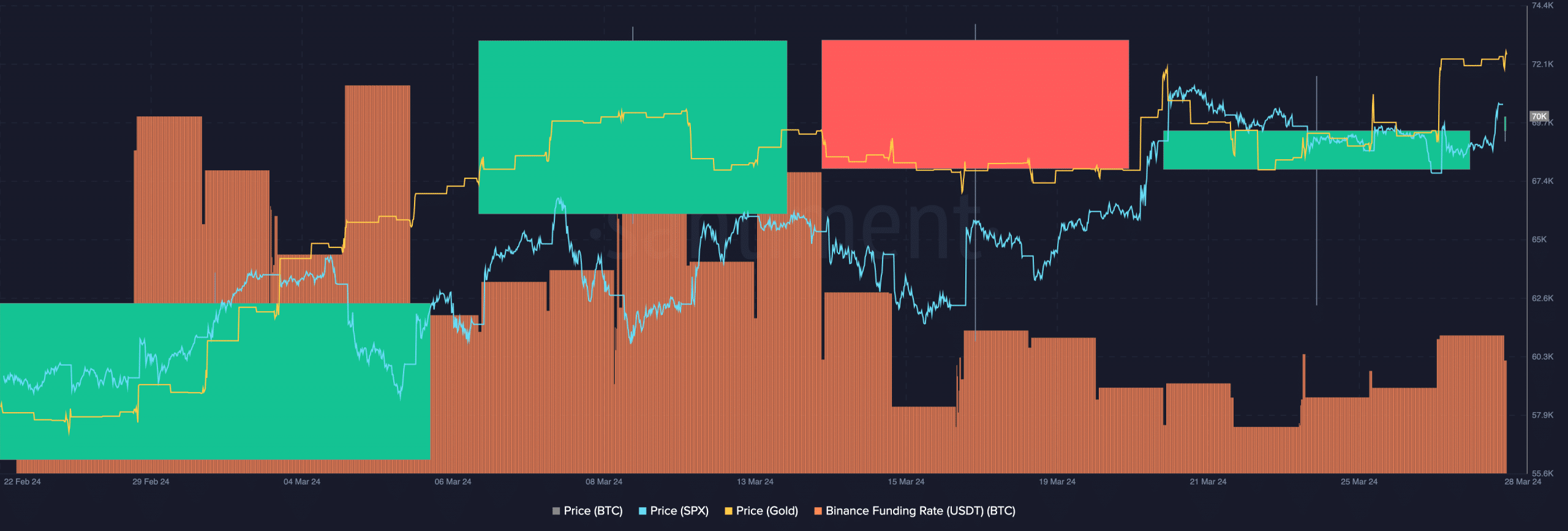

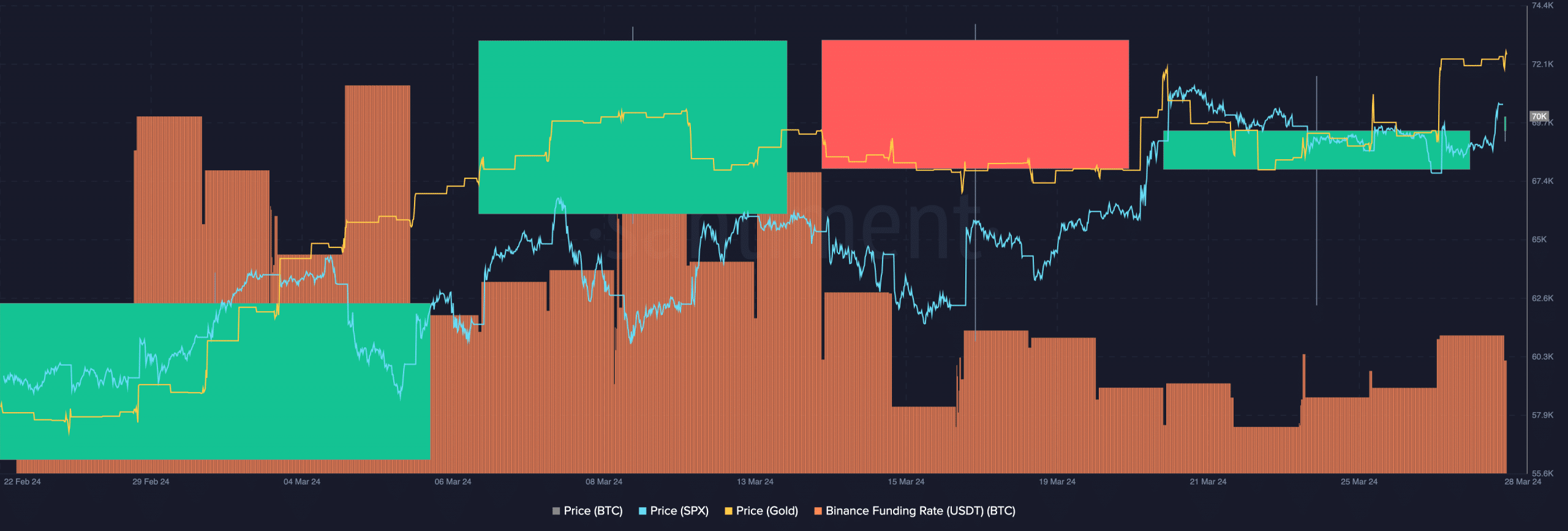

Bitcoin [BTC] traders are at it again. But this time, they are not wagering big money, and predicting a nosedive for the coin. Instead, AMBCrypto’s assessment of the Funding Rate showed that many traders were long.

Being in a long position means that a trader is expecting to make gains from a cryptocurrency’s price increase. Also, Funding Rate tells if longs are paying shorts otherwise.

A divergence caused the doubling down

At press time, Bitcoin’s Funding Rate was at its highest point since the 18th of March, Santiment showed. At press time, BTC had increased to $70,368.

When funding becomes more positive as price increases, it means perp longs are aggressive, and are getting their rewards. In the context of the price, this is potentially bullish. If this continues, the price of the coin might rally higher than the predicted $75,000.

Source: Santiment

Meanwhile, traders seemed to have their reasons for betting big on Bitcoin. Interestingly, it was something outside of the crypto ecosystem.

From AMBCrypto’s scrutiny of the situation, traditional assets like the SPX and gold retested their respective all-time highs. This happened at a time when Bitcoin was struggling to climb back to $73,000.

Historically, a divergence like this when the halving is close suggests that BTC was not done with its pre-having rally. Therefore, the distribution experienced over the last few weeks might grind to a halt.

All things are working together in BTC’s favor

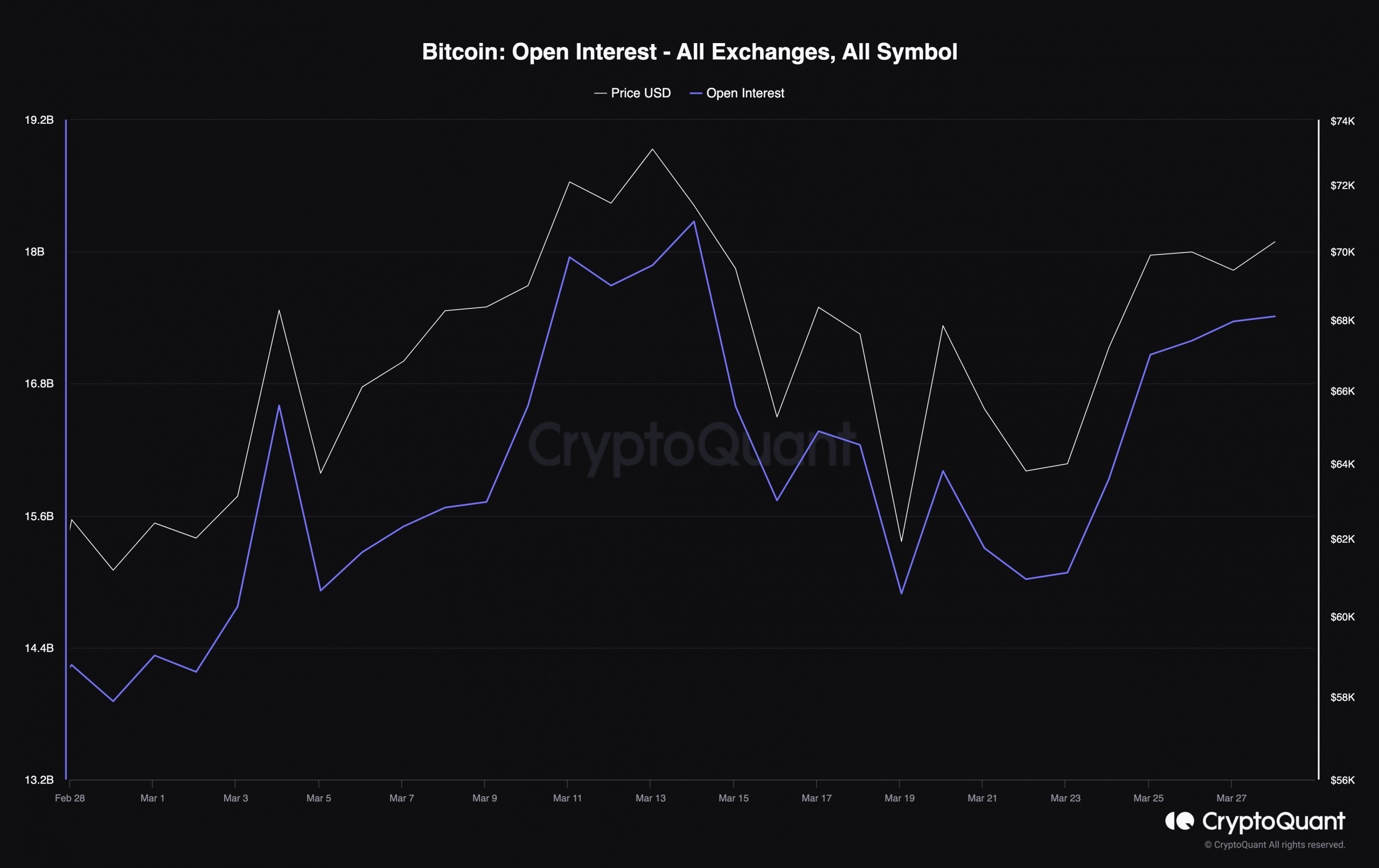

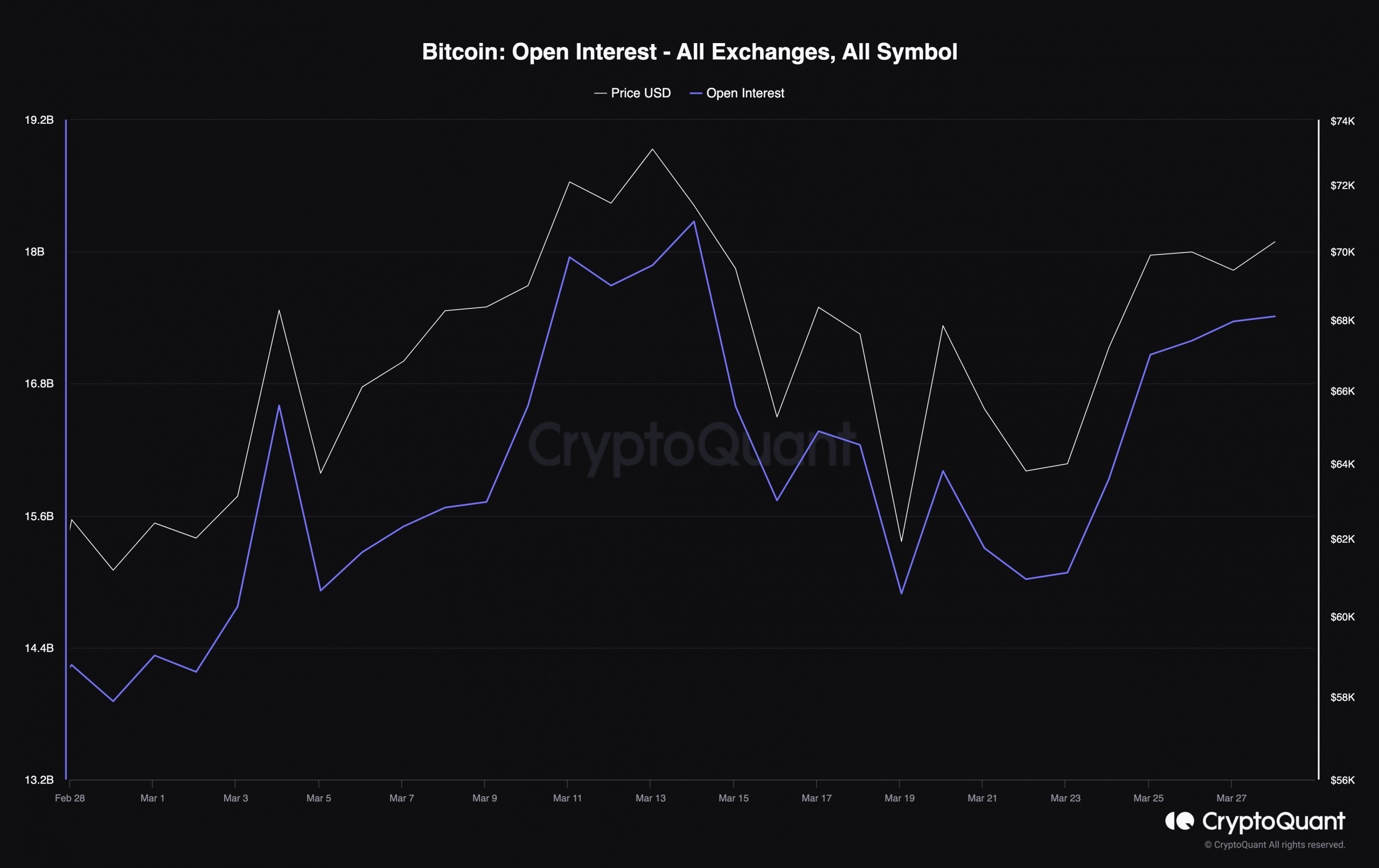

Regardless of the Funding Rate indications, it is important to assess Bitcoin’s Open Interest (OI). OI is the value of open positions in the derivatives market.

An increasing OI suggests more liquidity, attention, and volatility coming into the market. However, if the OI decreases, it means traders are increasingly closing their positions.

Using data from CryptoQuant, AMBCrypto observed the hike in Open Interest. At press time, Bitcoin’s OI was a mind-blogging $17.41 billion.

Source: CryptoQuant

Alongside the price action, the increasing OI was a sign of strength for Bitcoin. Should the OI continue to increase as BTC does the same, another all-time high before the halving might appear.

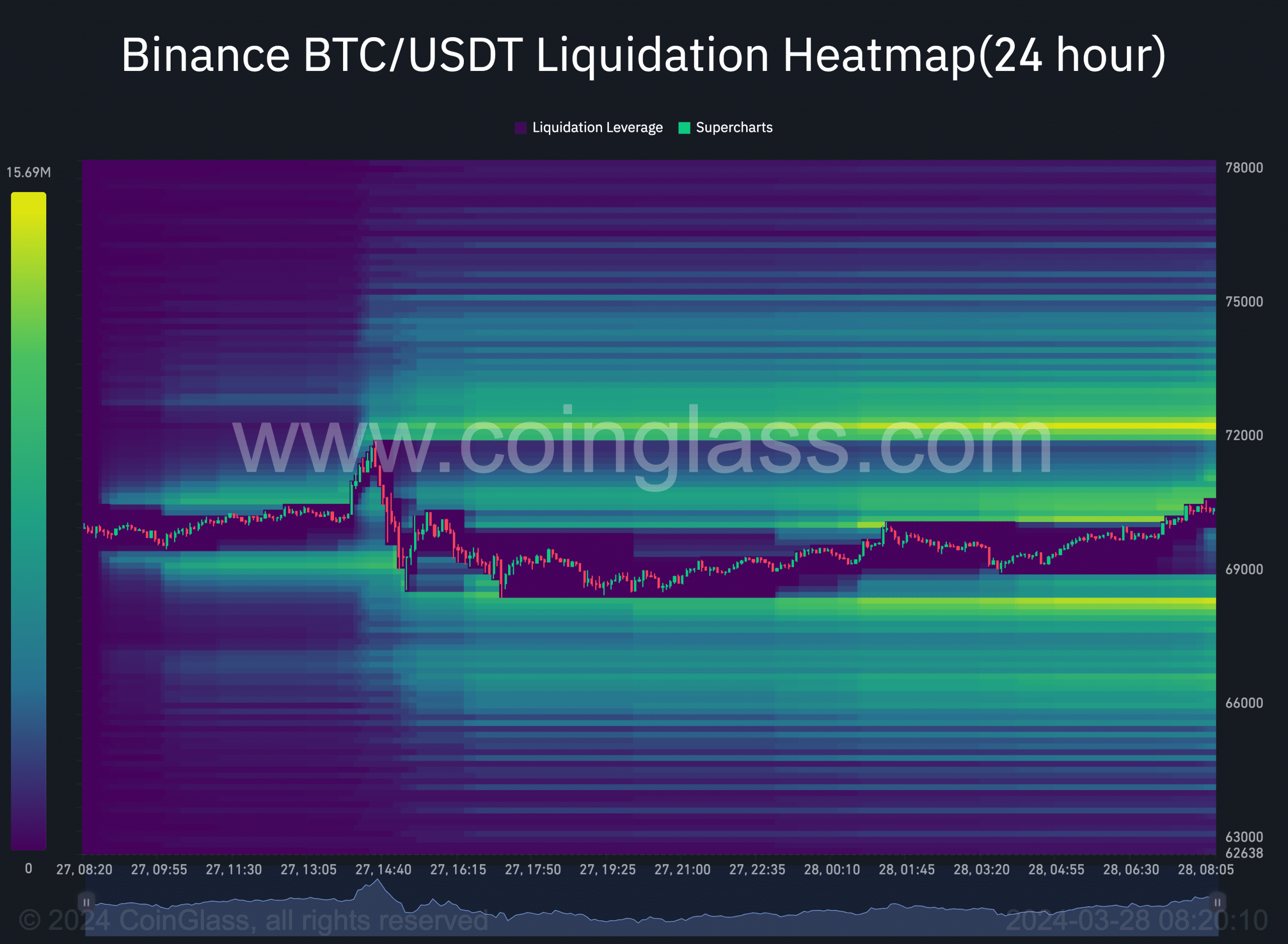

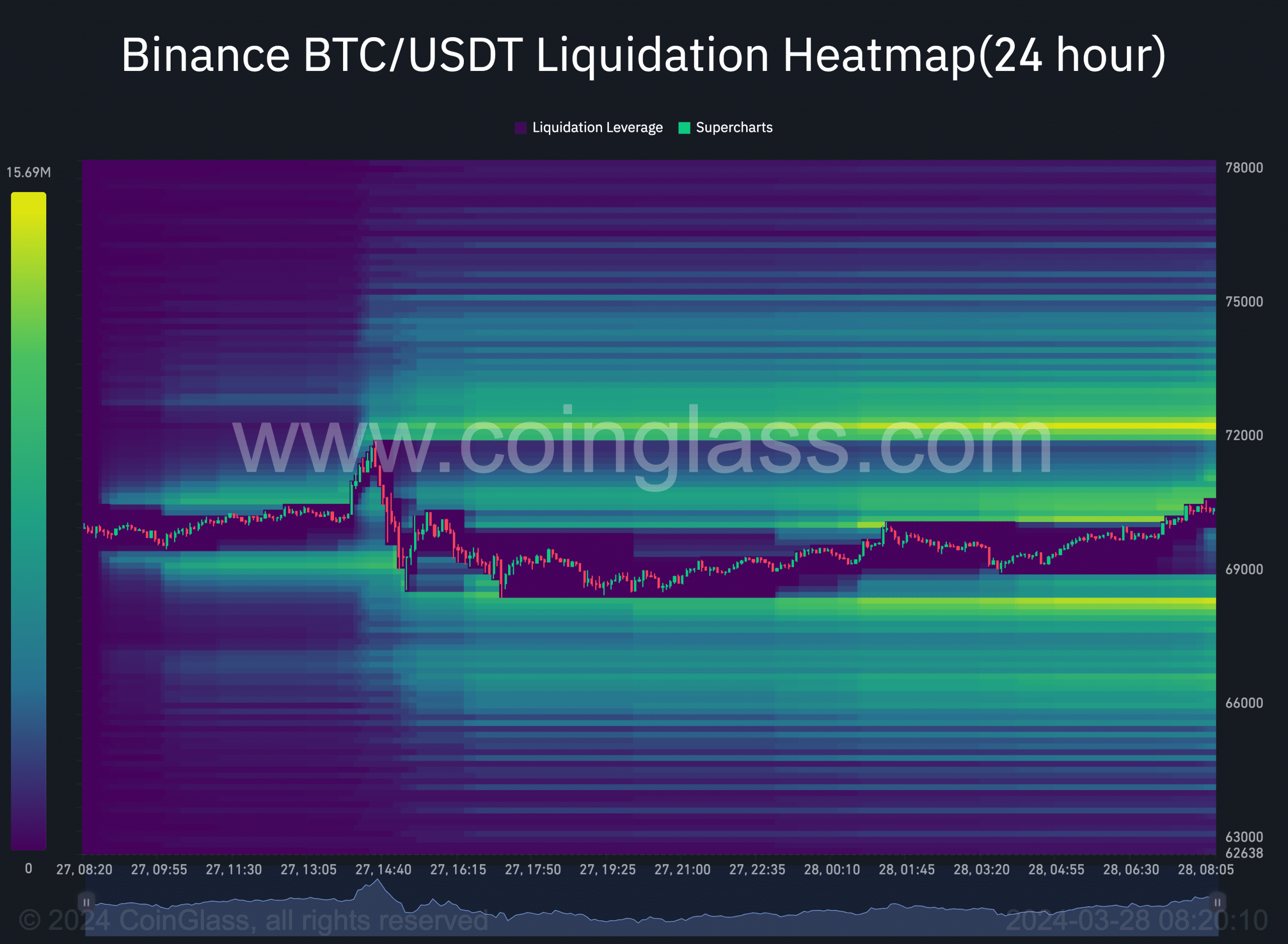

On another end, we looked at the liquidation data. As of this writing, many shorts have seen their positions wiped out within the last hour.

According to Coinglass, the liquidation heatmap showed that BTC might approach $73,311 soon. If the coin hits this price, open contracts worth about $6.31 million would be liquidated.

Source: Coinglass

Is your portfolio green? Check the Bitcoin Profit Calculator

In addition, a large part of the casualty might be shorts who used medium to high leverage.

From a trading perspective, a large Open Interest plus short liquidations might lead to a breakout. While Bitcoin might not hit $80,000, a possible rise toward $77,000 is one prediction that could come to pass.

Leave a Reply