The Bitcoin Fear & Greed Index shows that the sentiment around the asset has cooled off a bit recently, something that could pave the way for a rebound.

Bitcoin Fear & Greed Index Has Gone Through Some Decline Recently

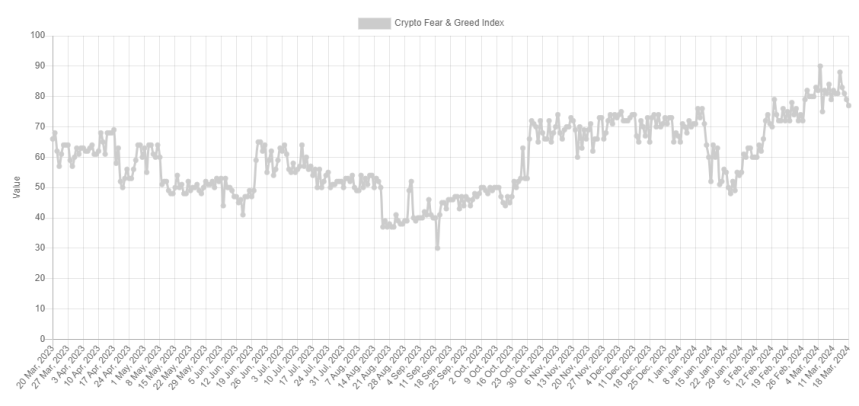

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment present among the investors in the Bitcoin and wider cryptocurrency market

To determine the trader mentality, the index takes into consideration for these five factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

The metric uses a numeric scale that runs from zero to hundred for representing this sentiment. A score of 46 or less implies the presence of fear among the investors, while that of 54 and above suggests greed in the market.

The territory between these two (47 to 53) naturally corresponds to the neutral mentality. Besides these three sentiments, there are also two extreme sentiments called “extreme greed” and “extreme fear.”

The extreme greed occurs at values above 75, while the extreme fear takes place below 25. Historically, these two sentiments have been quite relevant for BTC’s trajectory.

Tops have generally tended to form when the investors have held the former sentiment, while bottoms have been probable to happen when the market has been in the latter region.

At present, the traders are holding a mentality of extreme greed, as the latest data of the Bitcoin Fear & Greed Index shows.

Looks like the value of the metric is 77 at the moment | Source: Alternative

As is visible, the indicator’s value is 77 right now, meaning that while it’s indeed inside extreme greed, it’s only so just. This is a fresh change from how it has been recently, as the chart below displays.

The value of the indicator appears to have been going down recently | Source: Alternative

From the graph, it’s visible that the Bitcoin Fear & Greed Index has mostly stayed deep inside the extreme greed region recently. On the 14th of this month, the indicator hit the 88 mark, and alongside this high, the BTC price registered its current all-time high of about $73,800.

Since this peak, though, the asset has plunged, and it appears that alongside it, so has the sentiment among the traders. As mentioned earlier, tops have been more likely to occur when the market has shared a mentality of extreme greed and this probability has generally only gone up the more extreme levels the metric has hit.

This could perhaps explain why the recent top occurred when it did. Another top this month, the one that took place on the 5th, also coincided with high values in the Fear & Greed Index (a peak of 90 this time).

Shortly after this earlier peak and the plummet in the cryptocurrency that had followed, the asset found its bottom as the metric briefly exited the extreme greed region.

As the Bitcoin Fear & Greed Index is once again looking to dip outside this territory, it’s possible that a bottom may be near for the price this time as well. It now remains to be seen if the sentiment would cool down enough in the coming days so as to leave the extreme region behind, at least temporarily.

BTC Price

Bitcoin had plunged towards $64,500 during the weekend, but it seems the coin has made some recovery in the past day as it’s now back at $68,000.

The price of the coin seems to have gone through some volatility recently | Source: BTCUSD on TradingView

Featured image from Yiğit Ali Atasoy on Unsplash.com, Alternative.me, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Leave a Reply