Worldcoin controversy in South Korea is driving trades on the Bithumb crypto exchange, a media report has claimed.

According to Busan Ilbo, trading in the Worldcoin (WLD) token has spiked in the wake of a new Personal Information Protection Commission probe.

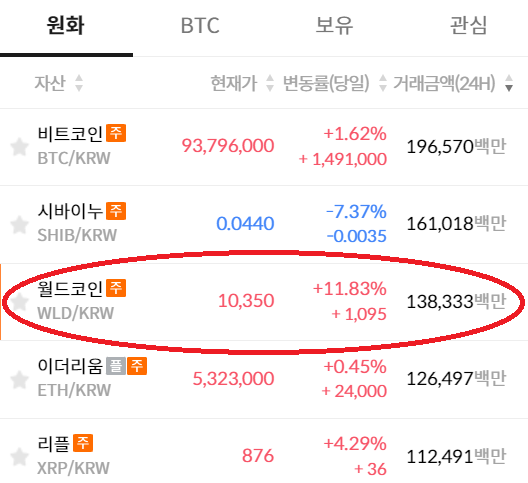

This has seen WLD trading balloon on the platform. On March 4, 24-hour Worldcoin trading surpassed Bitcoin transaction volumes “by nearly 2 billion won [over $1.5 million].”

Worldcoin Controversy: Bithumb a Beneficiary?

Authorities believe that at least 50,000 South Koreans hold WLD tokens. However, the coin has reportedly “gained great popularity among crypto investors” in recent weeks.

The media report noted that as of 6:30 am UTC on March 7, 24-hour WLD trading volumes on Bithumb hit the $107.3 million mark. These figures were only surpassed by two other tokens: Bitcoin and Dogecoin.

Bithumb has “benefited” from listing the coin, unlike its closest rival Upbit – which once dominated the market in almost every trading pair.

On March 7, Spanish regulators ordered the Sam Altman-orchestrated Worldcoin project to halt operations in the nation.

This has likely sparked more trading fervor on Bithumb. At the time of writing, WLD transaction volumes on the platform were higher than all but SHIB and BTC.

WLD trading volumes on the Bithumb crypto exchange over the past 24 hours. (Source: Bithumb)

WLD trading volumes on the Bithumb crypto exchange over the past 24 hours. (Source: Bithumb)The media outlet wrote:

“This is all good news for Bithumb. Typically, cryptoasset exchanges make money from commissions generated from trading. In other words, the more active WLD traders are, the more profit Bithumb can make.”

WLD holders seem confident that despite the Worldcoin controversy in South Korea, their investments are safe for the time being.

The report noted that “even if” the regulator rules that the Worldcoin project “violates personal information protection protocols,” the “industry consensus is that delisting is still a long way off.”

Worldcoin officials have “temporarily suspended iris scanning in South Korea” until at least March 20.

Bithumb appears resolute on the matter. A spokesperson told the outlet that the exchange was “following the deliberations of the Personal Information Protection Committee.”

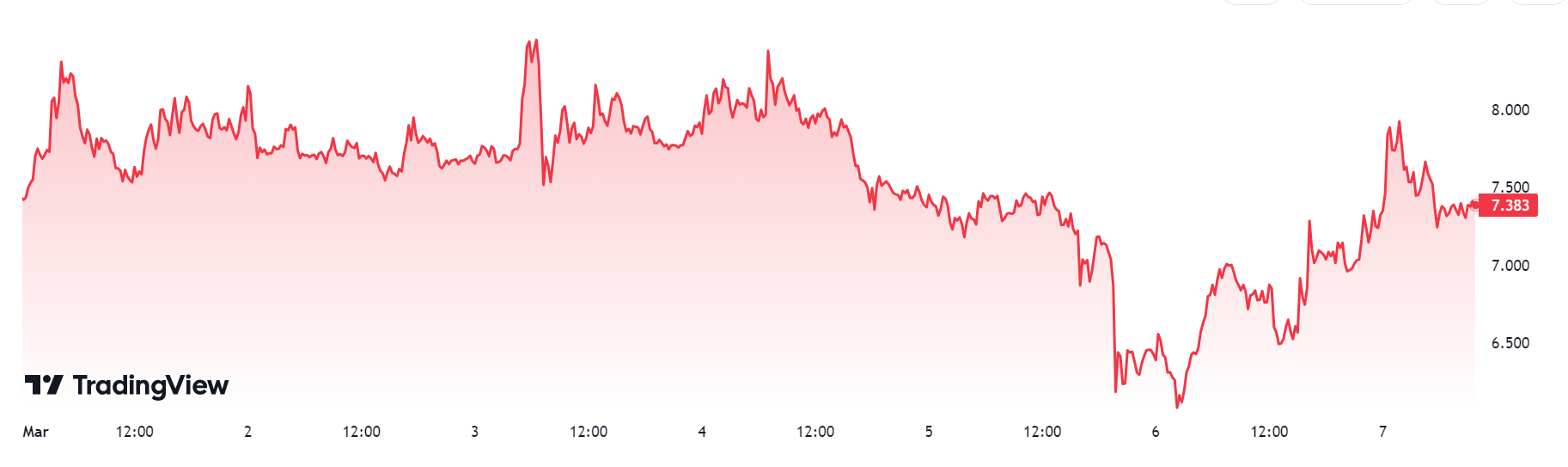

WLD prices over the past seven days. (Source: TradingView)

The Bithumb spokesperson said that it was “still too early to discuss Worldcoin” delisting-related matters.

Self-regulating Body May Eventually Decide WLD’s South Korea Fate

However, the exchange conceded that if the committee were to rule “in the negative” against the project, a body named DAXA would make delisting-related decisions.

Spain blocks Sam Altman’s eyeball-scanning venture Worldcoin https://t.co/THiU9YX0QC

— Financial Times (@FT) March 6, 2024

DAXA, short for the Digital Asset Exchange Association, is a self-regulating body that comprises the nation’s five licensed, KRW-trading crypto exchanges. Both Bithumb and Upbit are members.

The body makes decisions on a wide range of crypto-related matters, including token listing and desisting policies.

Spanish regulators have said it has concerns that Worldcoin representatives have collected data about minors.

They have also said the firm failed to follow domestic data laws that allow users to exact greater control over their private information.

The South Korean Personal Information Protection Committee, meanwhile, said that it had received complaints Worldcoin’s handling of personal information and iris scanning activities.

The committee said Worldcoin representatives were still collecting facial and iris recognition data at some 10 locations in the country.

Hong Kong’s data protection authority has also investigated six Worldcoin operators over similar concerns.

Leave a Reply