- BTC was down by more than 4% in the last 24 hours alone.

- A few of the metrics suggested that BTC might witness a trend reversal.

Bitcoin [BTC] continued to remain bearish as it witnessed multiple price corrections. Though there must be various factors at play causing the price drop, one of the most important reasons is high selling pressure. Will this cause BTC’s value to plummet further?

Investors are selling Bitcoin

Bitcoin’s price action caused the entire market to turn bearish as the king of crypto’s value dropped by over 14% last week. In the last 24 hours alone, BTC’s value dropped by over 4%.

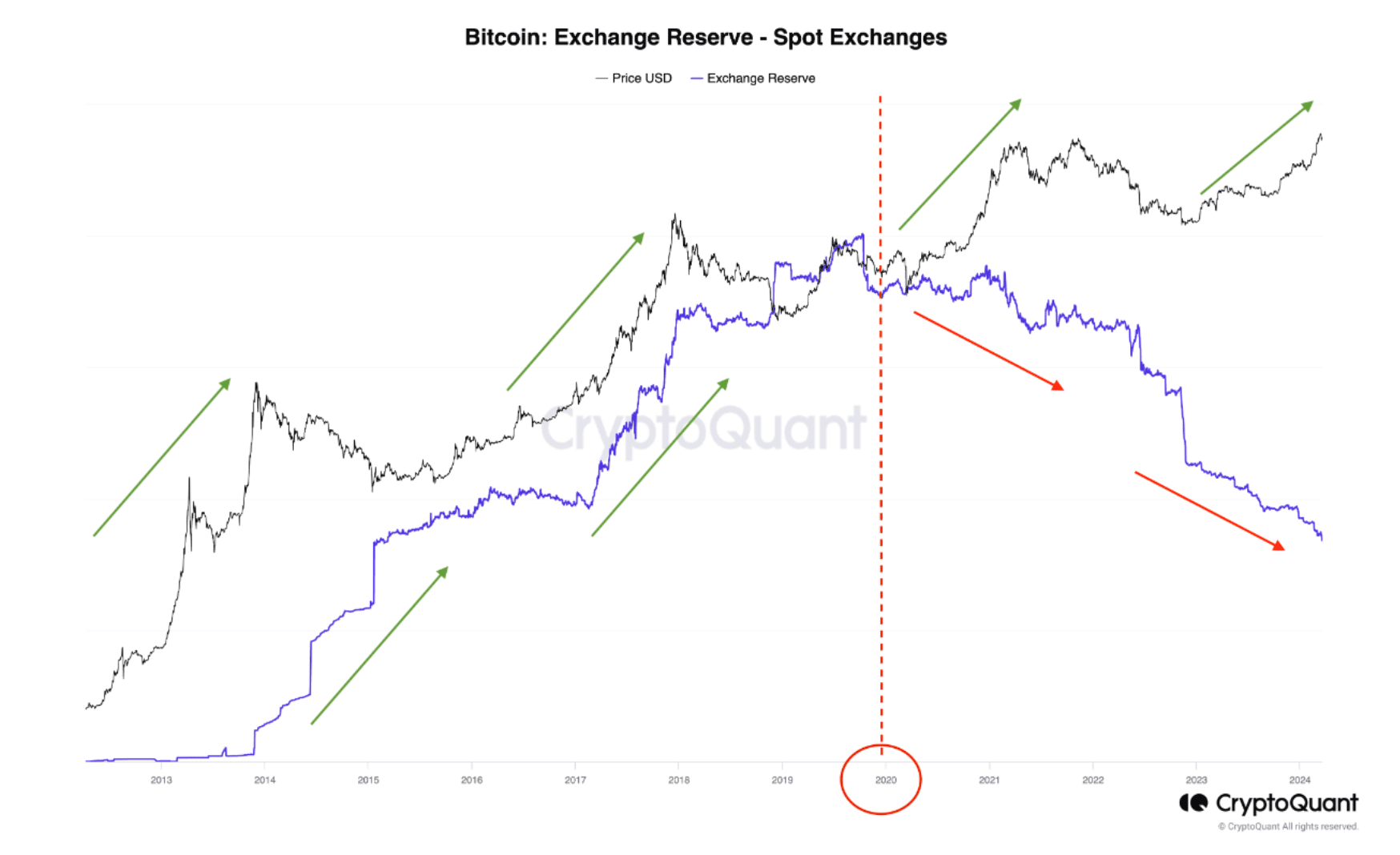

At the time of writing, BTC was trading at $61,396.57 with a market capitalization of over $1.2 trillion. In the meantime, tugbachain, an analyst and author at CryptoQuant, posted an analysis highlighting Bitcoin’s exchange reserve.

Source: CryptoQuant

As per the analysis, since 2020, regardless of whether prices have been falling or rising, exchange reserves have continued to decline consistently.

The analysis mentioned, “This suggests that in the upcoming bull run, Bitcoin will be subjected to more supply shocks compared to previous periods, which will contribute positively to its price.”

To better understand whether selling pressure on BTC was high, AMBCrypto checked other related metrics. We found that BTC’s net deposit on exchanges was high compared to the last seven days, further establishing the fact that investors were selling.

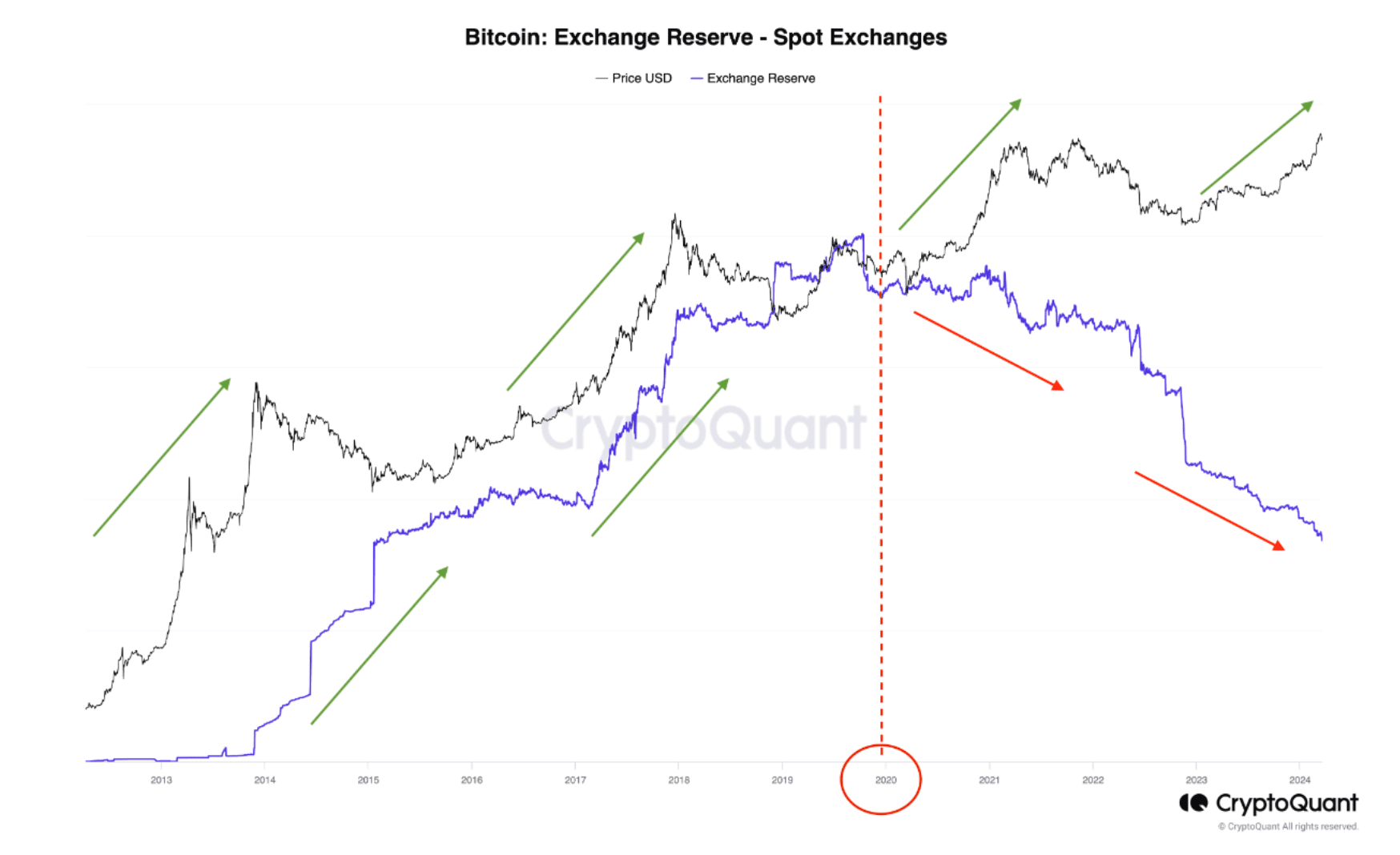

Additionally, both BTC’s Coinbase premium and Korea premium were red, meaning the selling sentiment was dominant among US and Korean investors.

Source: CryptoQuant

WIll Biotcoin witness a trend reversal?

As selling pressure was high, a continued downtrend in the short term seemed likely.

Ali, a popular crypto analyst, recently posted a tweet mentioning key support zones for BTC. The tweet mentioned that BTC has strong support near $61,100. If BTC fails to test that support, Its value might as well plummet to $56k.

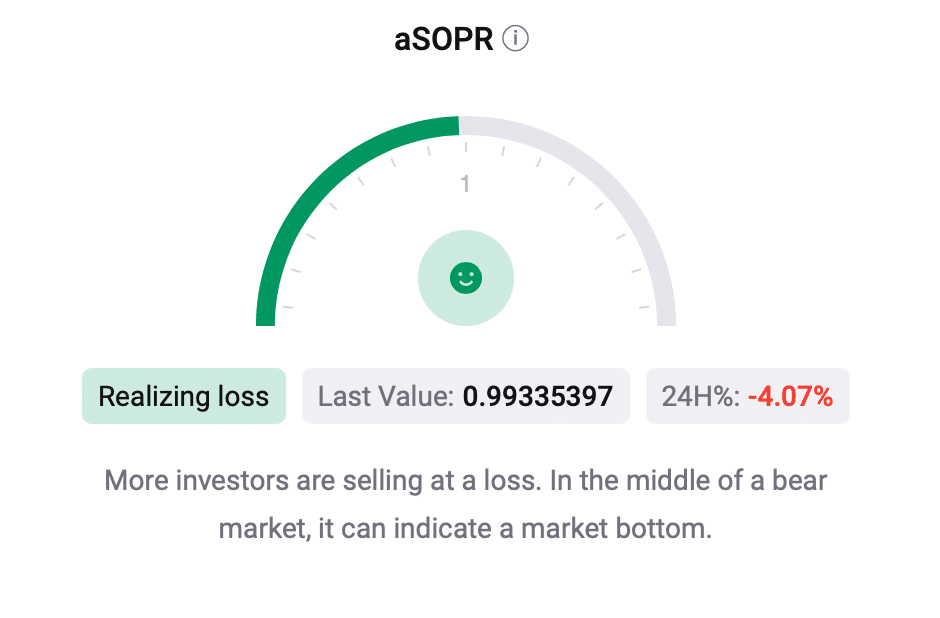

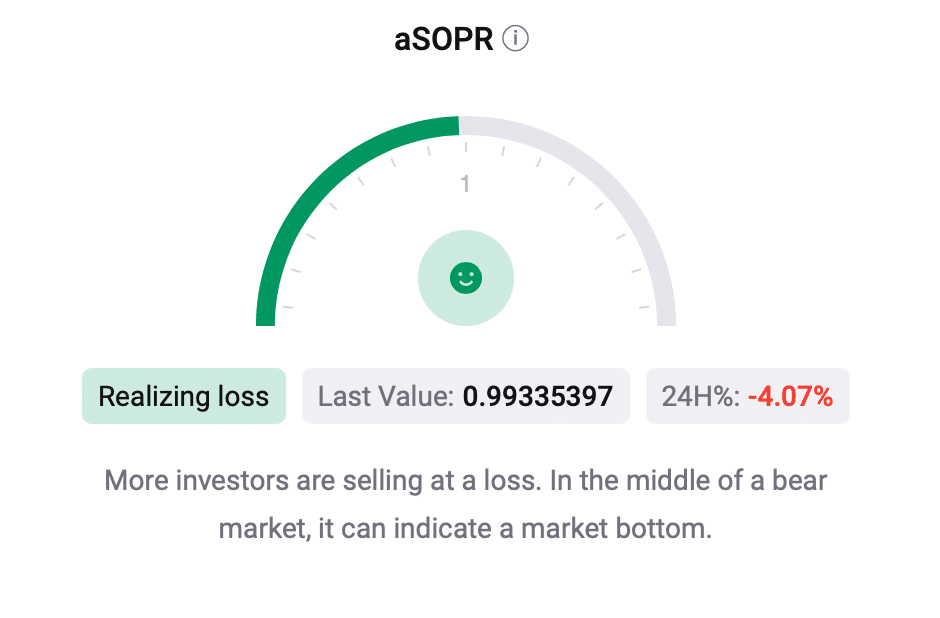

However, if BTC manages to stay above $61,100, then it might witness a trend reversal and reach its resistance zone near the $66k mark once again. The possibility of a trend reversal can’t be ruled out, as BTC’s aSORP turned green.

This meant that more investors were selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

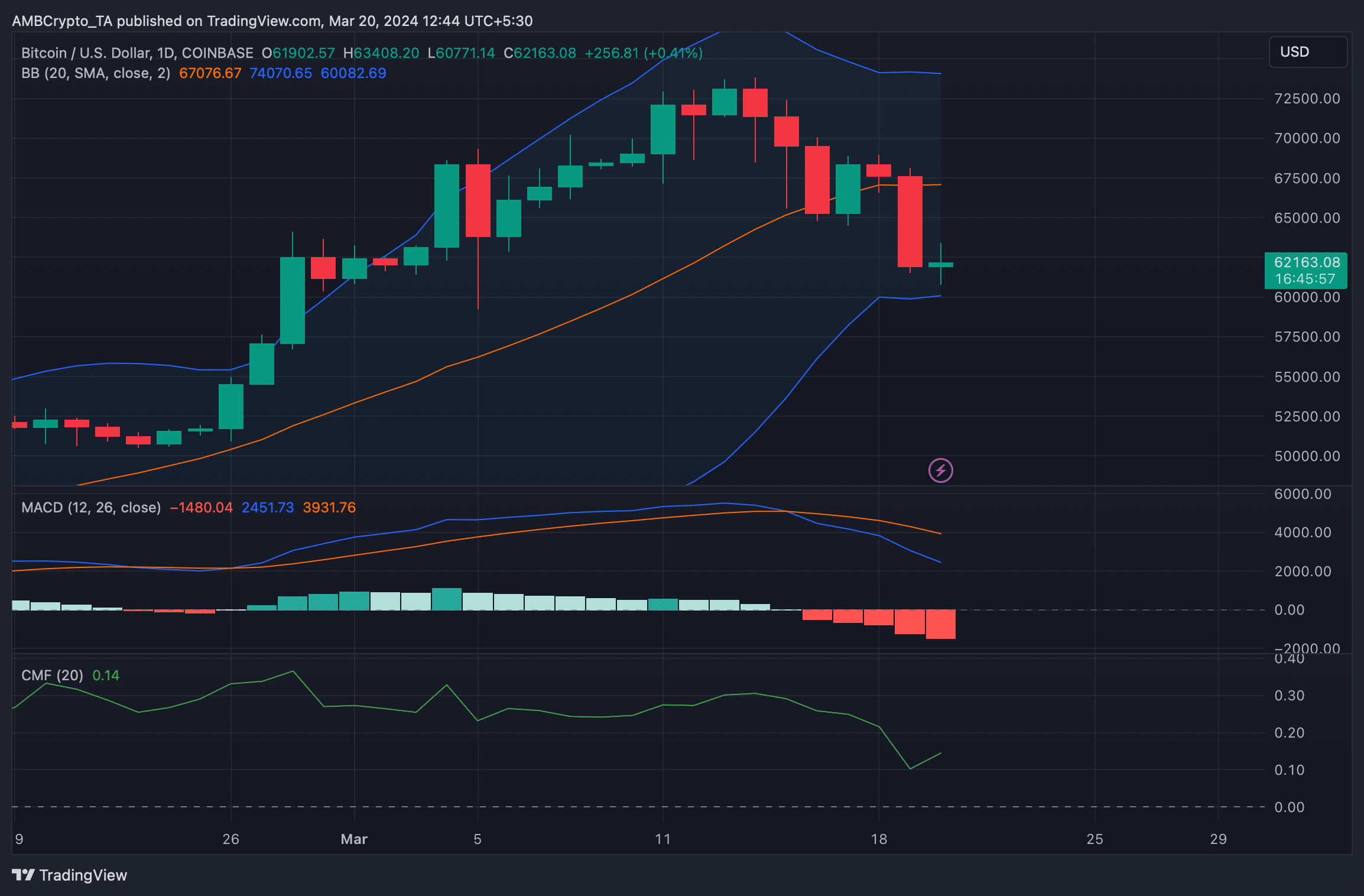

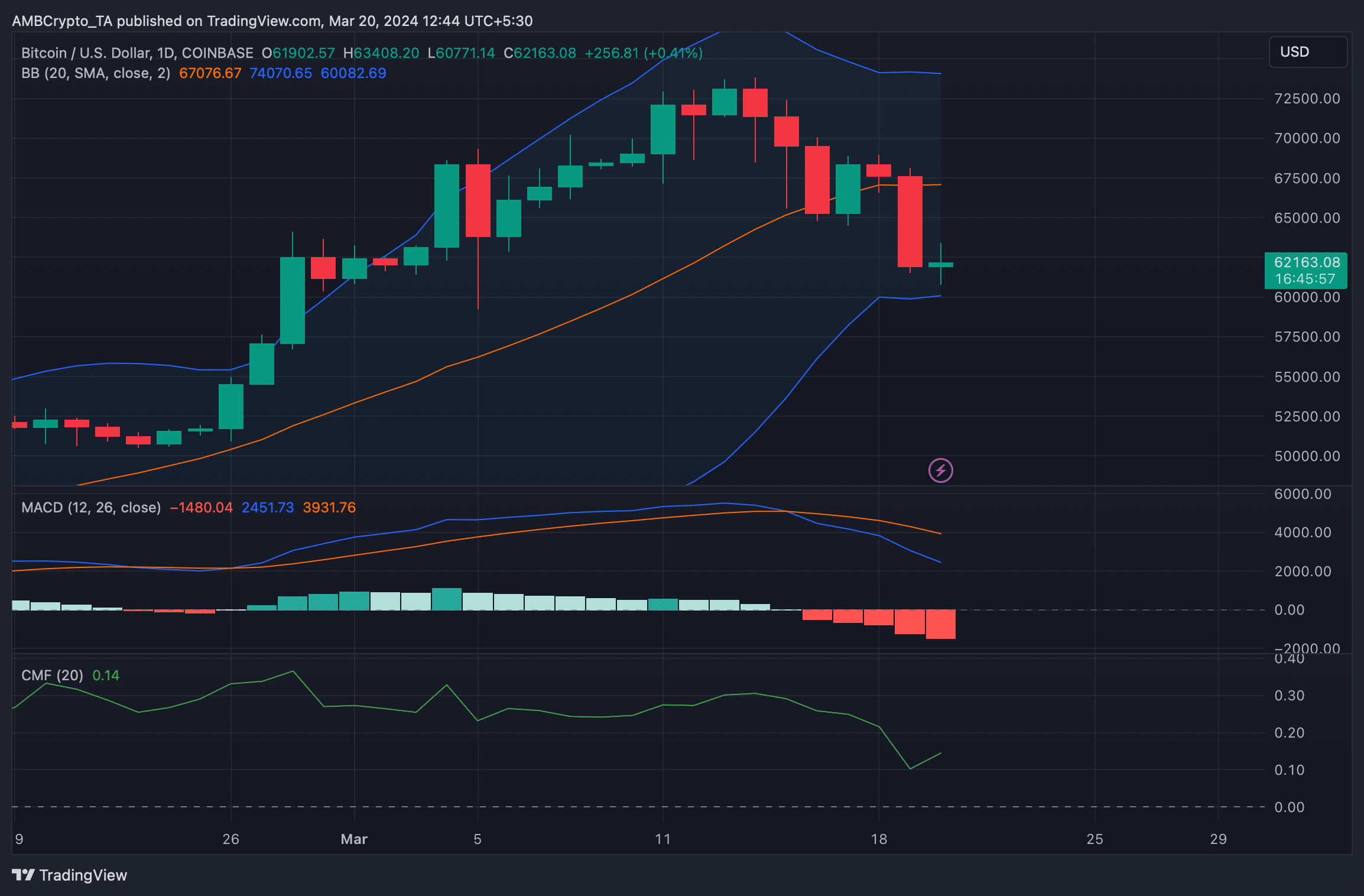

Therefore, AMBCrypto then took a look at BTC’s daily chart to see what technical indicators had to say. Our analysis revealed that Bitcoin’s Chaikin Money Flow (CMF) registered an uptick. Its price also touched the lower limit of the Bollinger Bands, indicating that a trend reversal might happen soon.

Nonetheless, the MACD continued to support the sellers as it displayed a bearish advantage in the market.

Source: TradingView

Leave a Reply