- Avalanche displayed a bearish momentum divergence on the one-day timeframe.

- The liquidity below $50 presented an attractive buying opportunity.

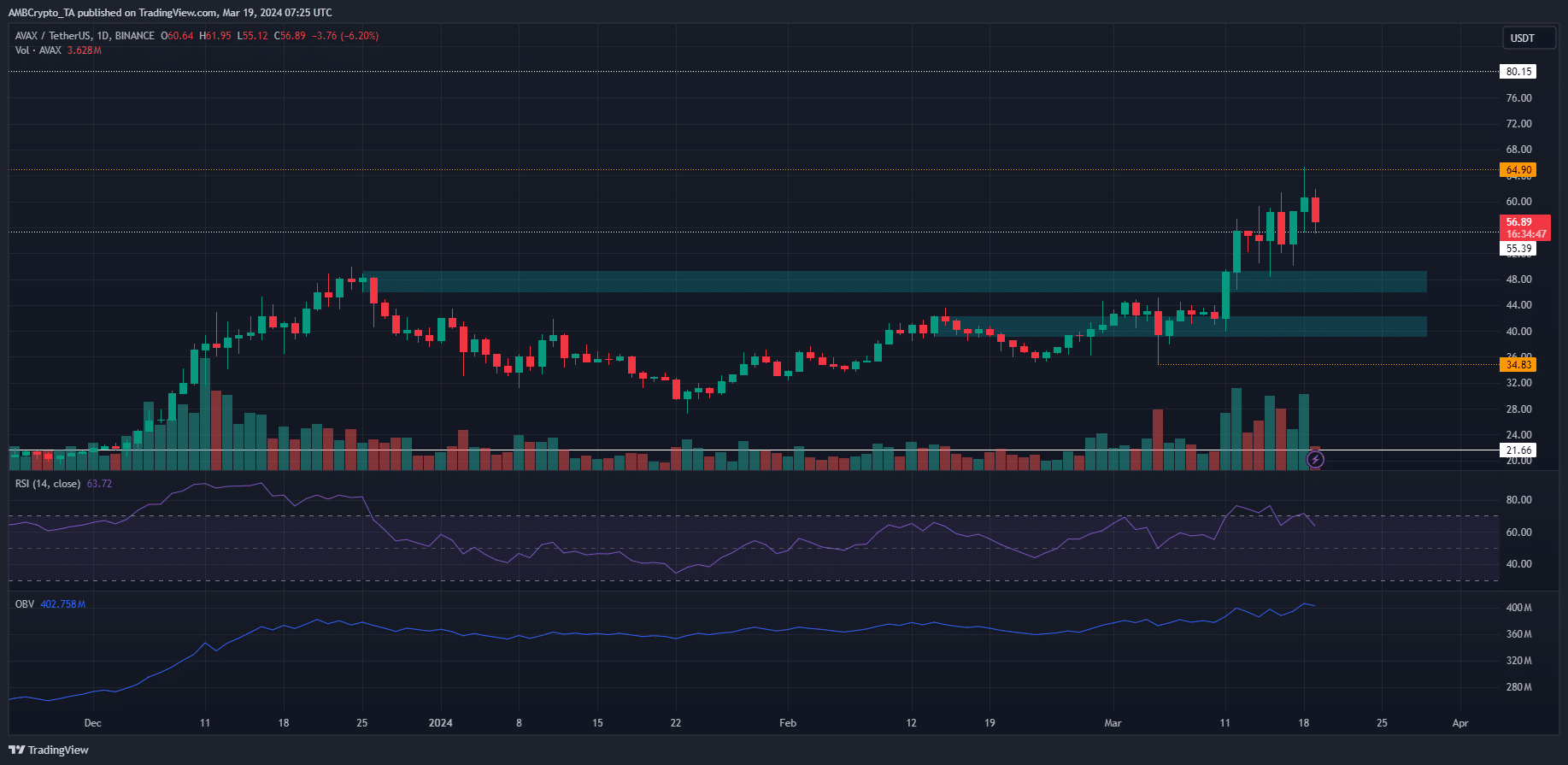

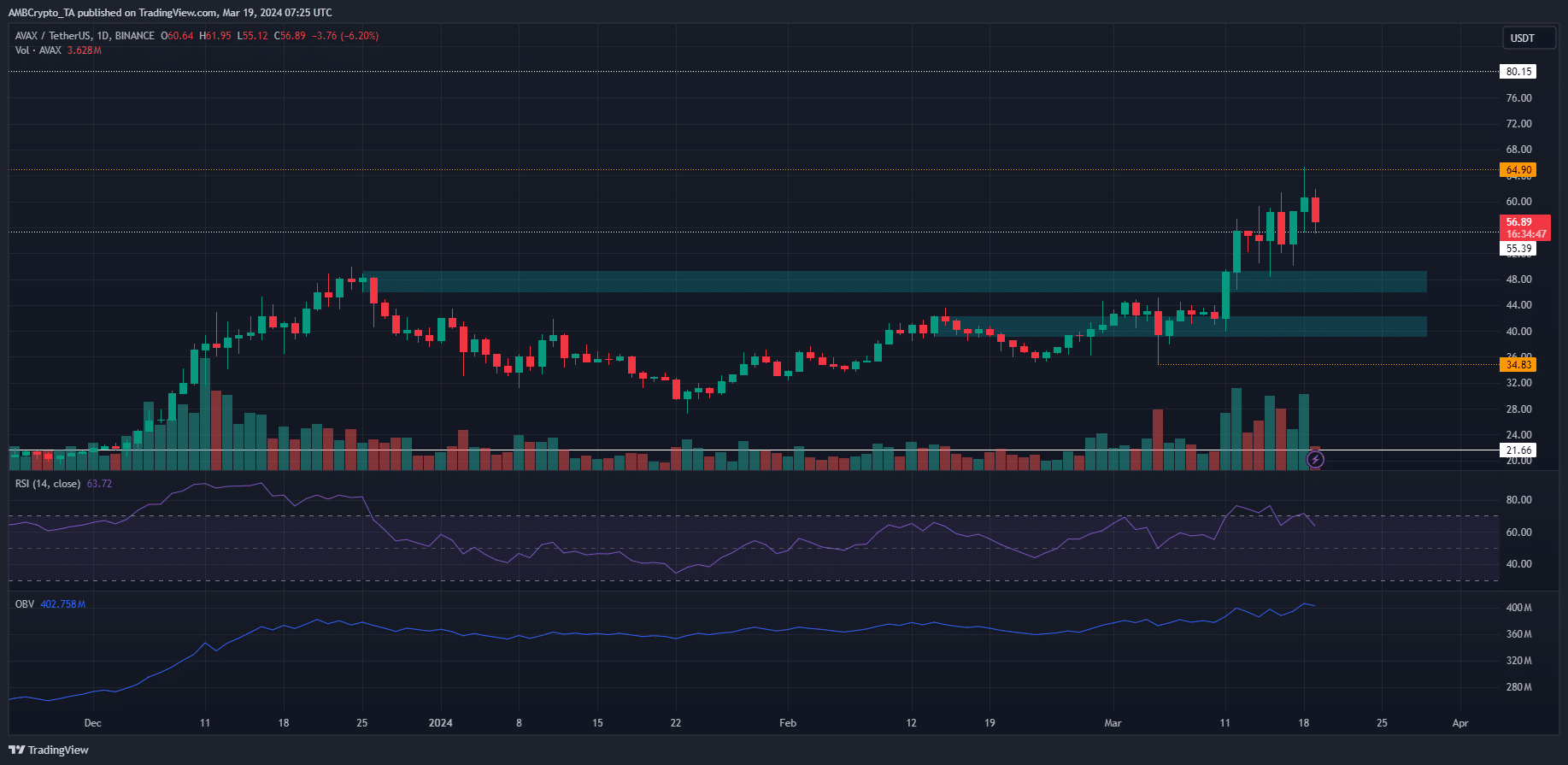

Avalanche [AVAX] pulled back from $65.39 to $56.89 within the past 24 hours, a 12.9% drop. The long-term bias was bullish, but the price action showed we could see further losses.

In other news, the Avalanche Foundation announced its investment in five meme coins. The tokens on the list saw significant trading volume and surged higher following the Foundation’s disclosure.

A momentum divergence was underway

Source: AVAX/USDT on TradingView

Since the 12th of March, the RSI on the one-day timeframe of AVAX has formed lower highs while AVAX prices pushed higher. This was a bearish divergence.

It suggested that a pullback was likely around the corner for the token.

On the other hand, the OBV continued to trend higher alongside the price. This suggested that buying pressure has not slowed down, and any pullbacks would likely see a quick recovery.

To the south, the former bearish order block on the daily chart at $48 was a demand zone.

A move just beneath its low at $46.2 appeared likely, given the market-wide selling pressure and the momentum divergence.

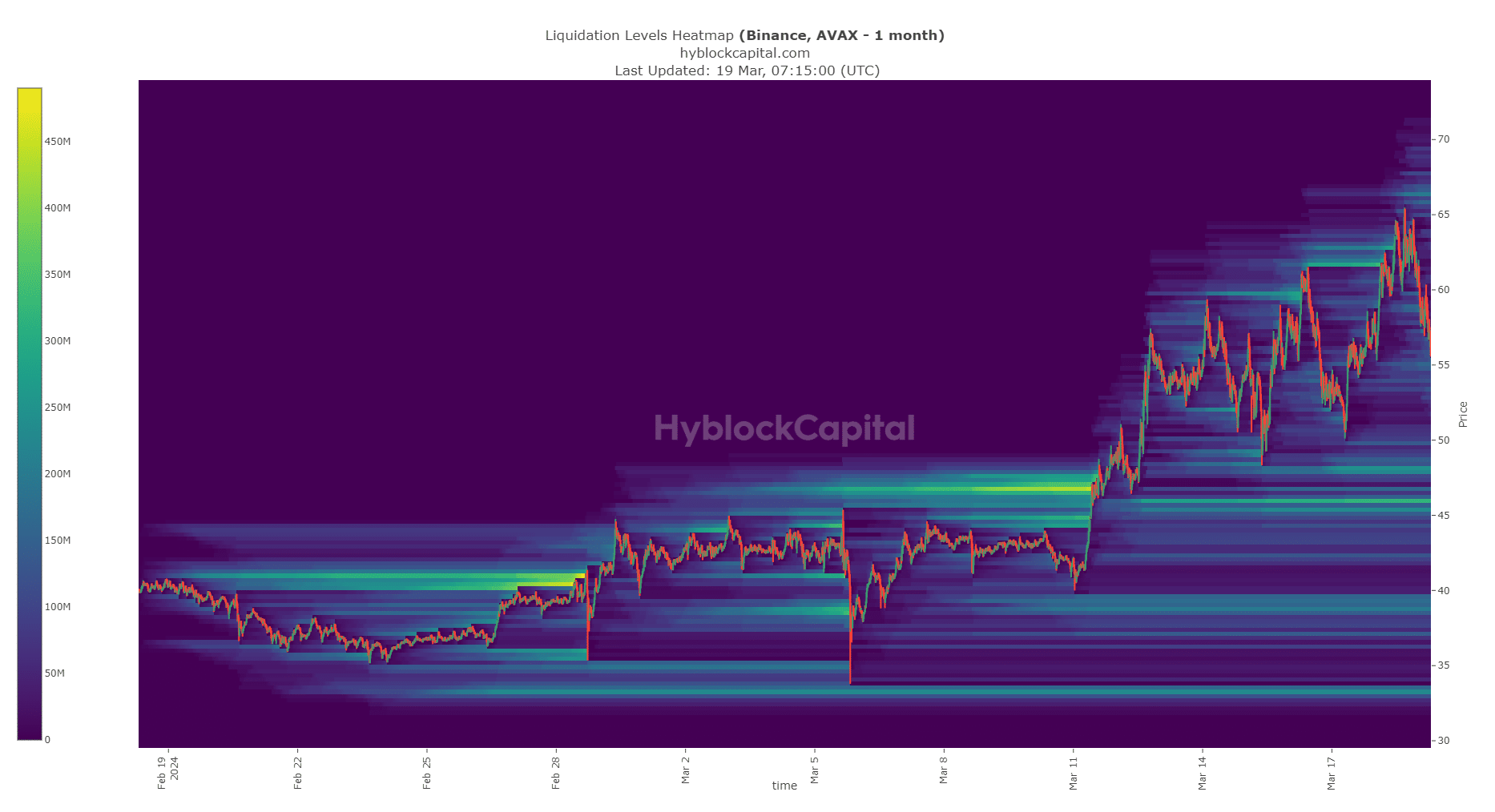

Understanding the liquidity charts

AMBCrypto analyzed the liquidation heatmap data from Hyblock to see where AVAX would be attracted to. The $65.8-$66 region was the bullish target.

However, $48.15 and $45.94 were more likely targets given their proximity to demand zones.

Is your portfolio green? Check out the AVAX Profit Calculator

If Bitcoin [BTC] prices trend lower in March, it would drag the crypto market further south. Hence, AVAX investors could wait for a dip below $50 to add to their holdings.

The long-term uptrend is expected to remain intact, as a drop below $34.83 is required to flip the 1-day market structure bearishly.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply