- Solana whales sold their holdings as prices surged.

- Price remained unaffected, however, traders turned bearish.

Solana [SOL] had an extremely positive run in terms of activity over the last few months thanks to the popularity of the memecoins on its network. The price of SOL also soared amid the bullish frenzy in the market.

Whales cash out

However, whales were observed to be engaging in profit-taking. According to Lookonchain’s data, recently, a whale deposited 534,039 SOL tokens totaling $87.6 million into Binance in the last 24 hours.

This same investor then withdrew 879,441 SOL tokens worth $67.92 million from Binance, at an average price of $77 per token. Subsequently, the whale redeposited 711,238 SOL tokens valued at $106.7 million into Binance, at a price of $150 per token.

As a result of these transactions, the investor realized a profit of approximately $38.7 million.

The rapid buying and selling activity conducted by the investor within a short time frame can contribute to heightened volatility in SOL’s price, potentially triggering market fluctuations and uncertainty among other investors.

Such volatility and uncertainty can erode investor confidence in SOL’s long-term viability and dampen sentiment surrounding the token, leading to cautious or bearish attitudes toward SOL in the near term.

Overall, while the investor’s actions may yield significant profits in the short term, it can also create selling pressure on SOL and negatively impact sentiment around the token.

Analysing the price movement

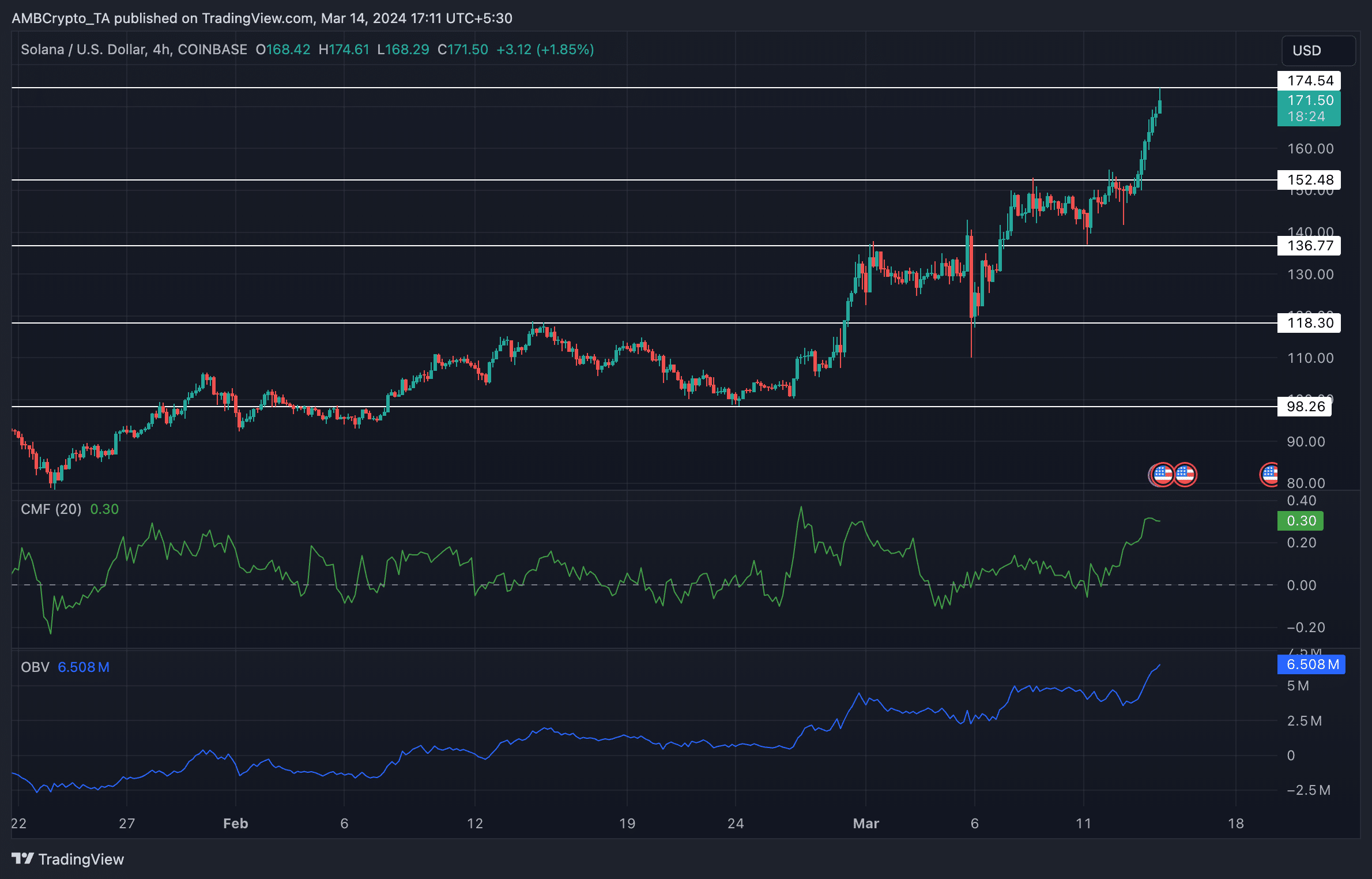

Despite this, SOL’s price surged by 11.25% in the last 24 hours. The recent uptick in SOL’s price was not an isolated event but rather part of a larger bullish trend that has been driving the token’s value upwards.

During this period of price appreciation, the Chaikin Money Flow (CMF) for SOL spiked to 0.30, indicating substantial buying pressure and positive money flow into the token.

This surge in CMF further reinforces the bullish sentiment surrounding SOL and suggests that the recent price surge is supported by strong investor demand.

Furthermore, the On-Balance Volume (OBV) for SOL experienced a notable spike during this period of price appreciation. The OBV is a momentum indicator that measures buying and selling pressure by adding or subtracting volume based on price movement.

How much are 1,10,100 SOLs worth today?

A spike in OBV suggests increased buying activity and positive momentum in the market.

Source: Trading View

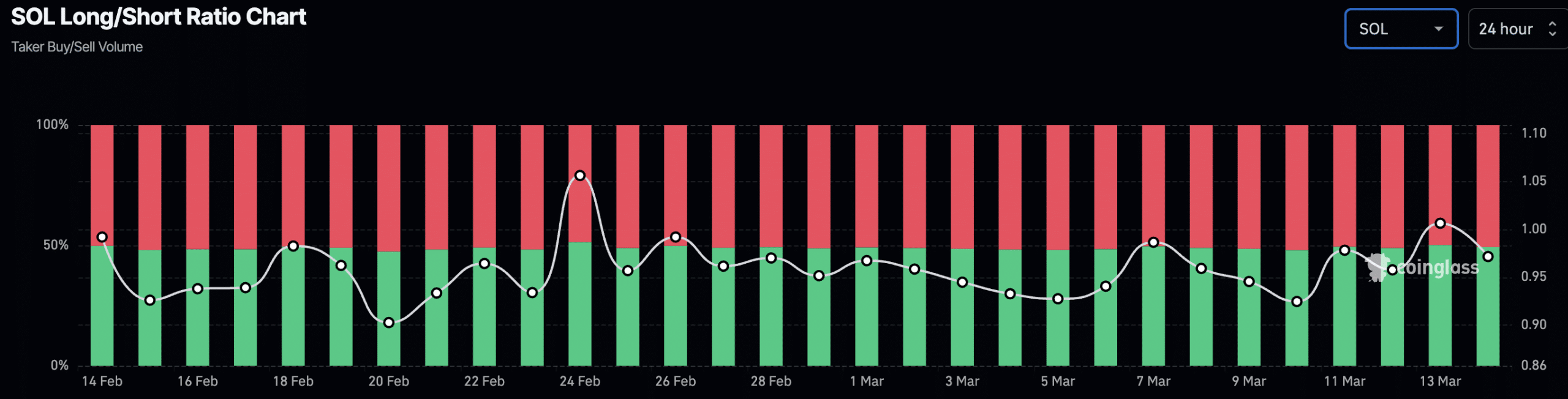

However, many traders were skeptical of this surge in price. AMBCrypto’s analysis of coinglass’ data showcased that bearish positions against SOL were on the rise.

Source: Coinglass

Leave a Reply