- Ethereum prices soared even though it lacked the demand from ETFs that Bitcoin has.

- Profit-taking activity as ETH crosses $4k could commence, according to the age-consumed metric.

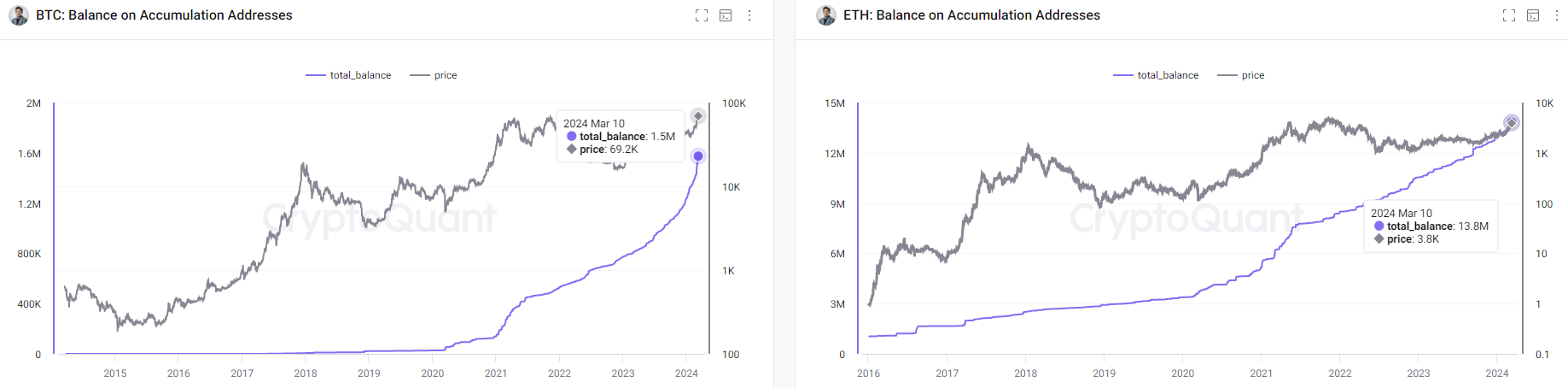

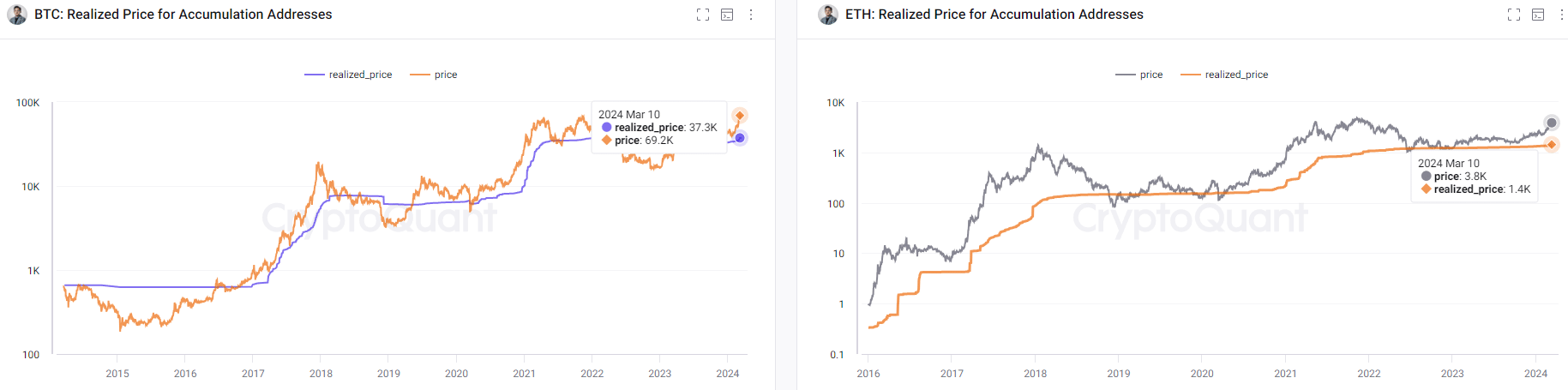

Bitcoin [BTC] and Ethereum [ETH] accumulation addresses were at 171% and 80% unrealized profit respectively, according to data that CryptoQuant CEO Ki Young Ju posted on X (formerly Twitter).

In the past three months, Bitcoin saw enormous institutional demand due to the ETFs. While Ethereum does not have ETFs, it still saw strong demand.

Bitcoin witnessed a faster rate of accumulation than Ethereum

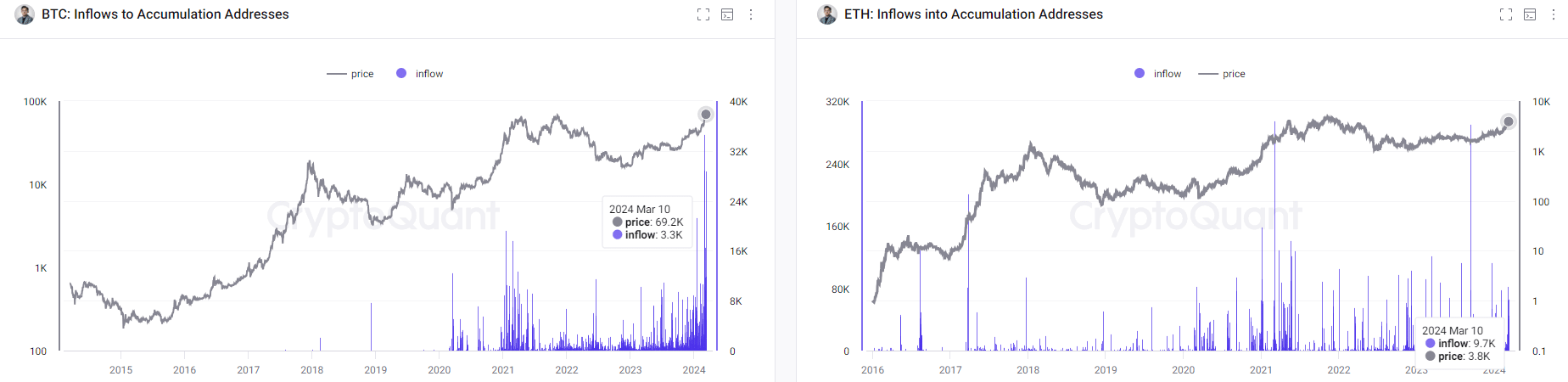

The inflows to accumulation addresses, in USD terms, have rapidly gained pace for Bitcoin in 2024. The ETF approval in January had a huge impact on this metric.

Meanwhile, Ethereum was unable to match the pace of demand for Bitcoin.

Similarly, the whale addresses holding Bitcoin saw a sharp uptrend since 2021. This has only sped up even more in 2024. Meanwhile, Ethereum saw a more steady uptrend since 2021 without sudden bursts of acceleration.

Even without institutional demand to the same degree as Bitcoin, Ethereum was able to hold its own in terms of demand and popularity. It underlined that whales still saw the largest altcoin as a safe alternative to Bitcoin.

Realized price refers to the price of the Bitcoin or Ethereum at which they were last moved on average. The accumulation addresses were at 92.5% unrealized profits on Bitcoin, and 183% unrealized profits for Ethereum.

This highlighted an especially bullish case for Ethereum. Demand on the scale that Bitcoin is witnessing right now could propel ETH prices into the stratosphere, which should have investors jumping for joy.

Examining the accumulation trends across the network

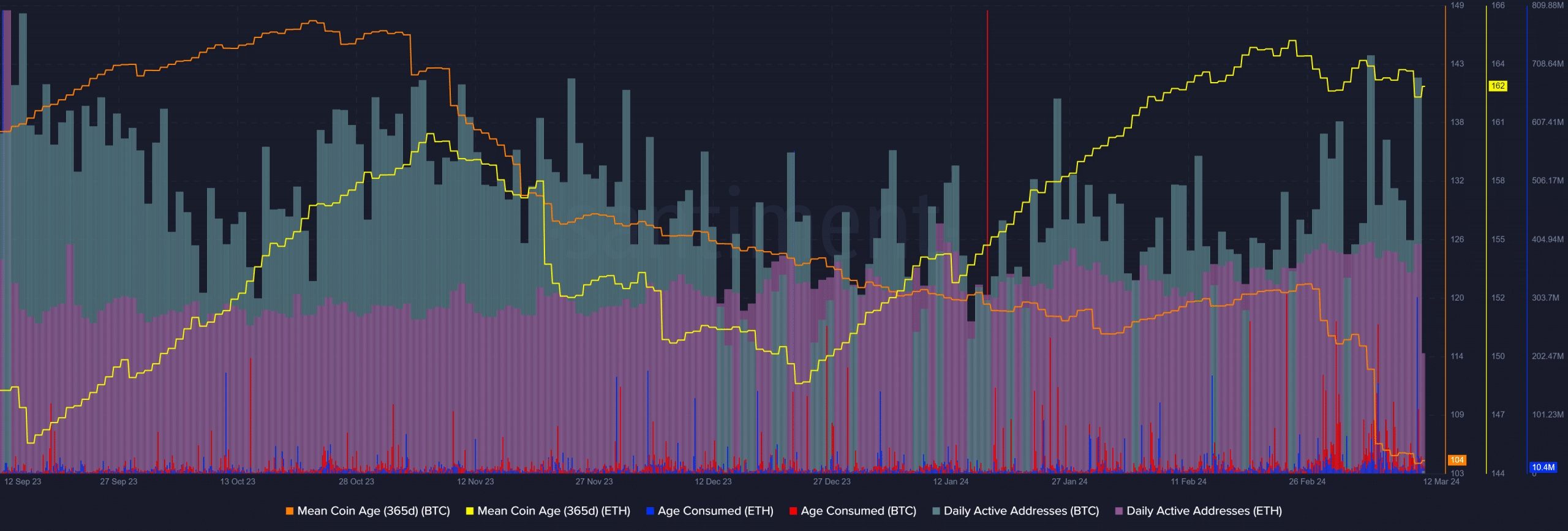

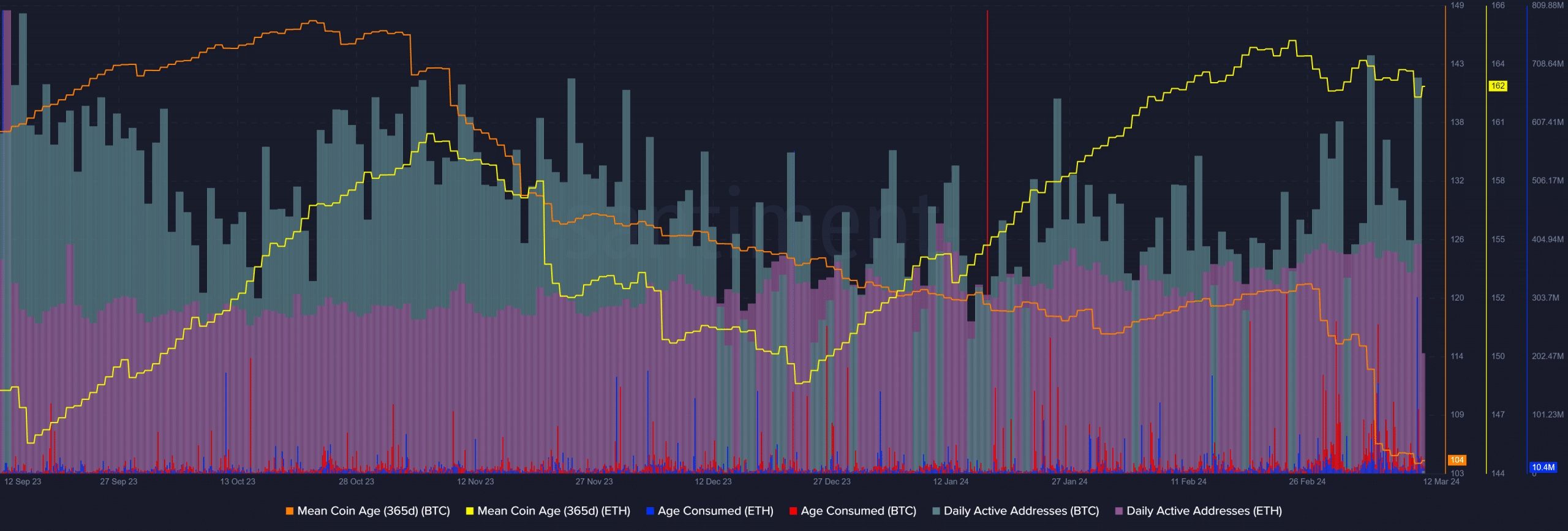

Source: Santiment

AMBCrypto looked at the wider BTC and ETH network activity to contrast CryptoQuant’s dive into the accumulation addresses. The Santiment data above showed that the daily active addresses of ETH were about half that of Bitcoin since early February.

The Ethereum age-consumed metric saw a huge spike on the 11th of March when the prices burst past the $4k psychological resistance. This pointed toward profit-taking activity.

Is your portfolio green? Check the BTC Profit Calculator

On the other hand, the mean coin age of ETH has trended upward over the past four months. In contrast, Bitcoin’s mean coin age has fallen since the second half of February.

Once again, this suggested that holders were booking profits on BTC, while they were mostly happy to let Ethereum run higher. Despite this inference, the large age-consumed surge warranted some caution from investors.

Leave a Reply