- The 24-hour price increase triggered a switch from the bearish sentiment.

- DOT might dump into its immediate support despite having positive funding.

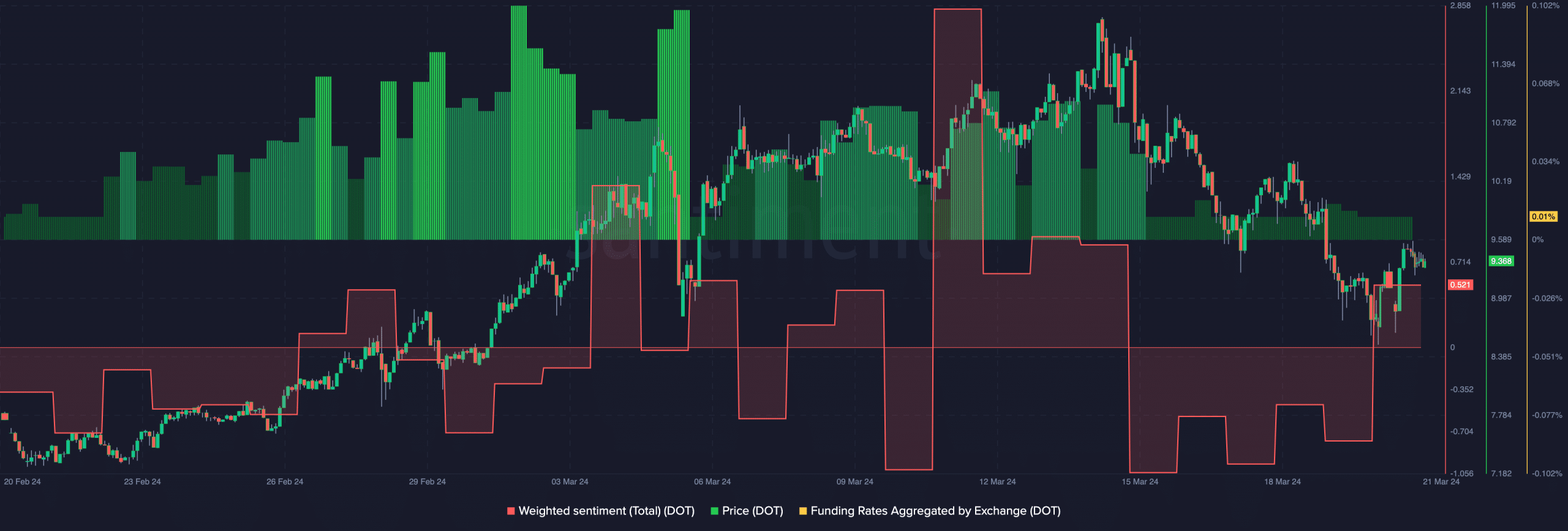

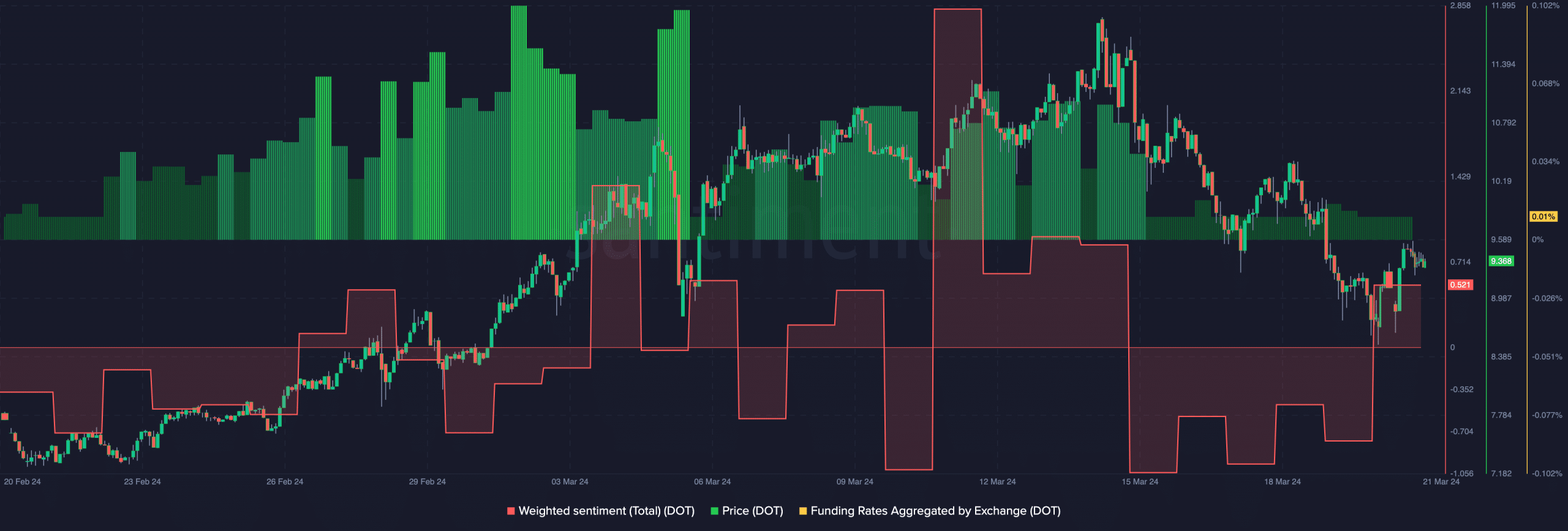

After enduring a significant price shrink from the 14th to the 19th of March, Polkadot’s [DOT] Weighted Sentiment has risen into the positive region. As of this writing, the Weighted Sentiment was 0.521.

But during the five days mentioned above, the metric went as low as -0.977. This reading was a sign that traders lacked confidence in the price action of DOT.

However, the recent increase implied that comments about the token were more positive than earlier. The reason being that the value of DOT has recovered from its lows. At press time, the price of DOT was $9.36— a 2.94% increase in the last 24 hours.

The bull has not appeared

Though the value jumped, it was still much lower than $11.84, which SOL hit on the 14th. A situation like this suggested that the Polkadot native token was not yet out of danger.

To ascertain if the price might increase or not, AMBCrypto engaged the Funding Rate. If the Funding Rate is positive, it means that the perp price of the token is trading at a premium.

Source: Santiment

On the other hand, a negative Funding Rate suggests that the perp price is trading at a discount. At the time of writing, DOT’s Funding Rate was positive. However, we observed that it was lower than the reading on the 19th.

Another observation was that DOT’s price had stalled. When the price stalls and funding is positive, longs are aggressive. But they are not getting rewarded for it. For the price action, this is a bearish move.

Therefore, this could force Polkadot’s price to key into the immediate resistance. A highly bearish scenario could see DOT decline to $8.87. However, if bulls come to the token’s aid, the momentum might change and the price might hit $10.

OI increases but it’s not enough

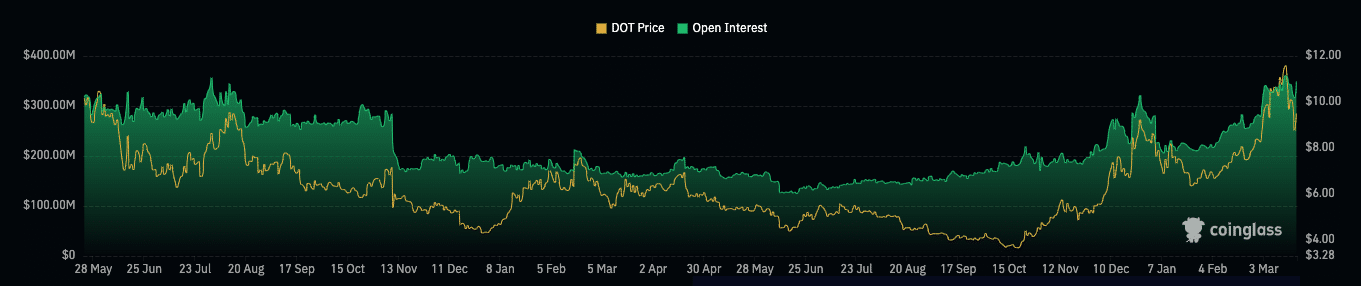

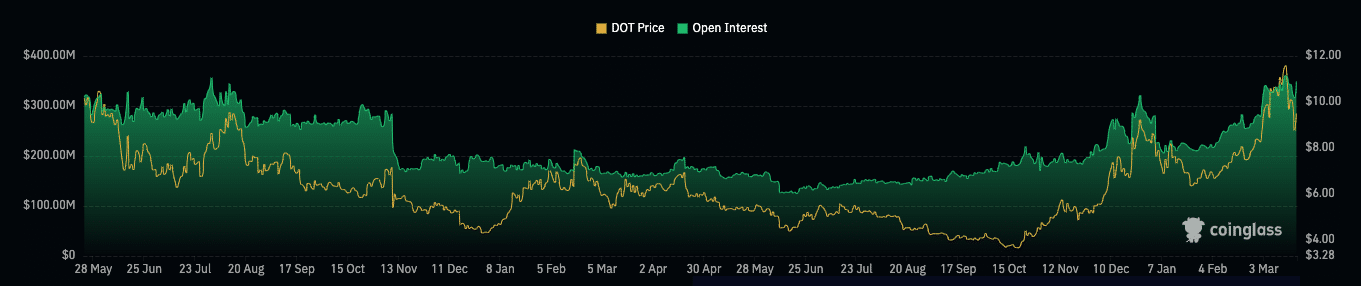

But inspecting other parts of DOT beyond the price and funding is also necessary. This was why AMBCrypto looked to the Open Interest (OI).

The OI decreases or increases based on net positioning. Thus, if the OI increases, it means that buyers are aggressive with their position. It also implied that more contracts are being opened.

Conversely, a decreasing OI suggests that sellers are the more aggressive ones. In this instance, the number of open positions reduces as liquidity exits the derivatives market.

Source: Coinglass

Read Polkadot’s [DOT] Price Prediction 2024-2025

Polkadot’s OI registered a mild 4.71% increase in the past 24 hours. However, the OI does not seem large enough to scale DOT through the overhead resistance.

Hence, the inference here could draw DOT’s price down. If this is the case, the value of the token might dump into the underlying support.

Leave a Reply