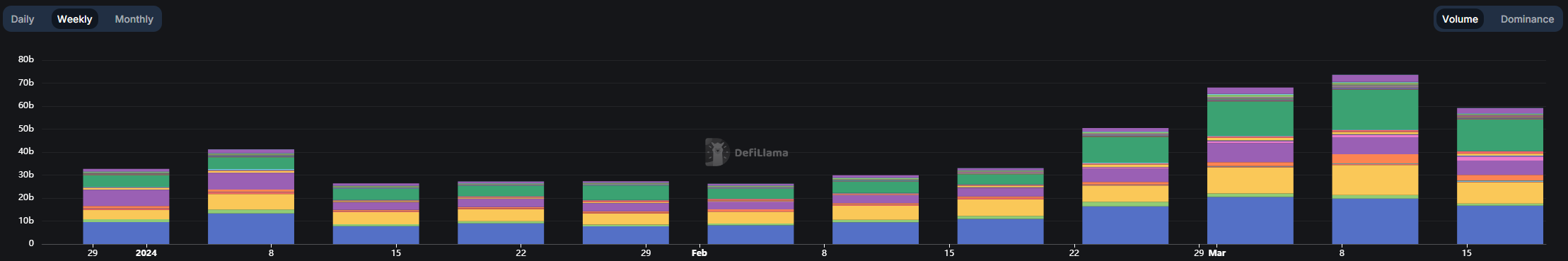

Decentralized exchanges (DEX) weekly trading volume fell by 24,5% in the past seven days, according to DefiLlama’s data. Within the top 10 blockchains by traded volume, Polygon’s 40% slump was the worst, followed closely by Avalanche’s 39,5% fall.

Not even meme coin’s favorite chain Solana escaped the fall in weekly trading volumes, with a considerable slide of 20%. Base, on the other hand, rose over 64% in the same period driven by its own ‘meme coin mania.’ Starknet also saw positive weekly variation, with 28% more activity in its DEXes.

Tristan Frizza, founder of the decentralized platform Zeta Markets, pointed out that this negative movement in trading volumes could be tied to the pullback in prices seen last week.

“Typically, such retractions in the market disproportionately affect memecoins and altcoins which ultimately leads to a significant reduction in trading activities for these types of cryptos. This phenomenon could be seen as common market behavior, where investors start retreating from more speculative assets, resulting in diminished trading volumes for these coins,” Frizza explains.

Moreover, this movement could be a healthy adjustment to market euphoria, since the $73,6 billion in weekly trading volume seen from Mar. 9 to 15 was the highest weekly volume ever registered on-chain.

Leave a Reply