- AVAX holders bought large volumes of the token as the price hit $57.

- A rise to $100 looked possible but first, a correction could happen.

In the last 24 hours, the price of Avalanche [AVAX] increased by 13.13% as it surpassed the $50 milestone. However, the altcoin value did not just get there without some underlying factors.

According to IntoTheBlock, the jump in large transaction volume was influential in driving the price increase. The crypto intelligence platform, in a post, mentioned that the volume hit $329 million on the 11th of March.

Source: X

It also noted that this was that highest amount the cryptocurrency has hit since December 2023. Though large volumes is no guarantee that price would increase, but in AVAX’s case, it was different.

A 2x is not close

Not only did large holder activity increase, AVAX experienced more of buying pressure than its extermination. Should this continue in the near term, it might be possible for the cryptocurrency’s price to double.

However, it is important to note that this prediction would not just come out of thin air. Thus, AMBCrypto assesses the possibility from a technical perspective.

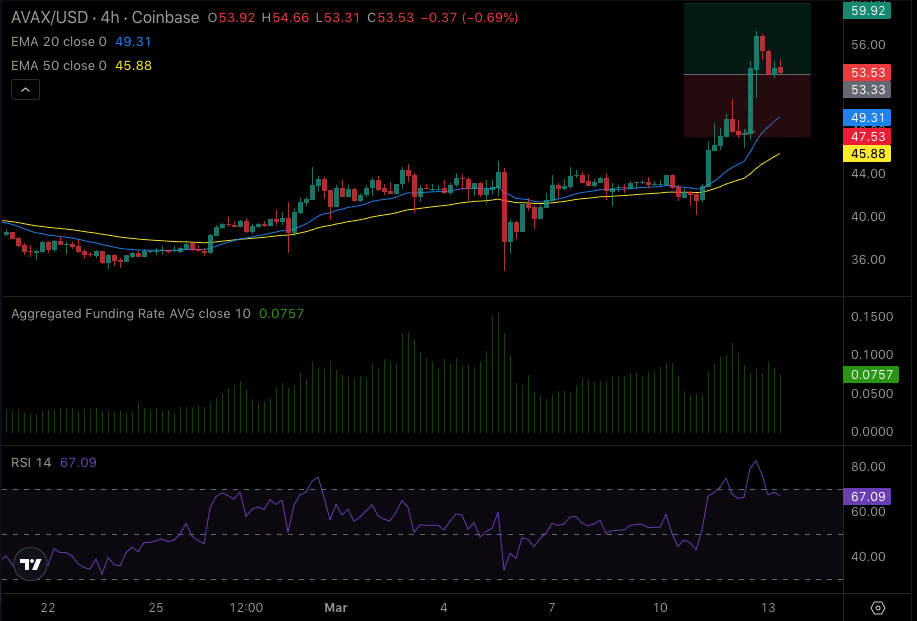

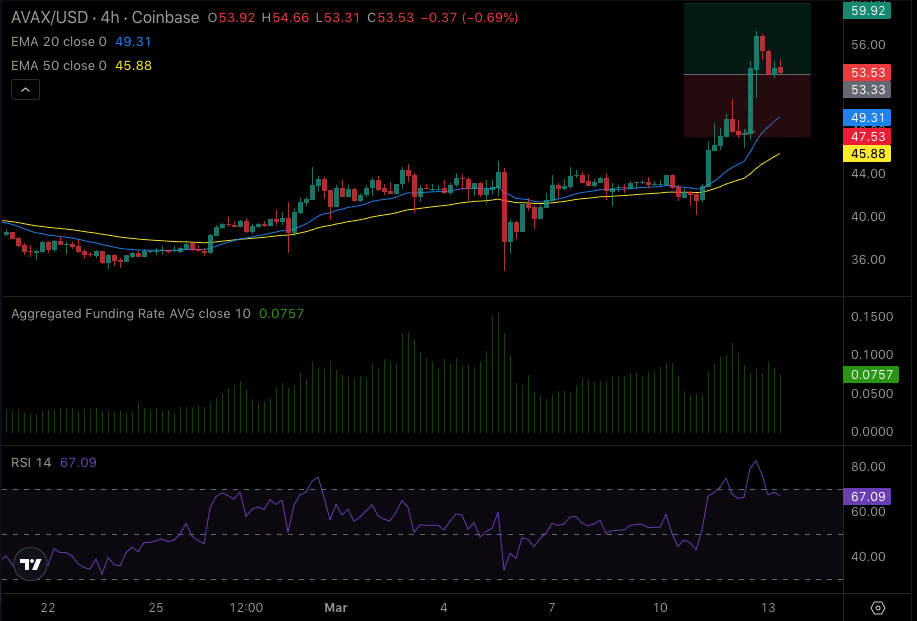

Based on the 4-hour analysis, AVAX had initially tapped $57 on the 12th of March. However, the attempt at breaking through the key resistance failed. At press time, bulls were attempting to retest the region. A successful close above the region could send AVAX to $59.92.

But if a rejection occurs again, the price of the token might decline to the $47.53 support. Previously, the Relative Strength Index (RSI) hit the overbough region. Upon reaching the zone, the reading fell, causing AVAX ‘s price to drop.

If the oscillator continues to decline, then AVAX might lose hold on $50. However, the Exponential Moving Average (EMA) indicated other signals. For instance, the 20 EMA (blue) had crossed over the 50 EMA (yellow).

Source: Coinalyze

Bears keep tabs on the token

A position like this implies that the bullish trend has not ended. As long as the price does not drop below $45.89, AVAX might rebound. In addition, the Funding Rate was positive, indicating that the price could key into the resistance and breach the area.

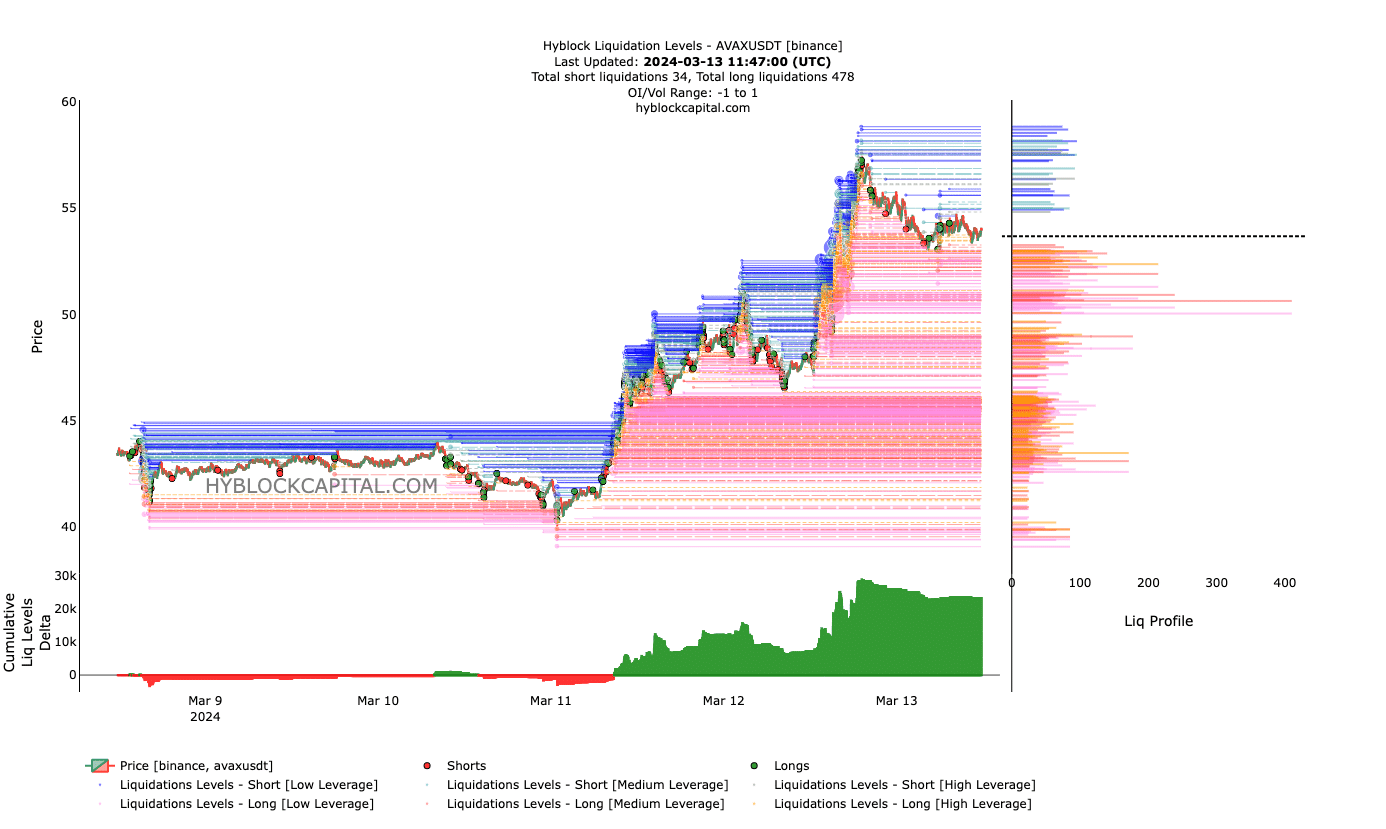

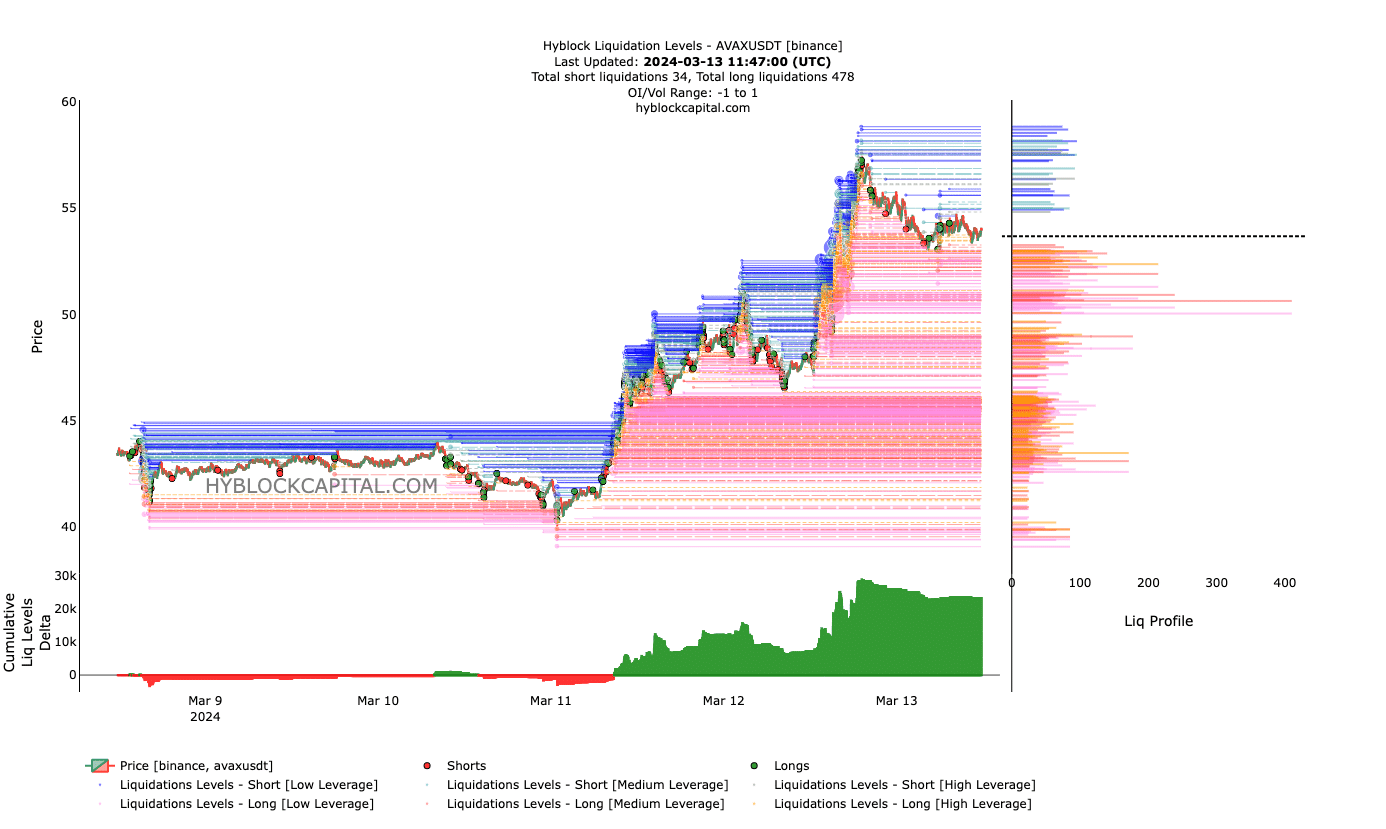

In terms of the liquidation levels, AMBCrypto noticed that traders had appetite for high risk position at $57 and above. This type of market condition suggest possible reversal as the price might struggle to establish a bullish bias.

Is your portfolio green? Check the AVAX Profit Calculator

Should this circumstance fail to change, AVAX’s price might drop below $50. Furthermore, the Cumulative Liquidation Levels Delta (CLLD) was postiive, leading to a slightly bearish bias.

Source: HyblockCapital

In a highly bearish situation, the price of the cryptocurrency might drop as low as $45. However, this does not mean that the value might not hit three digits.

Leave a Reply