- Buying pressure on Toncoin was high.

- Market indicators mostly looked bearish on TON.

Toncoin [TON] has been able to hold its ground well in the bear market as its weekly chart remained green. Since TON’s performance over the last week looked remarkable, AMBCrypto planned to have a look at its metrics to see whether this trend would last.

Toncoin’s price action is favoring investors

AMBCrypto reported a few days ago about TON’s bully rally. Our report pointed out how Toncoin’s value managed to go up by over 30% in just 24 hours.

A few days after TON’s bull rally began, Bitcoin’s [BTC] price crashed, causing the market to turn bearish. However, TON was not affected greatly as its weekly chart continued to remain green.

According to CoinMarketCap, TON was up by over 32% in the last seven days. At press time, TON was trading at $3.81 with a market capitalization of over $13.24 billion, making it the 13th largest crypto.

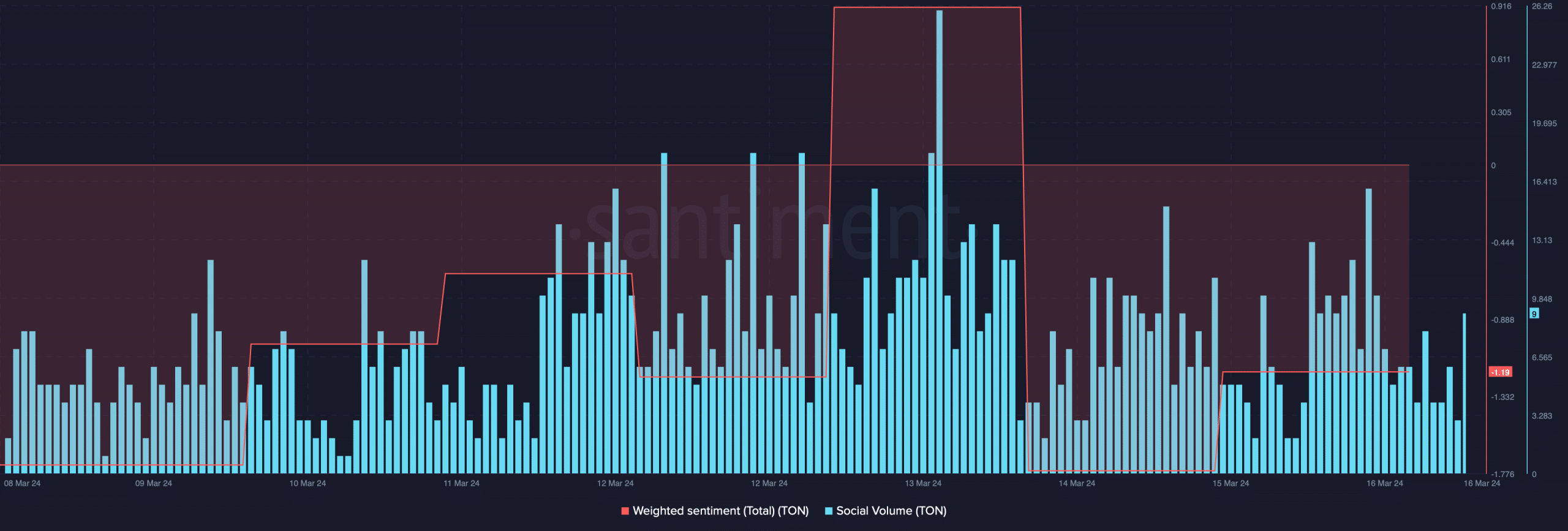

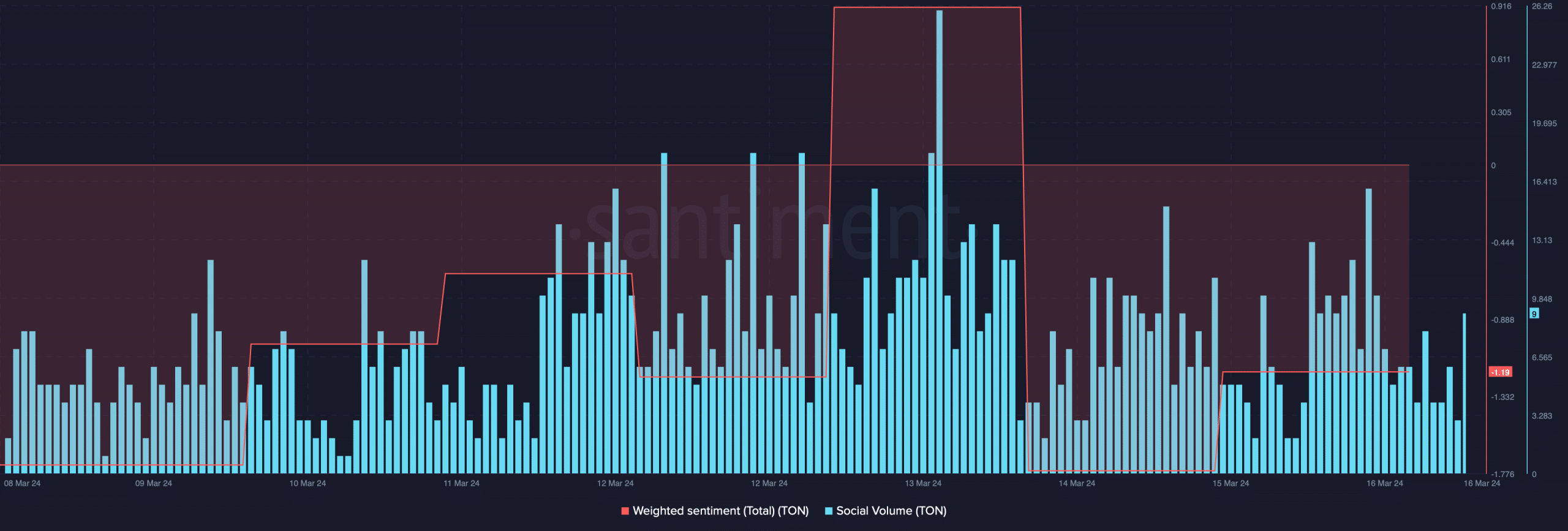

Interestingly, despite the positive price action, TON’s weighted sentiment dropped, which meant that bearish sentiment around TON was slowly rising. Its social volume also went down, indicating that investors were not talking about the token.

Source: Santiment

Investors are buying Toncoin

Since TON’s price action looked optimistic, AMBCrypto took a look at its metrics to see whether investors should expect another bull rally.

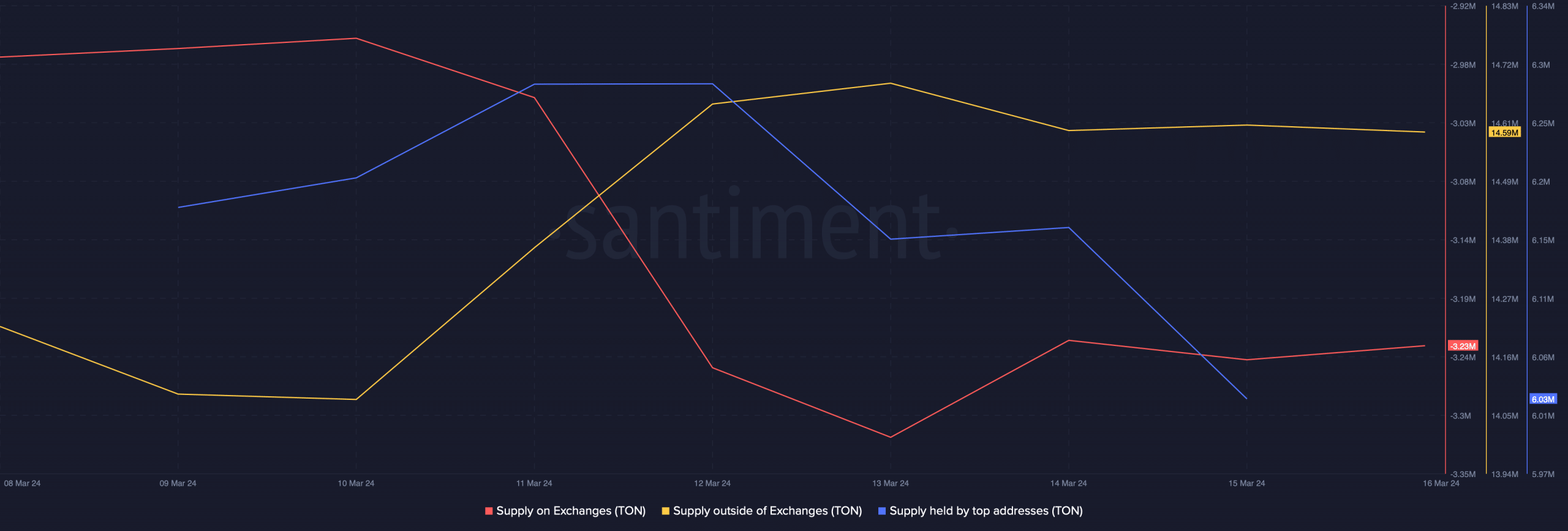

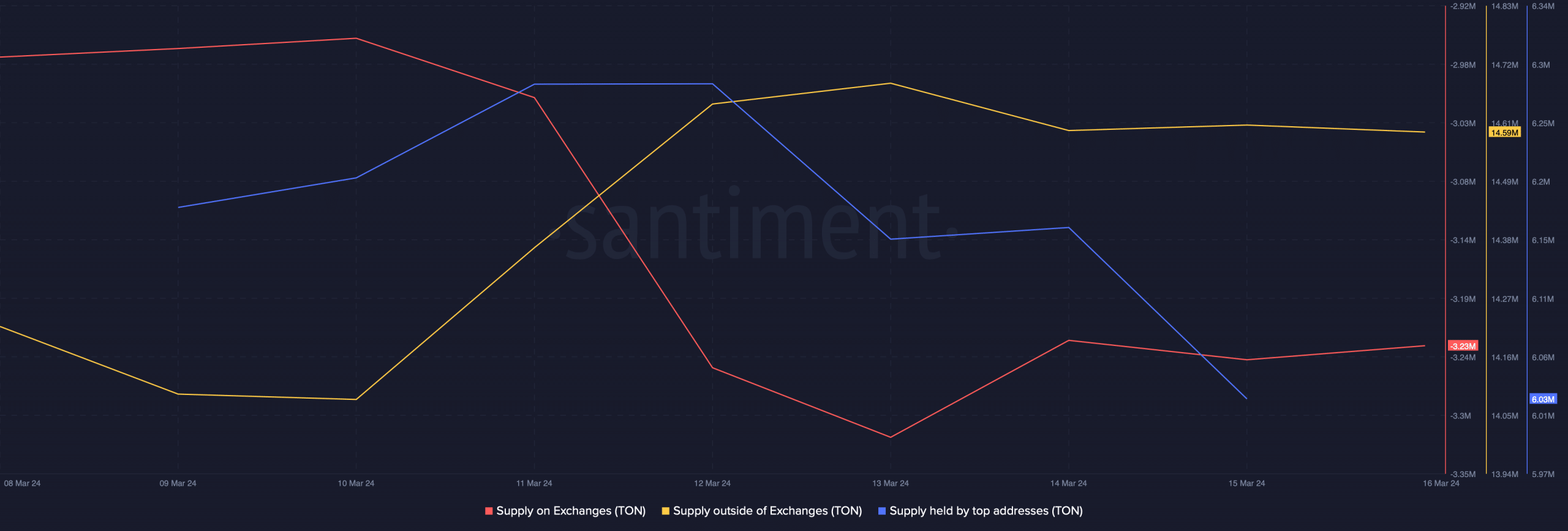

Our analysis of Santiment’s data revealed that buying pressure on Toncoin was high. This was evident from the rise in its supply outside of exchange and the dip in its supply on exchanges.

However, the big players in the market were selling TON as its supply held by addresses went down in the last few days.

Source: Santiment

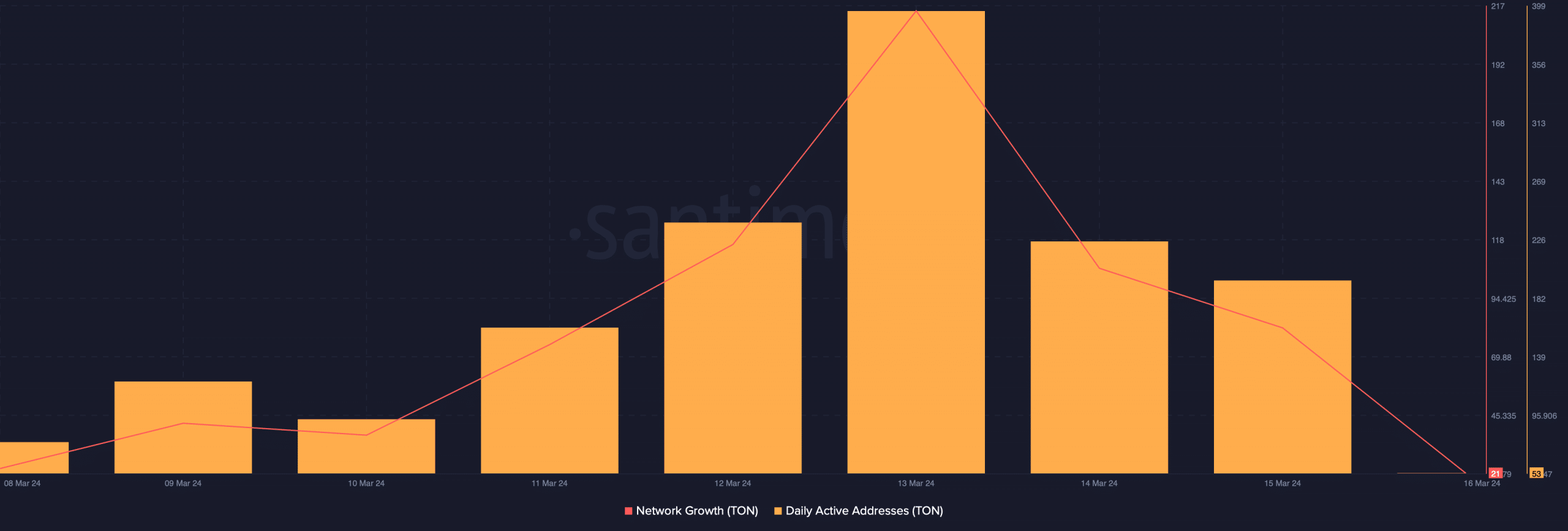

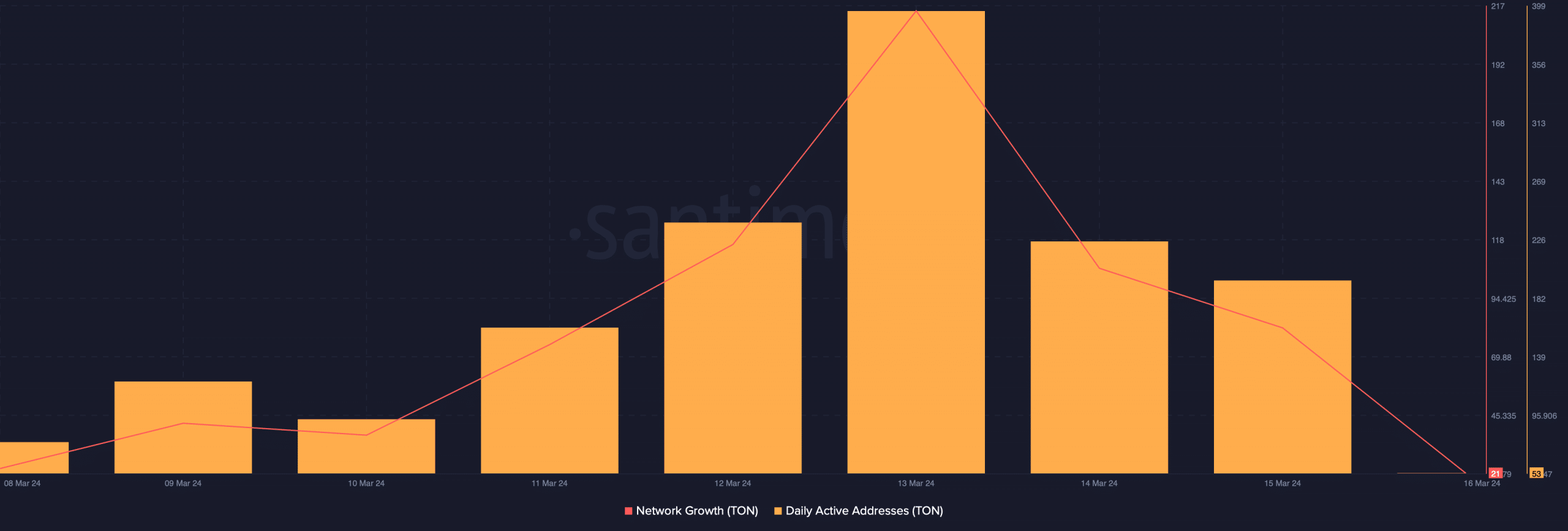

After a sharp rise, TON’s network activity dropped last week. As per our analysis of Santiment’s data, TON’s daily active addresses plummeted after spiking on the 13th of March.

Additionally, its network growth also sank along with active addresses. This meant that fewer addresses were used to transfer the token. A similar trend was also noted in terms of volume, as the metric dipped by more than 35% in the last 24 hours.

Source: Santiment

How much are 1,10,100 TONs worth today?

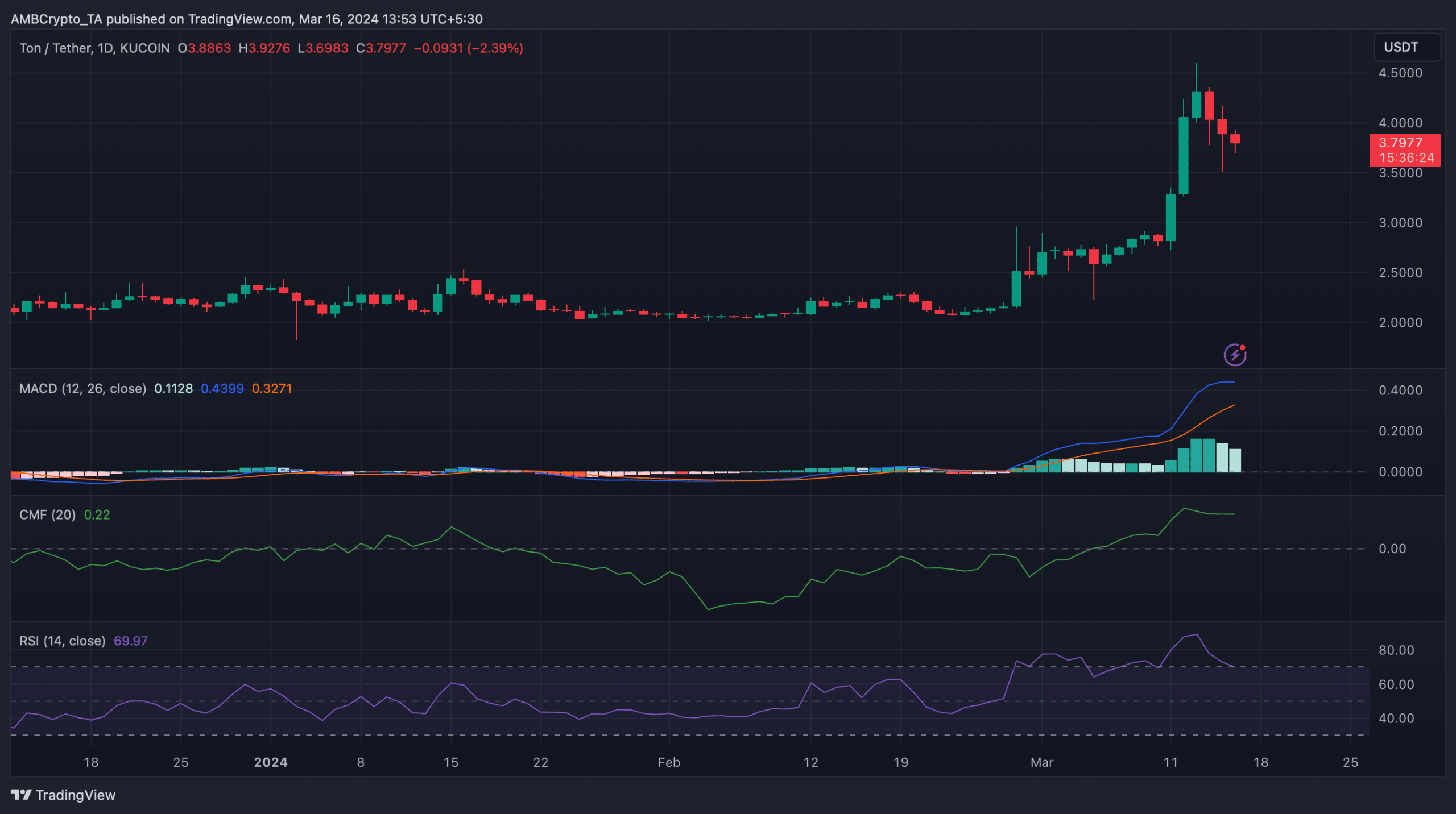

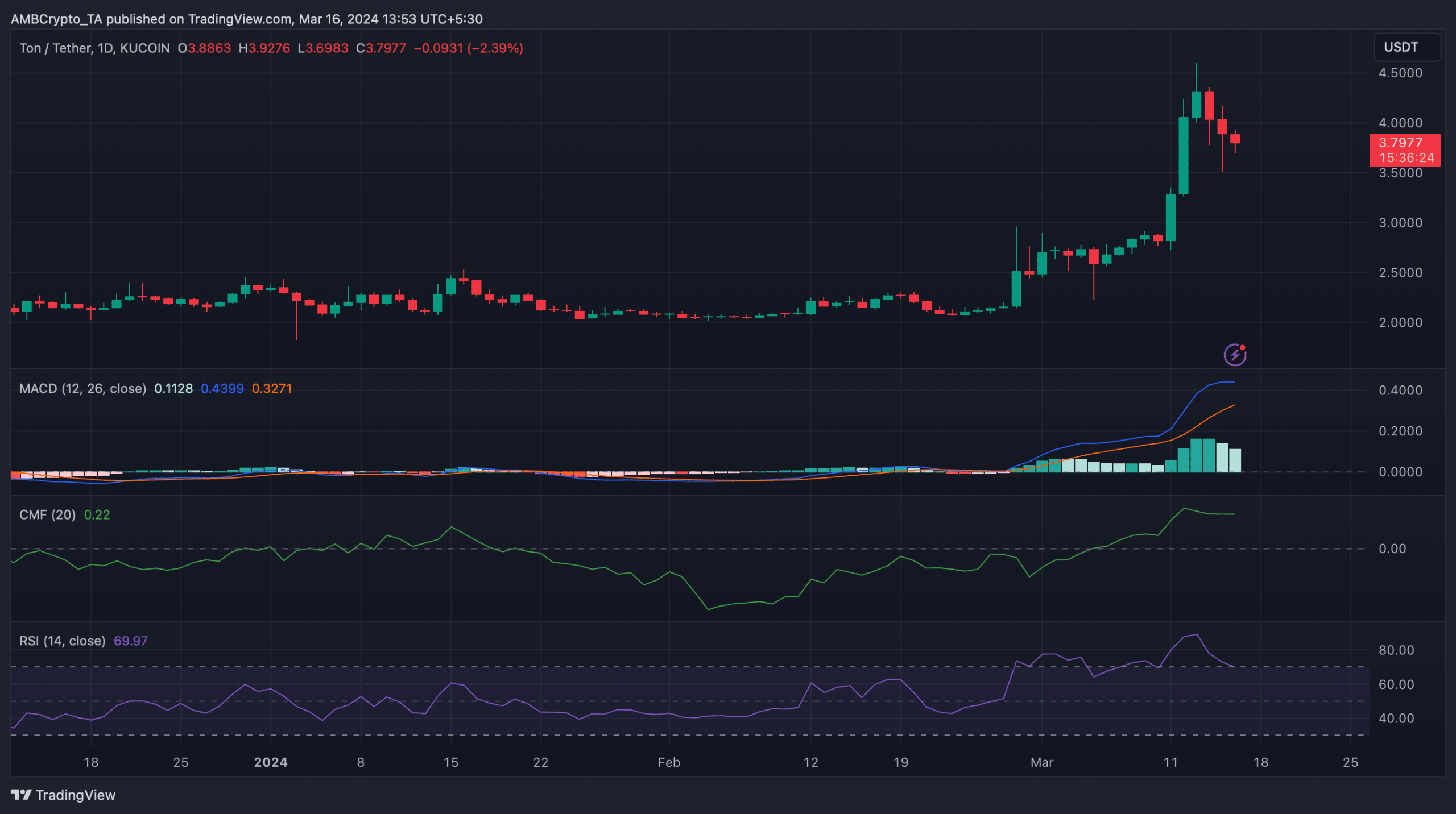

Though buying pressure on Toncoin was low, technical indicators suggested that investors might witness a few slow-moving days. Its Chaikin Money Flow (CMF) took a sideways path.

The Relative Strength Index (RSI) also registered a sharp downtick. Nonetheless, the MACD supported the buyers as it displayed a clear bullish upperhand in the market.

Source: TradingView

Leave a Reply