- BNB bulls showed initiative and strength to halt the losses at $500 and force a recovery.

- The diminished trading volume in recent days was a point against them.

Binance Coin [BNB] reached highs not seen since January 2022. The breakout from the $325 range saw BNB post 99.5% gains in 31 days. At press time, the market structure on the one-day timeframe was bullish.

BNB retraced some of its recent gains but bounced quickly from the psychological $500 level. Yet, some indicators suggested that a deeper retracement was possible.

The bulls were in a hurry

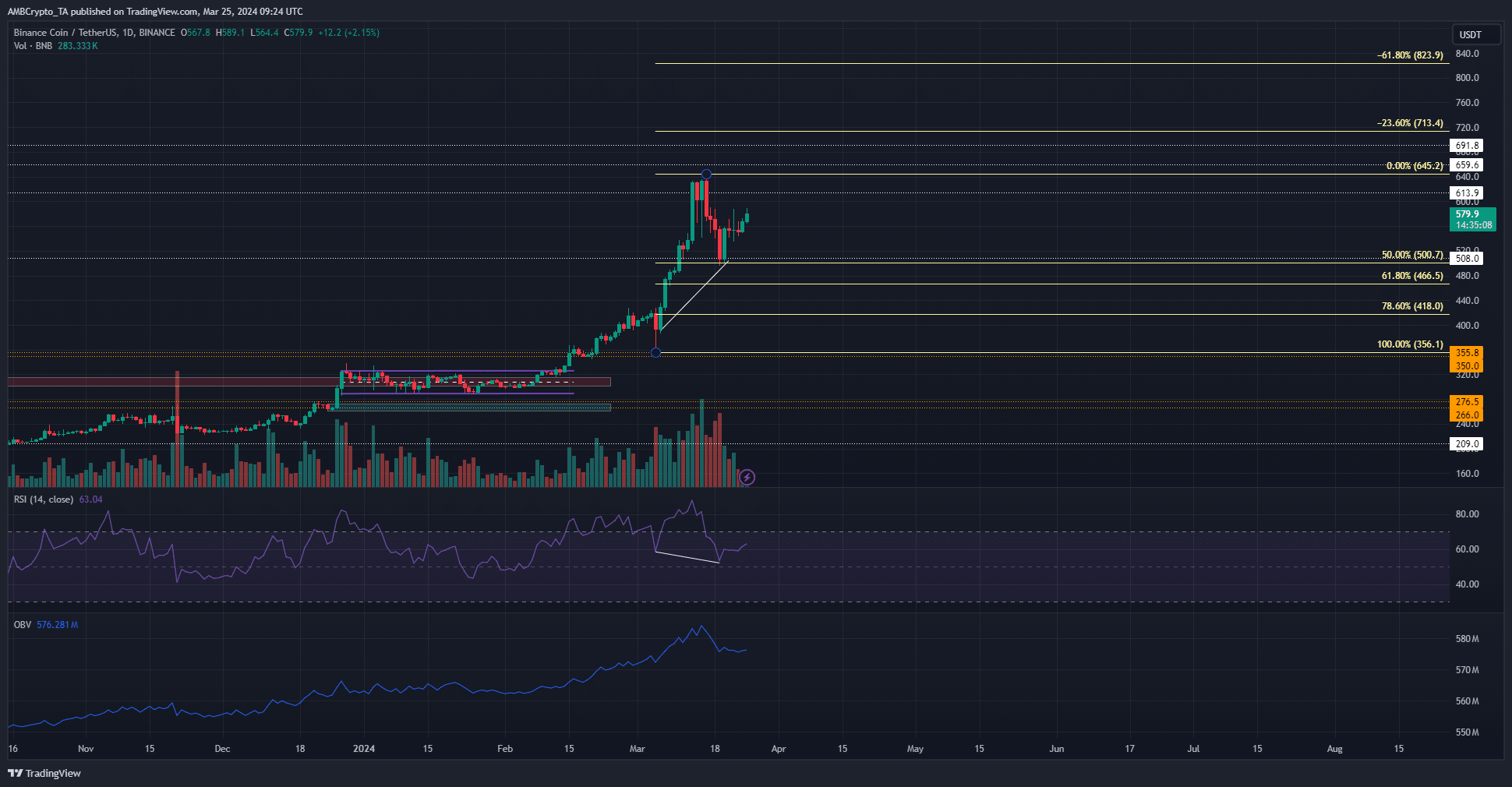

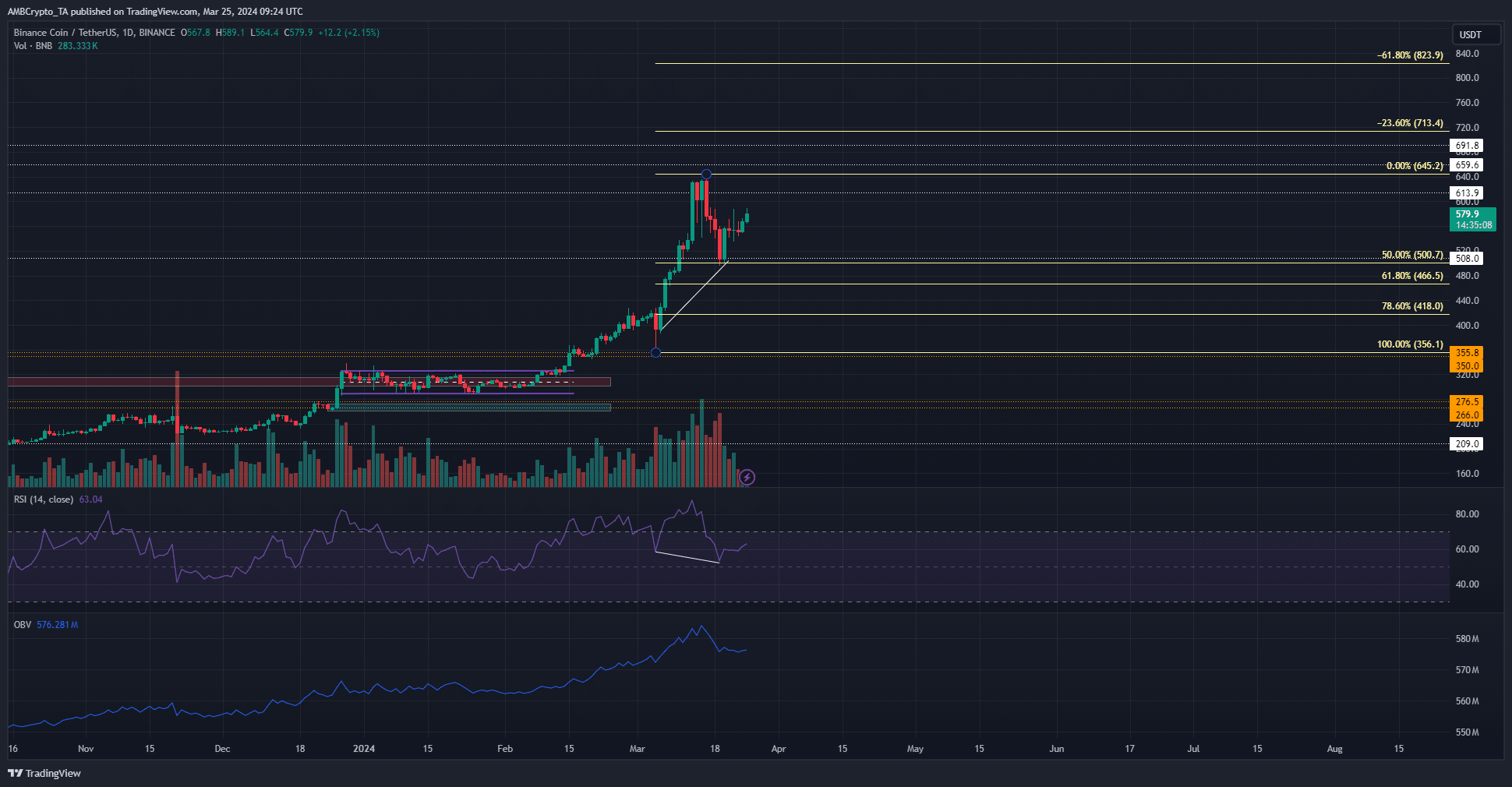

Source: BNB/USDT on TradingView

The retracement from $645 to $500 took four days to complete. This dip saw prices retest the 50% Fibonacci retracement level, plotted from the swing low at $356.1.

The bulls drove a recovery almost immediately after this pullback.

While prices bounded higher, the trading volume trended downward. This was seen on the OBV as well as the trading volume bars.

It indicated that demand might not be driving this rally, and new lows were still possible.

The RSI showed strong bullish momentum with a reading of 63. It also exhibited a hidden bullish divergence when the indicator made lower lows, but the price made higher lows.

Subsequently, BNB prices jumped higher from $500 to $579 at press time.

Will the liquidity near $600 halt the bulls?

How much are 1,10,100 BNBs worth today?

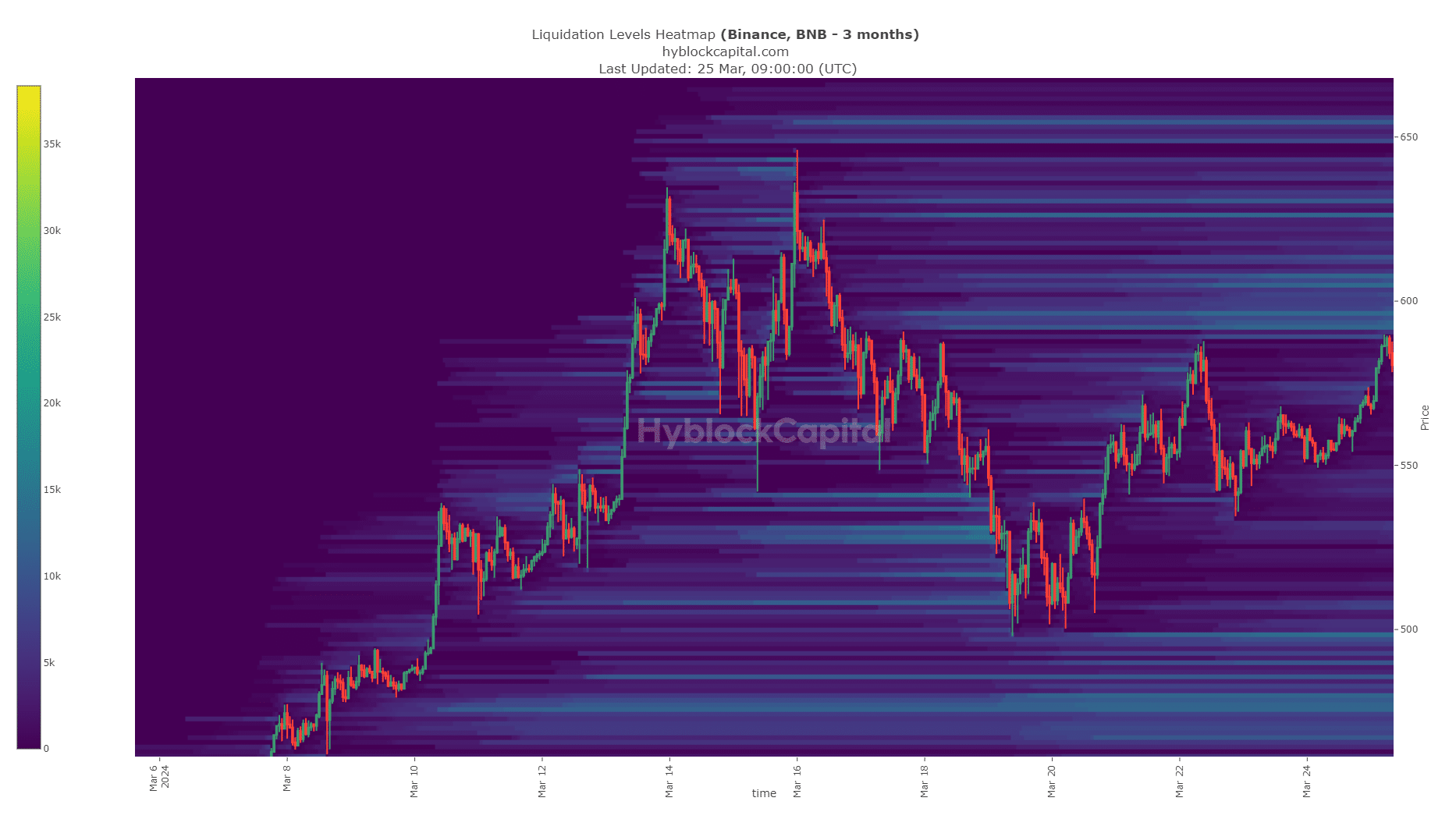

The $600, $626, and $653 levels represented liquidation levels that prices could be attracted to. To the south, the $500 and $475 were the closest pockets of liquidity for Binance Coin.

While these are levels of interest in the coming days, the trend remained biased bullishly. If we see another BNB dip to the golden pocket at $418-$466, it would present a buying opportunity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply